September 2022 Bitwise Investor Letter

San Francisco • Sep 7, 2022

In This Issue: Your Guide to Ethereum’s “Merge,” the Biggest Event in Crypto This Year

Market Overview

Dear Investors,

Buckle up. September is shaping up to be one heck of a month for crypto.

First, some context.

Usually, the crypto news cycle is unpredictable. Technological developments, regulatory actions, new applications … keeping up can feel like a game of Whac-A-Mole.

But sometimes, you can see what’s coming. And as we look ahead through September, there are a trio of high-profile developments on tap that promise to inject significant headline volatility into the crypto markets—some positive, some less so.

Here’s what we have our eye on:

1) SEC Enforcement Season

September is the end of the fiscal year for the SEC, which typically means a flurry of crypto enforcement actions from the agency’s cyber task force. We know from media reports that the SEC is investigating several large crypto entities, including Coinbase, Binance, and Uniswap. A major enforcement action against a large player could rattle markets in September.

2) The Biden Executive Order

President Biden signed an executive order on cryptocurrencies in March, directing multiple U.S. government agencies to prepare reports on crypto. It was a big deal at the time, a sign of crypto’s growing importance to the U.S. economy.

The reports are due to be released in early September. In these, we’ll learn everything from what the Federal Reserve is thinking about developing a central bank digital currency to how the Justice Department will handle money-laundering concerns going forward. There will also be a report from the Commerce Department on what steps the U.S. must take to maintain a leadership role in the global crypto economy.

We suspect these reports will generate a range of major headlines—some good, some bad—as the U.S. continues to iron out a thoughtful approach to this fast-growing market.

3) Ethereum’s “Merge”

Ethereum—the world’s second most valuable blockchain—is scheduled to undergo a massive technological upgrade in September, transitioning its core internal engine from “proof-of-work” to “proof-of-stake.” This change, akin to replacing a gas-powered motor with an electric one, will cut Ethereum’s carbon consumption by 99%, reduce its inflation rate by 75% to 90%, and introduce the ability for long-term Ethereum investors to earn a yield on their assets.

It’s likely that the confluence of these developments—plus whatever the Fed throws at us in its September 21 meeting—will whipsaw markets in September. Long-term, however, our hunch is that The Merge will have the biggest impact of the three.

Regulatory and legislative developments are important, but they are part of a continuum: The U.S. has been building its regulatory footprint around crypto since at least 2013, and policymakers will be refining it until the end of the decade. But a wholesale technological overhaul of the world’s second-largest blockchain has never happened before and may never happen again.

And so, while much has already been written on The Merge (including this great column in April by my colleague Anais Rachel), I want to cover a few key questions, as I think the market is underestimating its long-term importance.

What is The Merge, anyway?

The Merge is a technological upgrade to the Ethereum blockchain that will change a key part of its “consensus mechanism” from proof-of-work to proof-of-stake. It will, as mentioned above, have major impacts on Ethereum’s carbon consumption and inflation rate, and it will introduce the ability for long-term Ethereum investors to earn a 4% to 8% annualized yield on their positions.

Each of those developments is significant enough on its own, but together, they’re colossal. We believe they will fundamentally transform Ethereum as an investment and may push us toward a new bull market for crypto.

The Merge is scheduled to happen around September 15.

Which of the three impacts is the most important?

It’s hard to say.

It’s wonderful to see a significant reduction in Ethereum’s carbon footprint, and the introduction of yield will be very attractive for many investors.

But if I had to pick one, I’d focus on the reduction in new issuance. According to a recent report from our friends at Fundstrat, The Merge will reduce the new supply of ETH by about $20 million per day, or $7+ billion per year.

Think about it this way: Today, Ethereum needs to find more than $7 billion of buyers each year just to hold steady. After the Merge, that will fall (roughly) to zero. It may even be negative.

Negative?

Yep.

One feature of Ethereum is that a significant portion of the fees paid by people to use the blockchain are permanently removed from circulation, or “burned.” For the year ending August 31, the network burned roughly $4 billion of Ethereum. If that continues, the total amount of Ethereum that exists in the world will shrink every year.

It’s kind of like a stock buyback on overdrive.

If the demand to use Ethereum increases over time, so will the amount burned each year. As supply-and-demand dynamics would tell us, that could put upward pressure on ETH prices.

Is there any risk to The Merge?

Absolutely.

It bears saying: This has never been done before.

While other proof-of-stake blockchains exist, none has tried to change a blockchain as big as Ethereum from proof-of-work to proof-of-stake. This creates both known and unknown risks.

