October 2022 Bitwise Investor Letter

San Francisco • Oct 5, 2022

In This Issue: How To Navigate Market Turbulence in Crypto and Beyond

Market Overview

Dear Investors,

The late summer added further volatility to what has already been a roller coaster year for financial markets. Over the course of just 40 days, Jerome Powell’s Jackson Hole speech dashed any hopes of a soft landing, the U.K. market went into a tailspin that made it look like an emerging market (and sparked a pension fund crisis that required a bailout), Russia put nukes back on the table, and Credit Suisse faced a critical moment.

Risk assets, of course, took notice: The S&P 500 fell 9.2%, the Nasdaq tumbled 10.5%, and even gold slid 2.9% in September. Crypto fared relatively well given its volatility profile but still suffered: Bitcoin slipped 3.7% and Ethereum declined 15.1% despite a flawless implementation of its most fundamental upgrade to date.

It is widely said that difficult markets often sow the seeds for future opportunity; it’s where good planning can add great value. I think this is not only generally true but especially relevant as it pertains to crypto investments.

Here are two ways in which investors can thoughtfully navigate crypto investments under the current market conditions:

1) Keeping Behavior Biases in Check

If you have been following crypto for a while, chances are you’ve already bumped into the “Rule of the 10 Best Days,” popularized by Tom Lee of Fundstrat Advisors. If not, it is simple: The overwhelming share of crypto’s returns are concentrated in relatively few days. If you miss these days, your long-term returns get crushed.

