August 2022 Bitwise Investor Letter

San Francisco • Aug 10, 2022

In This Issue: When Will Crypto Go Mainstream? (Plus, the Most Important Chart in Crypto)

Market Overview

Dear Investors,

July was a good month for crypto.

After eight consecutive down months, the Bitwise 10 Large Cap Crypto Index gained 37% in July. Impressively, the market even managed to shrug off some fairly negative headlines: When word leaked that the SEC was investigating Coinbase for potentially listing unregistered securities, for instance, prices barely budged. That’s a strong sign.

The changing market sentiment shifted the types of questions we got from investors. During the market sell-off, all the questions were short-term in nature: Had we hit bottom? Would BlockFi survive? What would be next from the SEC?

With markets recovering, people’s focus adjusted. Suddenly, instead of asking short-term questions, people asked long-term questions—one of my favorite areas to explore as a long-term investor. The most common question was this:

When will crypto go mainstream?

It’s a great topic, possibly the most important in crypto. That’s why it’s the topic of this month’s Investor Letter.

The Most Important Chart in Crypto

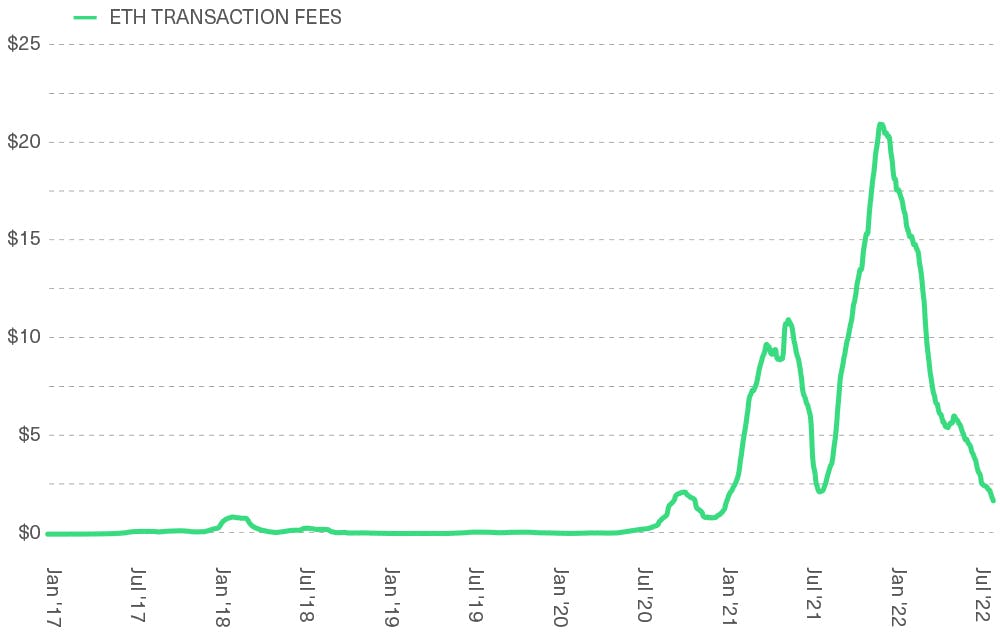

The place to start investigating this question is with the following chart, which I consider the most consequential in crypto. It’s a chart of the average cost to conduct a transaction on the Ethereum blockchain.

Ethereum Transaction Fees in USD, 60-Day Moving Average

Ethereum is arguably the world’s most important blockchain today. Bitcoin is larger by market capitalization and is fundamentally transforming the way money works (a huge market). But Ethereum is, at least for the moment, where the action is.

That’s because, unlike Bitcoin, in Ethereum it is possible to program virtually anything, as you could with a general computer.

Want to build a new version of the New York Stock Exchange? You can do that on Ethereum.

Want to build a digital alternative to Christie’s, the auction house? You can do that on Ethereum.