Among the known risks, one big worry is that the switch to proof-of-stake will raise concerns around decentralization. Post-Merge, entities like Coinbase that represent large numbers of investors could have significant influence over transaction processing on the Ethereum network. This could raise regulatory risks: For instance, would Coinbase—by virtue of providing a staking service—be held responsible for ensuring that every transaction on the Ethereum network complies with international sanctions?

Another is the potential emergence of a forked chain that maintains its adherence to proof-of-work mining, raising complications for both investors and the community. (Note: Bitwise is experienced in handling forks.)

But the unknowns are larger. Every technological upgrade comes with risk: Think about how many times you’ve installed new software on your computer only to have something else break. While The Merge has been tested and retested, there is always the chance of an unexpected issue or bug.

Chances are, things will work as expected. But there are no two ways about it: This is a high-stakes upgrade.

What do you expect from prices if The Merge goes through smoothly?

Crypto markets typically “buy the rumor and sell the news,” so often you see a short-term letdown after highly anticipated news events.

But ETH futures-pricing data from the CME suggests a fair amount of bearishness is already priced in. The annualized basis of ETH futures contracts currently stands at -19%, the lowest level at any point in the contract’s history. That suggests the path of least resistance may be upwards.

Regardless, our long-term view is that The Merge should be eminently positive for Ethereum. The combination of fundamental impacts is simply too large for investors to ignore.

Will The Merge only impact Ethereum?

No. It will affect the entire crypto ecosystem.

The biggest question in crypto right now is when it will go mainstream—that is, when people will start using crypto applications in their day-to-day lives.

This is a question that every disruptive technology faces at some point in its development. In the early days of the internet, for instance, people dismissed it as a toy for computer science nerds and college kids. No one suspected it would become the centerpiece of the global workplace.

History suggests that the path to “real-world impact” involves an intricate feedback loop between technological infrastructure and application development. We didn’t see mainstream applications of the internet like Facebook, Netflix, and Zoom, for instance, until we had the high-speed internet to support them. And cell phones didn’t go mainstream until they fit in our pocket.

Ethereum’s upgrade represents a major technological step forward in blockchain technology. It will also lay the groundwork for other future planned upgrades (including plans to increase Ethereum’s throughput 1000-fold). Together, these set the stage for entrepreneurs to build the applications that will take crypto mainstream, in industries ranging from arts and entertainment to healthcare and insurance.

At the same time, Ethereum’s upgrade will put pressure on competing blockchains like Solana and Cosmos to raise their game as well, creating a virtuous cycle of improving infrastructure. And that may be the biggest point of all.

Ethereum’s Merge is a reminder that we are early in crypto’s development, but the technology is progressing at a blistering pace. It may not always feel like that with prices hemming and hawing, but we are moving forward with incredible speed. Think about it this way: When’s the last time you saw another major technology cut its carbon/energy consumption by 99% overnight?

Conclusion: The storm before the surge

As I sat down to write this letter, I wondered: Is this the “calm before the storm” or the “calm before the surge”?

After dwelling a bit on The Merge, I suspect it will be a combination of the two.

September is shaping up to be a volatile month, swept by regulatory headlines, uncertainty around the Fed, and exciting technological progress. But as I look out just a little bit further, the forces fueling crypto’s continued growth become harder and harder to deny.

It will be fun to watch.

Matt Hougan

Chief Investment Officer

Events

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email investors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

Conferences

Future Proof | September 11-14 | Huntington Beach, CA

Titan RIA Retreat | September 12-13 | Lake Forest, IL

Digital Asset Summit | September 13-14 | New York, NY

BITG Digital Asset Conference | September 19-20 | Virtual

Converge 2022 | September 27-30 | San Francisco, CA

Barron’s Advisor 100 Summit | September 28-30 | Palm Beach, FL

Financial Planning Association Houston Symposium | September 29 | Houston, TX

Notes From the Research Desk

TornadoCash Sanctions Raise Thorny Questions in Crypto Circles

Perhaps the most heavily debated topic in crypto during August was the U.S. Treasury’s decision to place TornadoCash—a software protocol that allows people to mingle crypto assets to conceal their origin—on its Office of Foreign Assets Control sanctions list. The rationale was that the service has been used by hackers to launder money.

The debate got particularly heated around the potential legal implications of this action, as highlighted by crypto advocacy groups and even a member of Congress. This was a rare instance when an arguably neutral technological platform was sanctioned instead of a specific person.

Our view: For crypto to go mainstream, it must comply with a clearly defined regulatory framework (including OFAC sanctions). The main question is whether this adherence should be enforced at the foundational technological layer or at the level of individual applications and users. (It’d be like the difference between trying to ban the internet versus prosecuting someone who is using the internet for money laundering.) History suggests that freedom, innovation, and growth are best served when technologies are allowed to be credibly neutral, and bad acts are policed by going after bad actors.

