May 2022 Bitwise Investor Letter

San Francisco • May 6, 2022

In This Issue: Strong Fundamentals, Weak Prices

Note: This month, we are relaunching the Bitwise Investor Letter, our monthly look at the biggest themes shaping the crypto market, plus the latest updates on Bitwise. If you would like to subscribe to future Bitwise Investor Letters, please click here.

Market Overview

The old criticism of crypto was that it is all speculation and no fundamentals. Investors ran around chasing the latest overhyped meme coin, while skeptics scoffed at a lack of real-world impact.

Today, the opposite is true: The fundamentals of crypto are extremely strong, but the speculative excitement has disappeared.

Consider what happened last week: Fidelity announced it was making bitcoin available in 401(k)s … and crypto traded down.

There was a time when one of the most important financial firms in the world making bitcoin available to retirement savers at 23,000 companies would have lifted the crypto market. Now, nothing.

This story has repeated multiple times of late. From the Biden Executive Order to the planned Ethereum upgrade, crypto has made incredible progress across many measures—regulatory, venture capital, developer activity, overall adoption, and more—and yet crypto prices have been lackluster in 2022.

This is frustrating for those of us who live in crypto 24/7, and it’s painful for investors. But understanding this dynamic—what’s causing it and where the fundamentals are—is the key to understanding what happens next.

What's Going On

The strength of crypto’s fundamentals are undeniable. Consider:

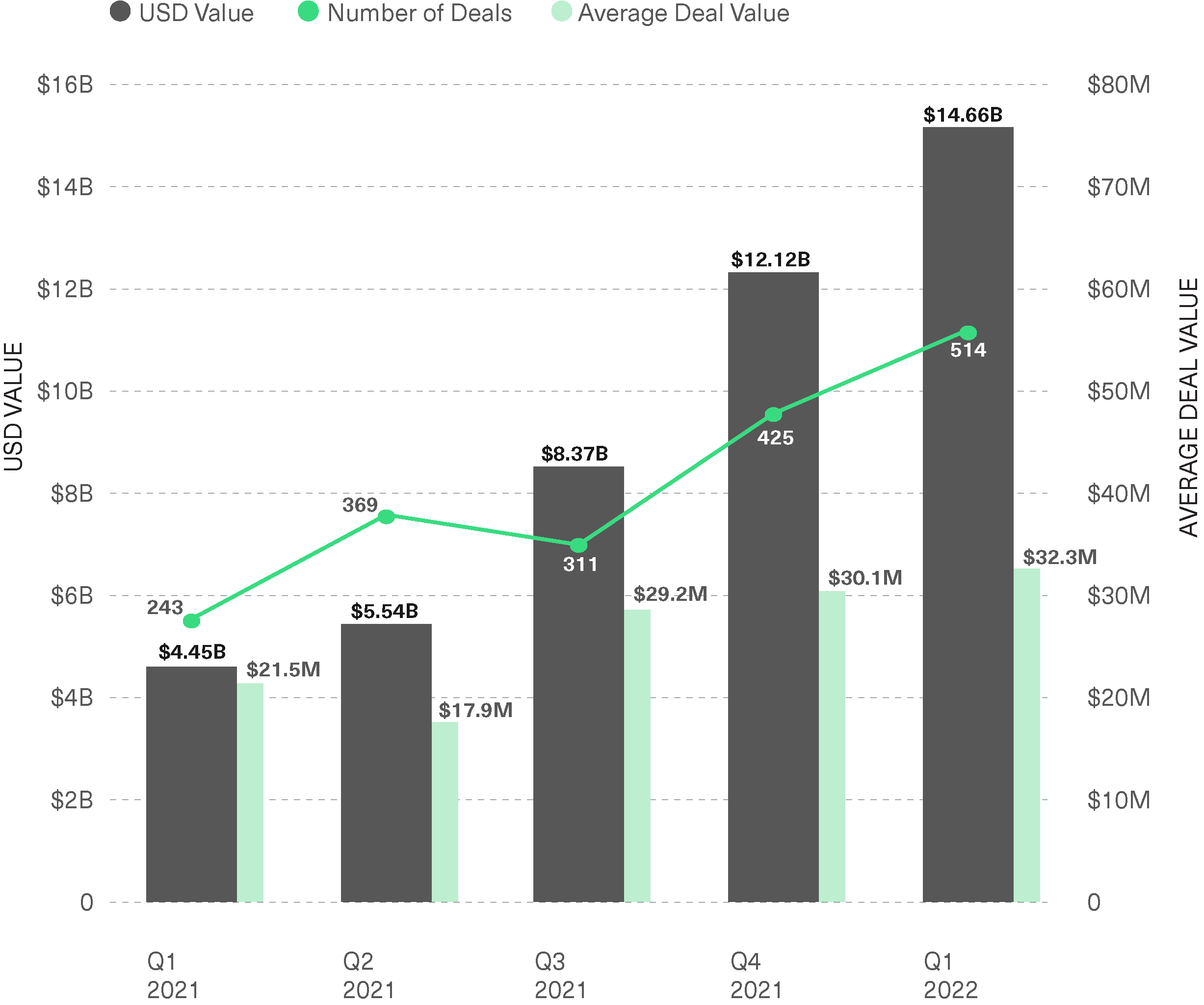

Venture Capital Activity

VC funding is the lifeblood of crypto innovation, and it’s booming. Venture capitalists poured $14.7 billion into crypto-related firms in Q1 2022, up 230% year-over-year. That’s on top of the $30.5 billion invested in 2021, which was more than the total value raised in the sector over the preceding 10 years.