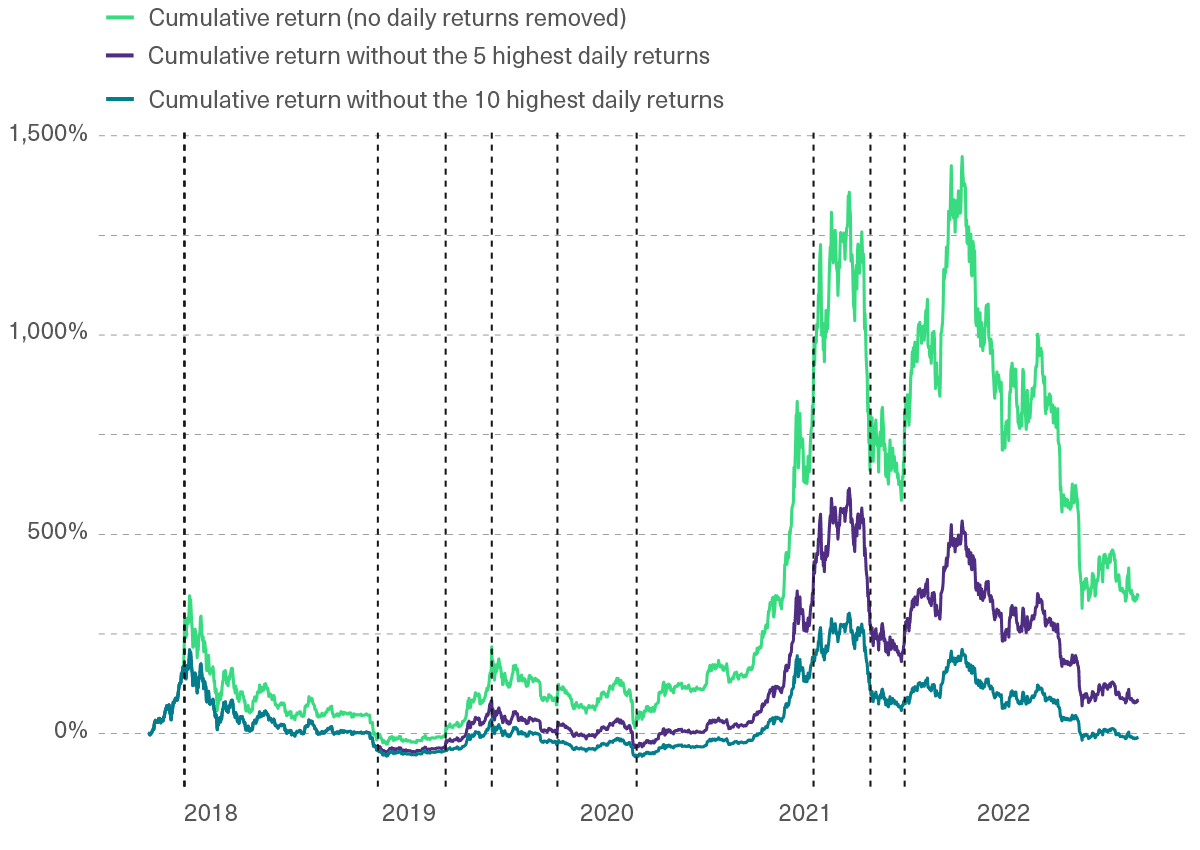

The chart below puts this into perspective.

The green line shows bitcoin’s cumulative returns for the five years ending September 2022. This was, of course, an exceptional period to be a crypto investor, as the price ran up from $4,325 to $19,485 for a total return of 348%.

But these returns were generated by a surprisingly few number of days. By removing just the top five return days, the total five-year return drops from 348% to 83%. If we remove the top 10 return days, the whole 348% is wiped out and becomes a 10% loss.

Missing Only the Top 10 Return Days for Bitcoin Would Wipe Out All Gains Over the Last Five Years

Bitcoin cumulative returns from September 30, 2017 to September 30, 2022, considering the whole period, missing the top 5 daily returns, and missing the top 10 daily returns. Dates of the top 10 daily returns are highlighted in the dashed vertical lines.

Source: Bitwise Asset Management

Past performance does not predict or guarantee future results. Nothing contained herein is intended to predict the performance of any investment. There can be no assurance that actual outcomes will match the assumptions or that actual returns will match any expected returns. Historical performance of assets has been generated and maximized with the benefit of hindsight. The returns do not represent the returns of an actual account and do not include the fees and expenses charged by funds.

Something this surprising bears repeating: Missing just the 10 best days from all the 1,826 days that bitcoin traded over the last five years would have wiped out all the incredible returns it generated in the period … and turned it into a loss.

One interesting and often overlooked part of this analysis is that these top 10 return days have been concentrated in bear markets or correction periods. The dashed vertical lines in the chart above highlight the days in question. Out of the 10 top return days, five happened in the 2018-2020 period and two in the 2021 mid-year correction. On top of that, all of the top 10 returns happened after short-term price corrections.

The learning from this is that investors looking to participate in crypto’s long-term potential need to be careful: Waiting on the sidelines for an “all clear” signal after a pullback could mean missing the market’s best days. There is no telling when the next big move upward will come.

As the saying goes, time in the market beats timing the market.

2) Tax-Loss Harvesting in Crypto: A Significant and Underexplored Opportunity

(Note: This section is based on our recently published white paper, “Tax-Loss Harvesting in Crypto: A Significant and Underexplored Opportunity for Financial Advisors.” You can access the paper here.)

Taxes can be a significant drag on investor returns. As a result, minimizing the impact of taxes on total returns has become particularly important. There is even a term for activities that use tax-minimization, tax-deferral, or tax-elimination strategies to boost after-tax returns: “tax alpha.”

One of the most common ways in which investors can achieve tax alpha is through tax-loss harvesting (TLH), which entails selling securities at a loss to offset capital gains on other securities sold at a profit.

Before proceeding, we should make clear that nothing in this section should be read as tax advice. The examples discussed herein are only for illustrative purposes. We strongly recommend investors who are interested in considering a TLH strategy consult with a tax or financial advisor.

One overlooked theme in crypto is that its volatility and return profile can make it an exceptionally good fit for TLH strategies. The myriad corrections crypto has been through, coupled with its strong long-term returns, can provide plenty of opportunities to harvest losses.