Want to create a new way to own music rights? Manage your medical records? Sell concert tickets fairly? Ethereum, Ethereum, Ethereum.

Ethereum is a globally decentralized operating system that entrepreneurs can build apps on, the same way people build apps for the iPhone. There are of course interesting alternatives to Ethereum, but none of them approach Ethereum’s size. If crypto is going to go mainstream, there’s a high probability it will be because of the decentralized apps built on Ethereum.

So why hasn’t it yet?

When people want to use the Ethereum database, they pay a fee for each transaction. But like any database, Ethereum can handle only so many transactions at once: Right now, that number is about 15 per second. This is a low throughput for a network that aims to reshape how we build and consume financial services, define the ownership of digital items, and ultimately restructure the internet. The Visa credit card network, by comparison, can handle roughly 65,000 transactions per second.

With this constrained bandwidth, when the demand to use the Ethereum blockchain rises, so does the price per transaction. The jumps you see on the chart above are the moments when the demand to use applications built on Ethereum soared: first in 2017-2018, during the initial coin offering (ICO) boom, and then in 2020-2021 during the rise of decentralized finance (DeFi), non-fungible tokens (NFTs), and stablecoins.

At the height of NFT popularity, the cost to process a single transaction on the Ethereum network shot up above $50. (The chart only shows about $20 because it shows the 60-day moving average; the intraday fees spiked much higher.)

There are many reasons why crypto applications haven’t gone mainstream yet, including evolving regulations, user learning curves, and more. But to me, this is the biggest.

Crypto hasn’t yet gone mainstream because it can’t handle mainstream volumes. You can’t build a new version of the internet if it costs $50 to post a single tweet.

How New Technologies Respond to Bandwidth Constraints

Crypto is not the only new technology to face bandwidth constraints. Virtually every new networked technology does.

The internet, for instance, faced severe bandwidth limitations in its early days. Talk to anyone over 40 and they will tell you horror stories about videos buffering, audio streams freezing, and the internet crashing.

Early cellular networks faced similar bottlenecks. In the earliest days of cellular technology, networks could only handle a few calls at once (like Ethereum today). As a result, cell phone calls were prohibitively expensive, with costs of $1 per minute or more. Small file downloads cost a fortune. Not surprisingly, cell phones were reserved for politicians, doctors, and the ultra-rich.

In each case, however, once the bandwidth problem was solved, use cases blossomed. Suddenly, everyone had a cell phone and we all started watching movies online. Moreover, we got new applications: video conferences, gaming, interactive data tools, and so on.

Technologists created the bandwidth, and entrepreneurs figured out how to use it.

We’re Approaching the Broadband Era of Crypto

Chances are, we’re nearing this point in crypto as well.

Scalability is particularly hard to build into a truly decentralized system like a public blockchain. In a traditional database, all records are stored on a single computer. If you want to process a transaction, you just update the file on that one computer. By comparison, the Ethereum blockchain is maintained by approximately 300,000 nodes. If you want to process a transaction on Ethereum, you need each one of these 300,000 computers to update their records all at once.

That’s much harder to do.

There is even a term for the particular challenge of scalability in blockchain design: the “blockchain trilemma.” Coined by Ethereum co-inventor Vitalik Buterin, the trilemma says that every blockchain must trade off between three factors: decentralization, security, and scalability. Historically, the understanding has been that you could design a blockchain that had two of these features, but not all three.

In the past year or so, blockchain engineers have made progress on a series of technological breakthroughs that, in aggregate, will let us work around the scalability issue, transforming Ethereum in particular into a sufficiently decentralized, appropriately secure, and highly scalable blockchain.

These technologies include the following:

1) Rollups

Rollups work on top of blockchains like Ethereum. That’s why they are called Layer 2 solutions: They allow lower-value transactions to occur without having to settle to the core Ethereum database. Transactions are batched and settled en masse as a single “group” transaction, using various techniques to ensure the transactions are secure.