David Lawant

Director of Research

The DeFi Area That Could Get a Boost From The Merge

I’m excited about the growing potential of staking as a service, a relatively new arrangement where users earn yield by depositing their crypto assets with a staking company or platform, which uses them to help secure the network. This is made possible by Ethereum’s upcoming change from proof-of-work to proof-of-stake.

Lido, the category leader, is already growing at an impressive rate: From its inception 18 months ago, the service has gathered more than $7 billion in staked assets, and over the past year it’s generated more than $300 million in revenue. But there’s room for growth to accelerate further once The Merge is completed. I also expect competition within this category to intensify, including from centralized players. Coinbase, for example, recently announced plans to launch a staking product that looks nearly identical to Lido’s.

Ryan Rasmussen

Head of Research

Ethereum’s Top Scaling Solution Just Deployed an Important Upgrade

Once Ethereum’s Merge is complete, all eyes will be on improving the blockchain’s scalability. These developments, which are being done in parallel, are running full steam ahead. For instance, Arbitrum, one of the leading Ethereum scalability solutions, shipped a key upgrade on August 31 that will make interacting with Ethereum faster and cheaper.

Before this most recent upgrade, Arbitrum—which holds more than $2.5 billion in deposits, or total value locked—was a victim of its own success: Heavy demand congested the network to the point that its scalability gains became exhausted. With this new upgrade, we’re unlikely to see that happen again. So far, users seem to be welcoming the improvements, with Arbiturm recently hitting a new all-time high in total daily transactions.

Crypto Equities’ Q2 2022 Earnings: Not the First Bear Market Rodeo

I’m still thinking about the most recent crypto equities earnings season. As expected, earnings missed consensus estimates in a quarter marked by crypto price volatility, a tough macroeconomic environment, and a myriad of company-specific events.

However, there were a few silver linings. For example, management guidance for the next 6-12 months didn’t change significantly, suggesting that operations have quickly adjusted to the new market environment. It’s clear that earnings momentum will likely continue to experience headwinds in the short run, but barring another market downturn, we expect profitability to gradually recover.

Out of all the highlights, the most important discovery to me was seeing that many leading crypto companies are well situated to seize opportunity in the bear market. During previous downturns, many of these same companies either established or significantly expanded their leadership positions, and I think they have a great opportunity to do it again.