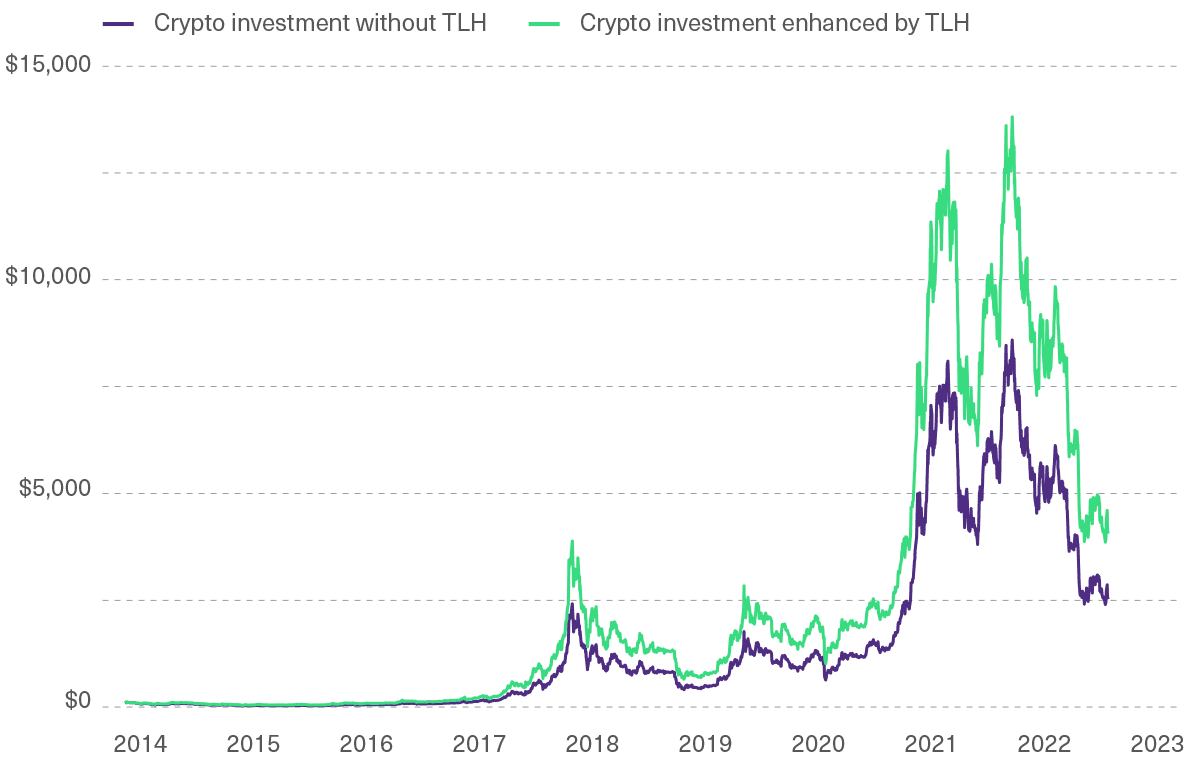

To use one example drawn from our white paper, consider a $100 investment made on January 1, 2014, and held until the end of our study on September 15, 2022. This was a strong period for crypto returns: This $100 investment would have turned into $2,523, or $2,038 net of taxes (assuming a 20% capital gains tax).¹

This is an excellent return, but a TLH strategy could have boosted it substantially. The same $100 investment made during this period but enhanced by a TLH strategy would have turned into $4,056, or $3,252 net of taxes at the end of the period.

The difference between the value of the portfolio with and without TLH is the potential tax alpha. In this case, the TLH alpha is a hefty 60.8% pre-tax and 59.5% post-tax. The chart below compares the returns with and without a TLH strategy in place.

Crypto’s Volatility Profile Makes It Especially Fit for TLH Strategies

Growth of a $100 initial investment from January 1, 2014 through September 15, 2022, with and without TLH. Assuming a 30% capital gains tax for TLH sales and 20% for portfolio liquidation.