Venture Capital Inflows in Blockchain

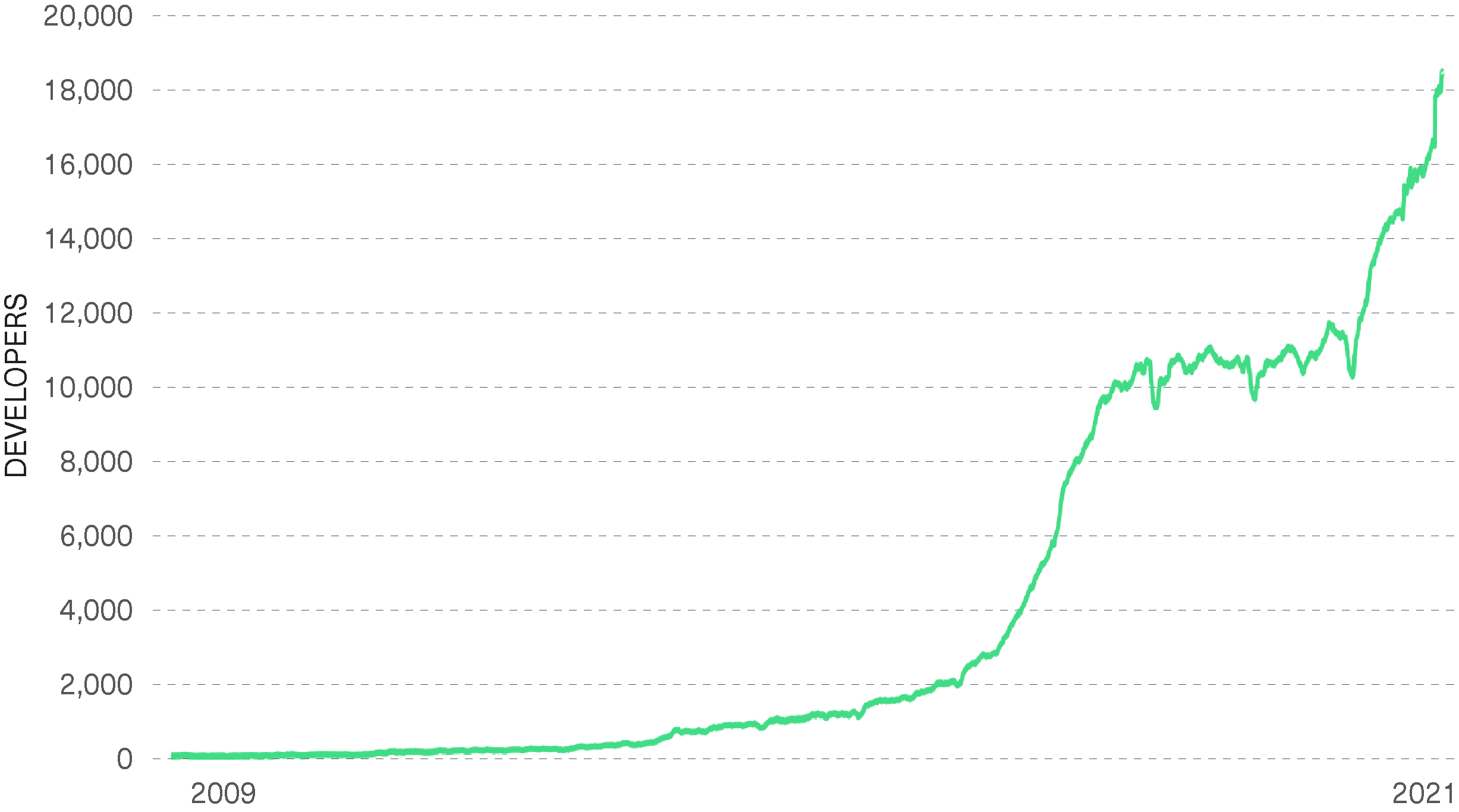

Developer Activity

The number of developers working on crypto protocols is at an all-time high, up more than 80% since the start of 2021. These software engineers guide the development of blockchains like Bitcoin and Ethereum, and we are seeing the impact of their increased activity. As discussed in a recent webinar, nearly every major blockchain is going through a significant upgrade in its technological capability. Ethereum’s “Merge” is the best known, but other examples include Bitcoin’s Taproot upgrade and Polkadot’s impressive technical roadmap. The pace of progress is staggering.

Monthly Active Crypto Developers

Regulatory Progress

Across the world, there’s been a sea change in regulators’ attitudes towards crypto over the past eight months. Whereas regulators in recent years focused predominantly on punishing bad actors, regulatory commentary today is focused on balancing regulation with the need to protect innovation. You can see this transition in U.S. Treasury Secretary Janet Yellen’s recent speech on digital assets, the U.K.’s about-face on crypto, and the nomination of a staunchly pro-crypto advocate to lead regulation at the Federal Reserve.

Consider the White House’s comment on the recent Biden Executive Order: “The rise in digital assets creates an opportunity to reinforce American leadership in the global financial system and at the technological frontier.”

Wow! Can you imagine that being written in 2020? Not a chance.

Historically, one of the biggest risks to crypto was that regulators would strangle it. But crypto has gotten big enough and is driving enough economic growth that the pendulum has swung firmly in the other direction.

So Why Is Crypto Flat?

Given the strong fundamental progress, why are crypto prices flat?

Our view is that negative macro news and risk-off sentiment are overwhelming the market in the short term.

The returns of capital assets—stocks, bonds, commodities, and crypto alike—are driven by two types of factors: macro factors and asset-specific (or “fundamental”) factors. The price of a stock, for instance, reflects both the performance of the underlying company and overall tenor of the market.

Crypto is a classic risk asset. It is highly volatile, and much of its value stems from expectations about its future importance. During risk-off markets, the market discounts that future value and crypto trades down. When the risk-off factor is strong, this can overwhelm the fundamentals.