New technologies like zero-knowledge proofs are making rollups significantly more powerful, and many believe rollups will be central to solving the scalability challenge.

2) Sidechains

Sidechains operate in parallel to blockchains like Ethereum and, like rollups, they allow lower-value transactions to be aggregated without having to interact with the core Ethereum database. Assets and transactions can be bridged periodically back to Ethereum.

Unlike rollups, sidechains are their own blockchains, with their own security guarantees that may be weaker than those offered by Ethereum. That sounds scary but can make a lot of sense: We use different payment systems to buy coffee than we do to buy houses. Security features that correspond to a transaction’s scale are a clever design solution.

3) Sharding

Developers use sharding to make databases more efficient. As the name suggests, it means splitting the information held in a database to reduce the amount that is required to be held by any one network participant. In the case of Ethereum, the technological roadmap calls for the implementation of sharding in the coming years, which would lower the burden of data that nodes are required to maintain. Paired with rollups and sidechains, sharding can be extremely helpful in scaling a blockchain.

All three of these ideas have been discussed for years, but they have matured rapidly in recent months and are now clearly on the horizon. In totality, experts expect them to boost Ethereum’s throughput from today’s 15 transactions per second … to over 100,000 per second.

What New Use Cases Will We See?

What will 100,000 transactions per second mean for Ethereum?

For one, it will mean that all existing applications are likely to get a lot better. High and variable fees (and slow transaction times, another element of scalability) put a tax on every DeFi app, NFT user, and stablecoin transaction. Enhance throughput and decrease costs, and common sense says growth will follow.

This seems particularly true for NFTs. In 2020-2021, the NFT market evolved from a low-cost emerging market into one focused on high-priced “art.” Part of this was driven by rising prices for blue-chip NFTs, but part was transaction-related: When it costs $50-$100 for a single NFT transaction, you’re not going to see a lot of innovation on the low end of the spectrum.

Many market observers believe we have thus far only scratched the surface of what NFTs can do. Solve the bandwidth issues, and we could see music rights, concert tickets, and real-world assets transform into NFTs, to great mainstream effect.

Some of the most interesting new use cases, however, lie beyond the financial world. Buterin himself wrote a blog about non-financial uses of blockchain. Once high fees and bandwidth constraints are solved, the surface area for entrepreneurs is enormous. Web3 applications like a decentralized Twitter are just the beginning.

And importantly, Ethereum is not the only blockchain that is evolving. Ethereum competitors like Solana, which were initially optimized for scalability, are evolving to improve their security offerings. And Bitcoin — the world’s largest blockchain — is changing as well: The Lightning Network, a Bitcoin Layer 2 solution, could be capable of processing more than 1 million transactions per second, while recent enhancements to the Bitcoin blockchain (like the Taproot upgrade) are allowing Bitcoin to handle more smart-contract applications, intruding slightly onto Ethereum’s turf.

The Mainstream To Come

Many people look at crypto and wonder why it hasn’t gone mainstream yet. As I look at crypto, I see a lot of evidence that suggests otherwise. Already, crypto is being discussed on the floor of Congress; already, it’s remaking parts of the art world; already, most Wall Street firms are hard at work figuring out how to adapt their businesses to a blockchain reality.

And despite all of this, we’re still in the dial-up era of blockchain. The real opportunities won’t start until we move into broadband.

So, to answer the question: When will crypto go mainstream?

Not tomorrow. The technologies I outlined above still need time to mature. We likely won’t see 100,000-transaction throughput on Ethereum for a few years, and other blockchains are maturing at different rates.

But what’s changed is that this future is now in sight. A high-bandwidth blockchain world is now a question of when, not if. And that means entrepreneurs can start building for it today. Expect to hear more and more about new mainstream, high-throughput solutions soon.