Source: Bitwise Asset Management

Past performance does not predict or guarantee future results. Nothing contained herein is intended to predict the performance of any investment. There can be no assurance that actual outcomes will match the assumptions or that actual returns will match any expected returns. Historical performance of assets has been generated and maximized with the benefit of hindsight. The returns do not represent the returns of an actual account and do not include the fees and expenses charged by funds.

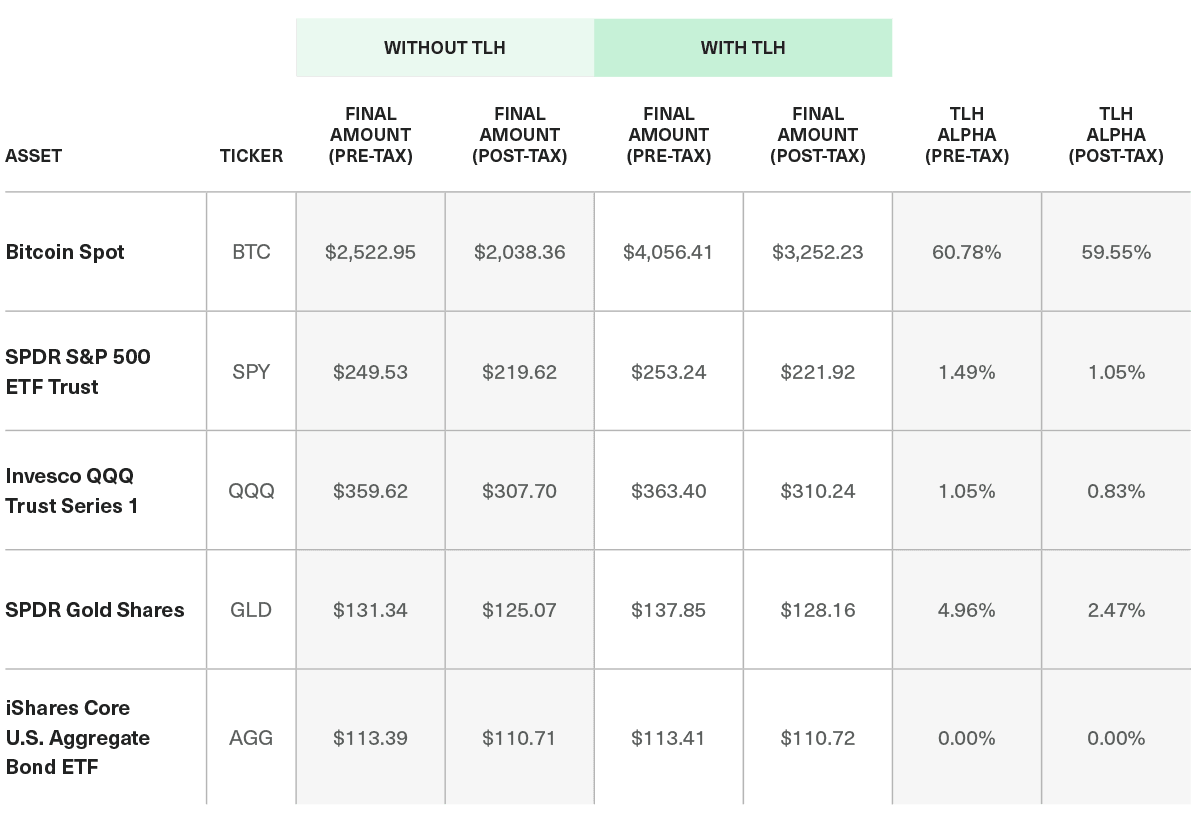

Many investors engage in TLH strategies in their equity and bond portfolios but have not adopted that practice in crypto. As the table below shows, however, TLH has historically been a much more powerful strategy in crypto than in other asset classes, thanks to crypto’s historical volatility.