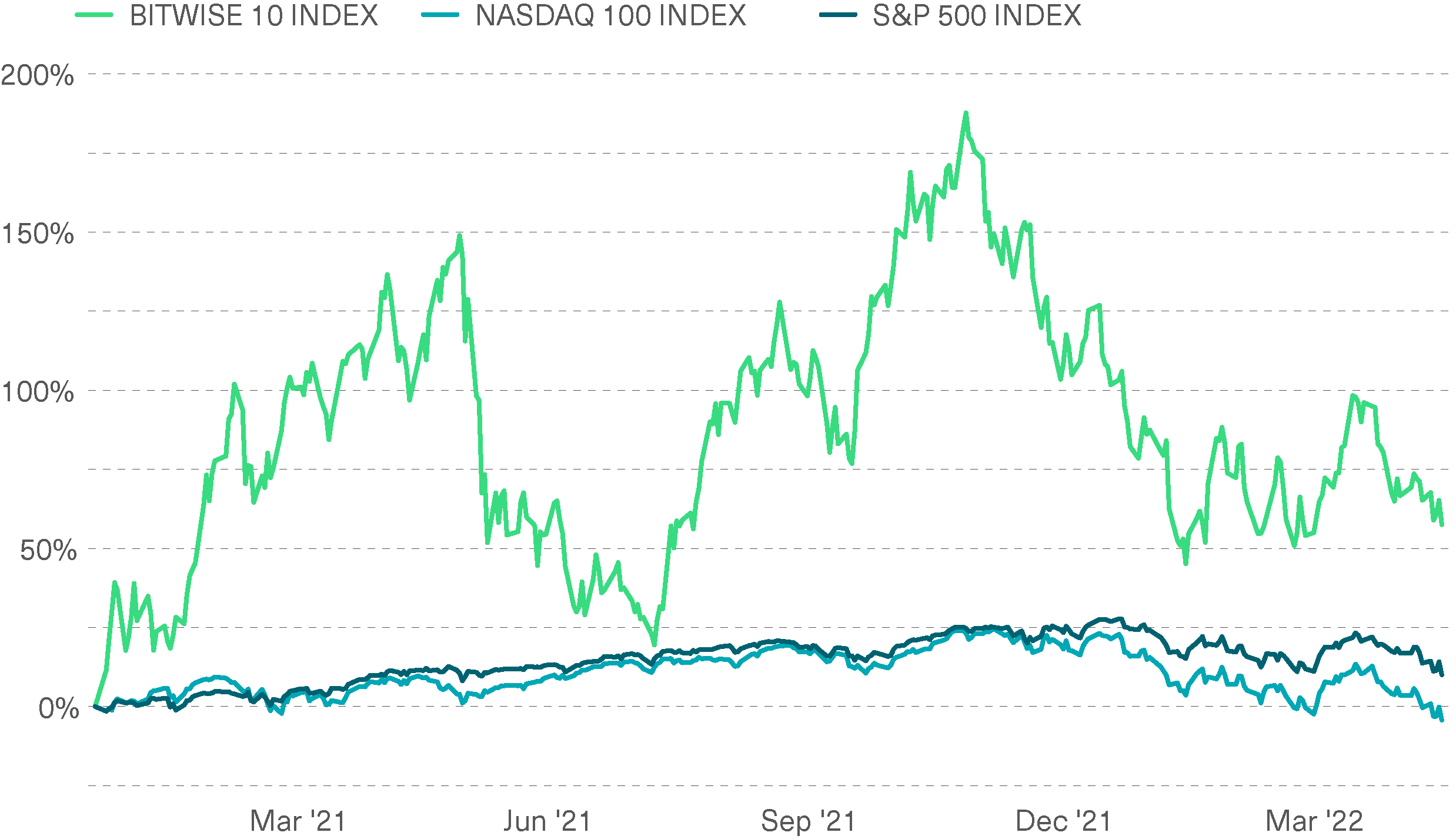

Today’s market is dominated by concerns from investors that the Fed will raise rates and push the economy into recession, and that the war in Ukraine and supply chain issues will keep inflation high. You can see this effect in all risk assets: Through April 28, the Nasdaq-100 (a common index of tech stocks) was down 9% year-to-date, with blue-chip names like Amazon, Alphabet, and Dell all down more than 15%. The Bitwise 10 Large Cap Crypto index was down a similar amount, at -20%.

Cumulative Returns

December 31, 2020 to April 29, 2022

What Happens Next?

The thing to remember about times like these is that while the underlying fundamental progress isn’t being recognized by the market, it’s still happening. Developers are still pushing the ball forward, venture capital is still helping companies hire more engineers, and regulators are still moving towards greater clarity.

We see this at Bitwise, where the pace and intensity of discussions with financial advisors and institutional investors continues to grow, week by week and month by month. Increasing numbers of people, when they look beyond the messy headlines du jour, believe crypto’s influence over our economy, government, and financial system is only getting bigger. As a result, they want to participate in it.