Matt Hougan

Chief Investment Officer

Events

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email investors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

Conferences

UBS Digital Asset Conference | August 23-26 | Virtual

Future Proof | September 11-14 | Huntington Beach, CA

Titan RIA Retreat | September 12-13 | Lake Forest, IL

BITG Digital Asset Conference | September 19-20 | Virtual

Converge 2022 | September 27-30 | San Francisco, CA

Barron’s Advisor 100 Summit | September 28-30 | Palm Beach, FL

Webinars

RIA Channel Webinar: "Crypto Basics for Advisors" | August 31 | Register Here

Notes From the Research Desk

Crypto Policy Debates Are Intensifying

The past month was a big one for legislative developments in crypto, with two key issues in the limelight: stablecoin regulation and the question of whether to characterize crypto assets as commodities or securities.

On the stablecoin side, the House Financial Services Committee made progress on a bipartisan stablecoin bill that would provide clarity to a critical space in crypto and allow banks to issue their own stablecoins. While the proposal was delayed after Treasury Secretary Janet Yellen pushed for changes, a final version of the bill is expected to emerge after Congress returns from its August recess.

On the definitional question, the two leading senators on the Senate Agriculture Committee sponsored a bipartisan bill that would give jurisdiction over most digital assets to the Commodity Futures Trading Commission instead of to the SEC. We expect such discussions to reach a fever pitch in the next 12 months. That leaves us optimistic about getting more regulatory clarity in the space.

David Lawant

Director of Research

It’s Crypto Winter, But Layer 2 Summer Is Heating Up

After the Merge, the next big topic for Ethereum will be scalability, or enabling high transaction processing speeds at lower costs. A key pillar in this endeavor is Layer 2s, which are secondary networks that batch transactions and use the Ethereum blockchain only periodically. There are a variety of Layer 2s, many of which are making noise in crypto circles: Optimism, a leading player among scaling solutions called “optimistic rollups,” launched its token in May. Now we’re anticipating its rival, Arbitrum, will follow suit, while StarkWare, a top developer of another type of Layer 2 solution (“zero-knowledge rollups”), announced a token for its StarkNet network in July.

Meanwhile, Polygon, a Bitwise 10 constituent, recently announced an enhanced version of this technology that will allow developers to migrate applications to Polygon without major code modifications. These game-changing developments are drawing more applications to Layer 2s while bringing Ethereum to the next level.

DeFi Blue Chips Keep Innovating

I'm excited about several new initiatives underway among blue-chip DeFi protocols Aave and Uniswap. In July, lending giant Aave took a big step toward targeting the roughly $140 billion stablecoin market when it approved the launch of its own crypto-backed stablecoin, GHO. Unlike algorithmic stablecoins such as the ill-fated TerraUSD, GHO will be backed by excess collateral posted by the token holder. This structure is comparable to DAI, the leading crypto-backed stablecoin, which currently has over $10 billion in AUM.

Meanwhile, the leading decentralized crypto exchange, Uniswap, completed the first phase of governance discussions to activate its so-called “fee switch.” Currently, all fees generated by traders on Uniswap are paid to the people who supply liquidity to the protocol. The “fee switch” (if fully approved) would direct a portion of the fee to the protocol’s treasury. The protocol has not determined whether these fees would be invested, used to burn UNI tokens, or distributed to token holders, and current proposals only call for a test of the switch. Still, it’s a big deal.

For both Aave and Uniswap, these measures would likely increase cash flows to their treasuries, which are ultimately controlled by token holders.

Ryan Rasmussen

Head of Research

Amid a Tough Stretch, Coinbase Scores Two Big Wins

Coinbase (COIN) continued to cement its position as the industry’s powerhouse in driving broader crypto adoption. On the institutional side, the company recently announced a partnership with BlackRock, the world’s largest asset manager, that lets select BlackRock clients trade and manage crypto using Coinbase’s platform. The integration unlocks a new access point for institutional investors to participate in the crypto economy. Additionally, the Coinbase wallet was among those selected by Facebook’s parent company, Meta, to support its upcoming feature to integrate NFTs on Instagram in more than 100 countries.