Comparison of Potential TLH Benefit: Crypto Versus Traditional Assets

Growth of a $100 initial investment from January 1, 2014 through September 15, 2022, with and without TLH. Assuming a 30% capital gains tax for TLH sales and 20% for portfolio liquidation.

Source: Bitwise Asset Management

Past performance does not predict or guarantee future results. Nothing contained herein is intended to predict the performance of any investment. There can be no assurance that actual outcomes will match the assumptions or that actual returns will match any expected returns. Historical performance of assets has been generated and maximized with the benefit of hindsight. The returns do not represent the returns of an actual account and do not include the fees and expenses charged by funds.

Our white paper digs deeper into this subject, including analyses of how consistent these gains are over different time periods, factors driving TLH alpha, and important considerations around the wash-sale rule for crypto.

Tax-loss harvesting is not risk-free. Trading costs, market volatility, wash-sale considerations, and other factors can all detract from long-term returns or introduce risk into the strategy. But done effectively under the proper guidance, it can be an interesting tool for savvy crypto investors to achieve higher after-tax returns.

There Is More to Investing Than Just Identifying the Best Opportunities

My excitement about crypto’s long-term potential has, if anything, swelled during the increasingly challenging market conditions of 2022.

When the dust settles, I expect bitcoin’s utility as a non-sovereign store of value to shine the brightest in a world that, on one hand, has central banks oscillating between unprecedented easing and unprecedented tightening—and on the other hand, is moving closer toward major currency regime changes.

The latest developments around Ethereum and smart contracts are equally exciting. Applications such as decentralized finance, NFTs, stablecoins, and Web3 have the potential to completely transform the way many of us lead our digital lives. Within a few years, we could see technical upgrades to Ethereum and other platforms that unlock opportunities for hundreds of millions—or even billions—of people around the world.

I reiterate the view that our CIO Matt Hougan shared previously in this letter: The fundamentals in crypto remain rock solid: Venture capital funding is fueling the entrepreneurial ventures that push the space forward, developer activity is creating better or newer applications and use cases, and fundamental technical upgrades are unlocking new realms of possibility in crypto. And all of these areas are trending up and to the right.

To be sure, uncertain macro conditions are taking a toll on risk assets across the board, including crypto. However, often it is precisely when everything is falling indiscriminately that the best long-term investment opportunities present themselves.

(1) Please refer to our white paper for the full methodological notes behind these and other calculations.

David Lawant

Director of Research

Events

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email investors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

Conferences

Stifel Blueprint | October 10-12 | Las Vegas, NV

Fundstrat Institutional Networking Event | October 12 | New York, NY

Forbes/SHOOK Top Advisor Summit | October 11-13 | Las Vegas, NV

Financial Planning Association Raleigh Symposium | October 13 | Raleigh, NC

Titan Investors Sonoma Due Diligence Retreat | October 18-19 | Rohnert Park, CA

DACFP 1-1 Meetings | October 27-28 | Phoenix, AZ

LW3 | October 23-25 | Miami, FL

UWM Webinar | October 24 | Virtual

Notes From the Research Desk

White House releases “comprehensive framework” on crypto regulation

The Biden White House released in September what it called the “first-ever comprehensive framework on crypto regulation” in the U.S., sketching out a rough plan that addressed investor protections, financial stability, financial access, and investment to support the burgeoning crypto industry.

In truth, “comprehensive framework” is an overstatement; the document is more a statement of first principles than a detailed regulatory roadmap. Still, it’s good to see the government pushing to lay down the regulatory guardrails the industry needs to move forward. There’s also more to come on that front: The Treasury is expected to release reports on financial stability risks, decentralized finance, and NFTs over the next eight months. In our view, the White House’s document was reasonably balanced and a good starting point to the regulatory conversation.