It may take months, or even quarters, for the market’s broad risk-off instinct to moderate and for this undercurrent of steady progress to become reflected in prices. There could be a lot of volatility in the meantime, too. But as we assess the moment, crypto increasingly feels like a tightly loaded spring.

Eventually, prices will catch up with the fundamentals, and that will be a very interesting moment indeed.

Matt Hougan

Chief Investment Officer

Notes From the Research Desk

Our research team captures some of crypto’s biggest themes and highlights in a word (or so).

The crypto VC boom gets bigger

One thing I’m keeping my eye on is the continued boom in venture capital activity. According to Cointelegraph, VCs invested $14.7 billion into crypto projects in Q1 2022, an all-time record. But more interesting than the record amount was where it went. According to data from The Block, NFT and crypto gaming made up more than one-third of deals, while DeFi projects garnered nearly 20%. This shows investors are playing the long game—for the most part, these aren’t late-stage deals for established crypto unicorns. That’s a good sign, particularly after a less-than-stellar few months for crypto prices that might have dulled risk appetites. Plus, that money is likely to lead to new applications and innovations in a year or so, moving the industry forward.

David Lawant

Director of Research

The Merge draws nearer ... with a twist

The Merge, one of the most anticipated upgrades in crypto history, is getting closer, and we’re excited about its impact. The network infrastructure upgrade will cut Ethereum's energy consumption by 99%, reduce new token issuance by 75-90%, and allow ETH holders to potentially earn up to 8-12% yields on long-term positions. Market suspense has increased since Ethereum core developers recently postponed The Merge by a few months despite a series of successful software dress rehearsals. Our view? The planned upgrade is both crucial to the Ethereum roadmap and extraordinarily complex, so it needs to be done right—and we think Ethereum’s developers are getting close. In the near term, we expect investor sentiment will hinge on whether The Merge takes place this year or slips into 2023.

Coinbase enters the NFT game

Coinbase (COIN), the largest U.S. crypto exchange, is now officially entering the non-fungible token (NFT) space. The company launched the beta version of its NFT marketplace on April 27, letting a few people from its waitlist of more than four million (!) experiment with the program. Among some of its perks: Transaction fees will be waived (for a while, at least), and the platform is aiming to implement a social marketplace where users can showcase their NFT collections and interact with one another. Think Instagram, but with NFTs. The move positions Coinbase as a potentially serious competitor to market leader OpenSea, the NFT pioneer that recently fetched a $13 billion valuation. That’s worth noting, since Coinbase’s market capitalization was only $26 billion as of April 29.