There’s no doubt Coinbase has struggled this year amid the plunge in crypto prices, growing competition, and regulatory headwinds. However, being selected as a partner by both BlackRock and Meta reinforces our view that the company is one of the best-positioned entities emerging from this crypto winter.

Alyssa Choo

Crypto Research Analyst

Performance

Market performance commentary

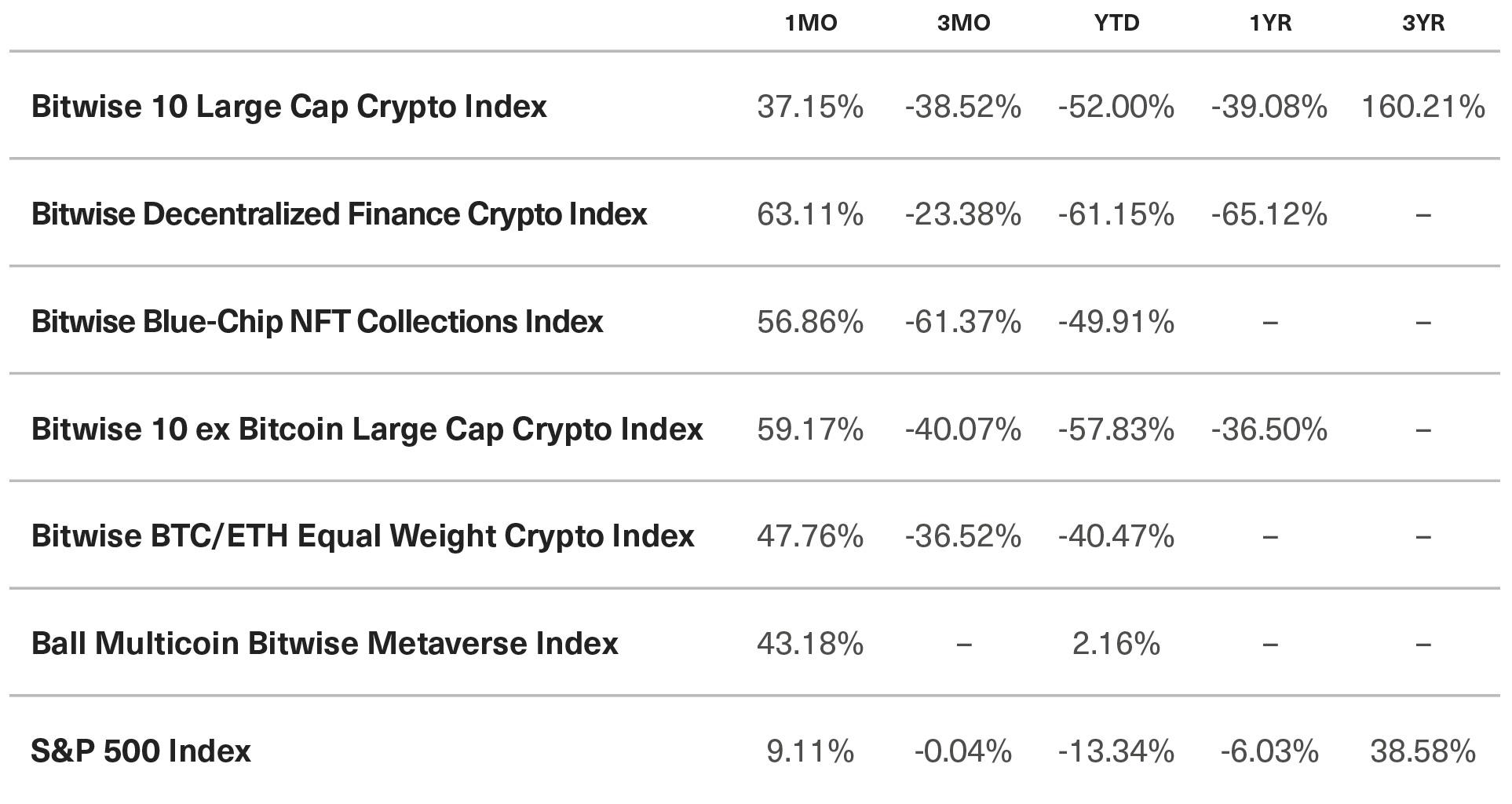

The crypto market posted a partial recovery in July following crushing performance in June. The Bitwise 10 Large Cap Crypto Index was up 37%, mainly on the back of ETH’s stellar performance (+69%) stemming from anticipation around the upcoming “Merge” upgrade. All other Bitwise indexes were up even more, with the Bitwise Decentralized Finance Index boasting a whopping 63% increase.

Benchmark Performance as of July 29, 2022

* Indexes that incepted after January 1, 2022 display performance since inception in the YTD column. The Bitwise BTC/ETH Equal Weight Crypto Index incepted on April 18, 2022, and the Ball Multicoin Bitwise Metaverse Index incepted on June 6, 2022.

Source: Bitwise Asset Management with data from Bloomberg.

Notes: It is not possible to invest directly in an index. Past performance is no guarantee of future results. The Bitwise 10 Large Cap Crypto Index captures the 10 largest eligible crypto assets by free-float-adjusted market capitalization. The Bitwise Decentralized Finance Crypto Index is designed to provide investors with a clear, rules-based, and transparent way to track the value of the rapidly emerging Decentralized Finance space. The Bitwise Blue-Chip NFT Collections Index is designed to broadly capture the investable market opportunity for the most valuable arts and collectibles NFT collections. The Bitwise 10 ex Bitcoin Large Cap Crypto Index captures the assets in the Bitwise 10 Large Cap Crypto Index, excluding bitcoin. The Bitwise BTC/ETH Equal Weight Crypto Index