David Lawant

Director of Research

Public miners vs. data-center owners: Relationships are tested

September was a challenging month for the bitcoin mining industry, as high-profile bankruptcies, inter-company disputes, and difficult market conditions pressured mining firms.

The biggest news event came from Compute North, a data-center owner that primarily hosts bitcoin mining rigs, which filed for Chapter 11 bankruptcy after overextending itself in this challenging market. The Minnesota-based company provides services to multiple publicly traded bitcoin miners, including Marathon Digital Holdings (MARA). In other news, bitcoin miner Riot Blockchain (RIOT) sued hosting firm Northern Data after acquiring its Texas bitcoin mine, alleging Northern Data failed to disclose $84 million in liabilities to a third party.

The silver lining to all this mess? The well-capitalized companies have a unique opportunity to build or expand their capacity at distressed prices. The lesson: Build your war chest.

Alyssa Choo

Crypto Research Analyst

Ethereum after The Merge: Less issuance, more staking

Ethereum perfectly executed the complex technological upgrade called “The Merge” on September 15, effectively transitioning from proof-of-work to proof-of-stake. The change reduced Ethereum’s energy consumption by 99%, cut ETH issuance by more than 75%, and put “staking” front and center in the minds of crypto investors. ETH holders who decide to stake can expect to earn up to 4-8% in yields in exchange for helping secure the network.

While ETH has sold off since The Merge, the fundamental impact has been significant. Since The Merge, investors have staked an additional 350,000 ETH, which will remain locked until at least March 2023. Moreover, just 11,000 new ETH have been issued post-Merge through October 2; under the old proof-of-work methodology, that figure would have been over 220,000.

New stablecoin bill would regulate one of crypto’s “killer apps”

Stablecoins have emerged as one of crypto’s killer apps. There is currently more than $140 billion in stablecoin assets under management, and stablecoin transaction volume is at an all-time high.

Lawmakers and regulators have been eyeing the stablecoin market for years. In September, the House Financial Services Committee drafted legislation offering a robust path forward for these emerging assets. The bill would issue a two-year ban on so-called “algorithmic stablecoins” (think TerraUSD), while paving the way for banks and other collateralized stablecoin issuers (like Circle) to operate within a clearly defined environment. The bill also creates an ongoing role for state regulators in the space, which is a big win for crypto. Many experts believe that increased regulatory clarity around stablecoins could unlock significant new markets.

Ryan Rasmussen

Head of Research

What’s New at Bitwise

Tax-Loss Harvesting in Crypto: A Big, Underexplored Opportunity

What does the research say about tax-loss harvesting and crypto assets? Our research team’s latest white paper explains how crypto’s distinct return and volatility profiles present a compelling opportunity today for financial advisors. The piece delves into metrics on the efficacy of crypto tax strategies across market environments, tax regimes, and investor types.

We Just Launched a Web3 ETF

Recently, Bitwise launched an exchange-traded fund designed to give investors exposure to one of the fastest-emerging themes in technology: Web3. The strategy centers on the companies helping to build the next generation of the internet.

The Top 3 Questions From Advisors in September (Video)

Bitwise CIO Matt Hougan offered two-minute answers to some of today’s most pressing questions on crypto: how to value crypto assets, how Bitcoin stacks up to Ethereum, and what's the most exciting opportunity through year-end.

Staking as a Service Is Becoming a Big Deal

Since Ethereum’s “Merge” transitioned the blockchain from proof-of-work to proof-of-stake, the spotlight is on staking—when crypto investors commit their native tokens to a blockchain for a set period of time in exchange for a yield. Three members of Bitwise’s research team explain why “Staking as a Service” providers are gaining clout in what experts believe could soon become a $40 billion market.

Select Media Appearances

CNBC: The future of crypto in the ETF space (Matt Hougan)

Protocol: California’s big veto is a win for crypto (Katherine Dowling)

U.S. News & World Report: Bitcoin vs. Ethereum (Matt Hougan)

Politico: Regulators need better coordination, dialogue (Katherine Dowling)

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.