Juan Leon, CFA

Senior Investment Strategist

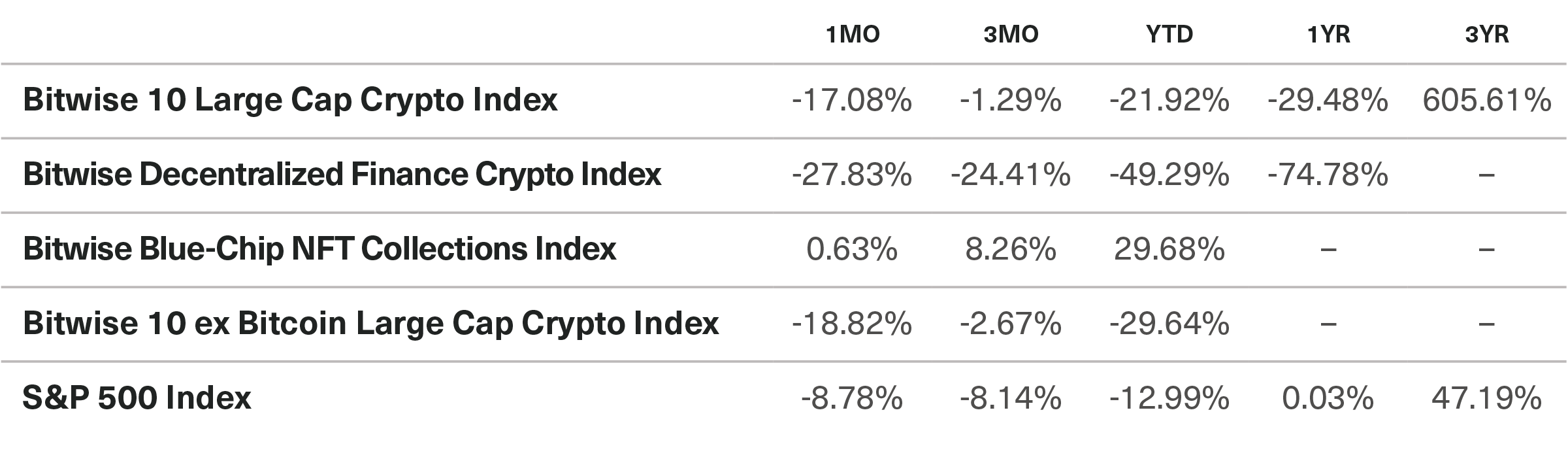

Performance

In April, risk-averse sentiment in the broader financial markets spilled over to crypto. The Bitwise 10 Large Cap Crypto Index fell 17%, erasing February and March’s gains and bringing the index negative over the last three months. The two largest crypto assets, Ethereum (ETH) and Bitcoin (BTC), outperformed the other eight index constituents.

The decentralized finance (DeFi) market fell 28%, extending its losses to nearly 50% in 2022. On a brighter note, the NFT market continues to perform well as the Bitwise NFT Blue-Chip Collections Index ended the month in positive territory, with year-to-date returns near 30%.

Benchmark Performance as of April 29, 2022

Source: Bitwise Asset Management with data from IEXCloud.

Notes: It is not possible to invest directly in an index. Past performance is no guarantee of future results. The Bitwise 10 Large Cap Crypto Index captures the 10 largest eligible crypto assets by free-float-adjusted market capitalization. The Bitwise Decentralized Finance Crypto Index is designed to provide investors with a clear, rules-based, and transparent way to track the value of the rapidly emerging Decentralized Finance space. The Bitwise Blue-Chip NFT Collections Index is designed to broadly capture the investable market opportunity for the most valuable arts and collectibles NFT collections. The Bitwise 10 ex Bitcoin Large Cap Crypto Index captures the assets in the Bitwise 10 Large Cap Crypto Index, excluding bitcoin. The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What's New at Bitwise?

Noteworthy happenings and key milestones.

Bitwise Launches Separately Managed Accounts (SMAs) for Financial Advisors. Recently, we launched a new strategy that allows advisors to offer clients direct exposure to Bitcoin and Ethereum, following an equal-weighted index of the world’s two largest crypto assets. The structure is designed to fit seamlessly into existing advisor workflows, including reporting, billing, and portfolio management.

Select Media Appearances

Barron’s: Want to add crypto to your retirement portfolio? Here’s how - and what to consider

Pensions & Investments: SEC approval of spot bitcoin ETF would attract more institutions

ETF Trends: Bitwise launches SMA with direct Bitcoin & Ethereum exposure

“One Thing to Know About Crypto”

Recently, we launched a weekly educational video series as part of our sponsorship of a new crypto segment on CNBC. Check out some of our latest 30-second videos on the upside of regulation, the future of NFTs, or one question every crypto investor should ask. To see the next installment, tune in to Squawk Box on Monday mornings.

“I'm Looking for Something ... Well Balanced.”

In case you missed it, our inaugural TV ad is now playing on CNBC, Bloomberg, and Fox Business.

FAQs

For answers to basic questions on Bitwise, our offerings, or how to access them, be sure to check out the new FAQ section on our website.

Upcoming Conferences

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email investors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

SACRS Spring Conference | May 10-13 in Rancho Mirage, CA

ACE Academy 2022 | May 15-18 in Nashville, TN

Morningstar Investment Conference | May 16-18 in Chicago, IL

Permissionless | May 17-19 in Palm Beach, FL

Inside ETFs | May 31-June 3 in Hollywood, FL

Vision | June 7-8 in Austin, TX

Consensus | June 9-12 in Austin, TX

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.