captures the value of an equal-weighted index consisting of bitcoin and ethereum. The Ball Multicoin Bitwise Metaverse Index is designed to capture the investable market opportunity for crypto assets exposed to the emerging Metaverse. The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What’s New at Bitwise

Announcing the Crypto Market Quarterly Review

Last month, we launched the inaugural issue of our Crypto Market Quarterly Review, a comprehensive data-driven report on the key themes shaping crypto markets. It features an analysis of the crypto credit crisis, correlations, Bitcoin, Ethereum, NFTs, DeFi, and crypto equities … along with 50 charts on some of the most interesting stories in crypto today.

READ MORECrypto 101 in 30 Minutes

Bitwise CIO Matt Hougan has been called inimitable for his ability to explain crypto clearly and concisely to all audiences. Recently, he delivered a half-hour tutorial on crypto’s basics, including why Venmo helps people understand blockchain technology—and what made Bitcoin so groundbreaking. A must-watch video for crypto learners and educators alike.

READ MORECrypto 101 in 30 Seconds

The latest in our series of quick educational videos on CNBC featured Bitwise CEO Hunter Horsley explaining why decentralized finance is making Wall Street nervous (hint: downward pressure on fees). He also gave a brief definition of crypto miners and talked about the 30,000-plus developers who jumped into crypto last year.

Select Media Appearances

Bloomberg: A look at Ethereum’s Merge (Matt Hougan)

MarketWatch: When will the crypto winter end? (Matt Hougan)

CheddarTV: The SEC, crypto, and recent high-profile cases (Katherine Dowling)

U.S. News & World Report: Bitcoin vs. Ethereum (Matt Hougan)

DoubleLine Channel 11: Looking beyond the crypto credit crisis (Hunter Horsley)

Crypto 101 Podcast: How crypto can go mainstream (Matt Hougan)

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.