Alyssa Choo

Crypto Research Analyst

Performance

Market performance commentary

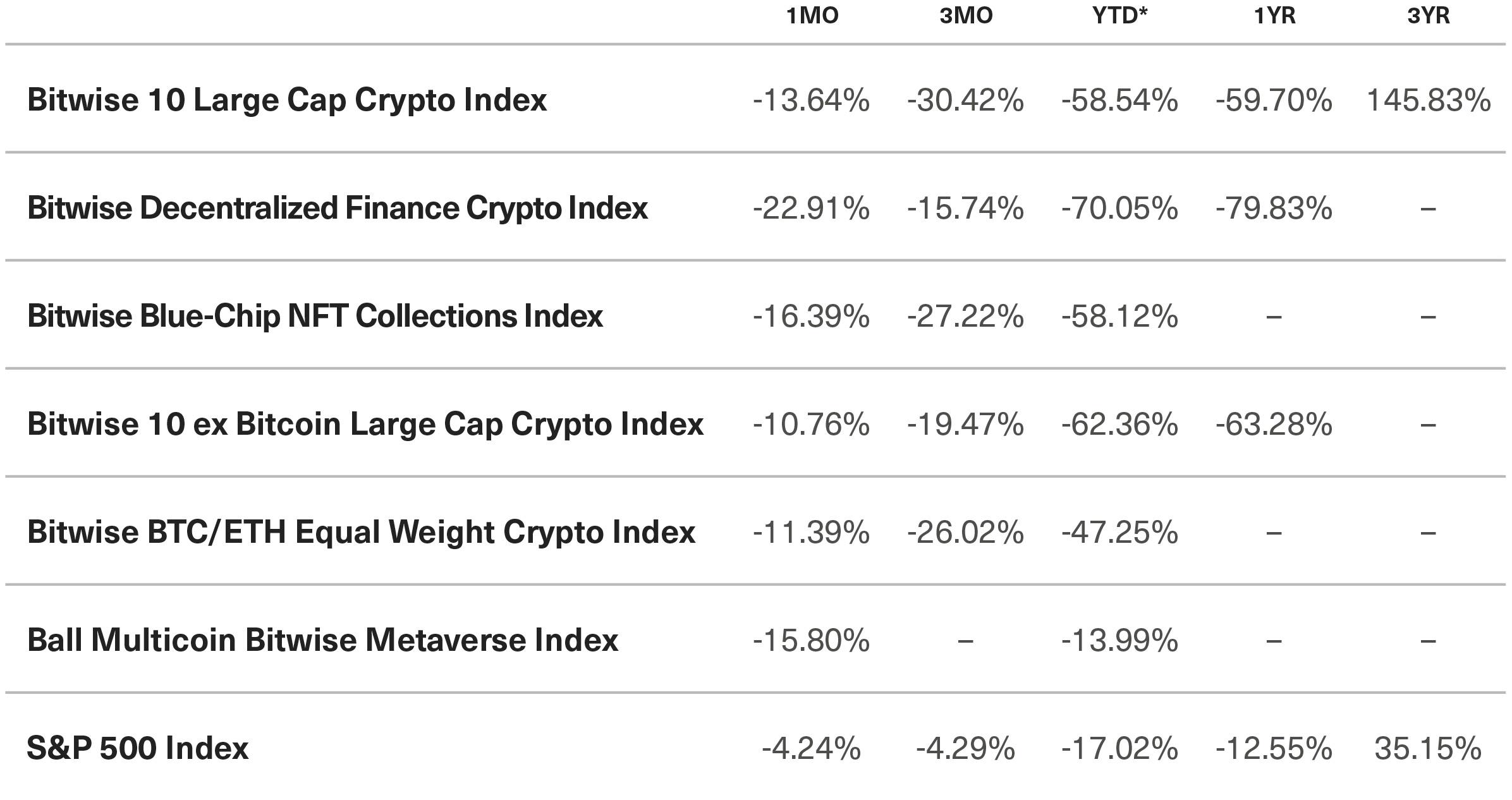

The crypto market remains under pressure. Uncertainty around the macroeconomic environment for risk assets took center stage during the month, intensifying after Fed Chair Jerome Powell’s Jackson Hole speech on August 26. The Bitwise 10 ended August down 13.65%, with ETH posting the best relative performance in light of market excitement around the upcoming Merge upgrade. DeFi, NFTs, and the Metaverse once again demonstrated high-beta behavior: The trio suffered losses of 22.91%, 16.39%, and 15.80%, respectively.

Benchmark Performance as of August 31, 2022

* Indexes that incepted after January 1, 2022 display performance since inception. The Bitwise BTC/ETH Equal Weight Crypto Index incepted on April 18, 2022, and the Ball Multicoin Bitwise Metaverse Index incepted on June 6, 2022.

Source: Bitwise Asset Management with data from Bloomberg.

Notes: It is not possible to invest directly in an index. Past performance is no guarantee of future results. The Bitwise 10 Large Cap Crypto Index captures the 10 largest eligible crypto assets by free-float-adjusted market capitalization. The Bitwise Decentralized Finance Crypto Index is designed to provide investors with a clear, rules-based, and transparent way to track the value of the rapidly emerging Decentralized Finance space. The Bitwise Blue-Chip NFT Collections Index is designed to broadly capture the investable market opportunity for the most valuable arts and collectibles NFT collections. The Bitwise 10 ex Bitcoin Large Cap Crypto Index captures the assets in the Bitwise 10 Large Cap Crypto Index, excluding bitcoin. The Bitwise BTC/ETH Equal Weight Crypto Index captures the value of an equal-weighted index consisting of bitcoin and ethereum. The Ball Multicoin Bitwise Metaverse Index is designed to capture the investable market opportunity for crypto assets exposed to the emerging Metaverse. The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What’s New at Bitwise

Crypto Companies Were Resilient in a Tough Q2

READ MOREEarnings for crypto companies suffered during one of the most tumultuous quarters in crypto history. But the period also saw notes of optimism, including balance-sheet improvements, year-over-year revenue gains for top miners, and strong customer growth for crypto banks. Crypto Equities Specialist Alyssa Choo and Director of Research David Lawant share five key takeaways from earnings season.

On-Chain Data Suggests the Worst Is Behind Us

READ MOREAn analysis of key blockchain metrics shows crypto flows to North American buyers stalled during the second quarter, smaller entities took on a larger role as investors, and more than half of bitcoin and Ethereum investors are sitting on unrealized losses. What does it all mean? The worst of the crypto downturn could be behind us, write Bitwise Research team members David Lawant and Gayatri Choudhury.

In Case You Missed It … Check Out the Crypto Market Quarterly Review

READ MORERecently, we launched the inaugural issue of our Crypto Market Quarterly Review, a comprehensive data-driven report on the key themes shaping crypto markets. It features an analysis of the crypto credit crisis, correlations, Bitcoin, Ethereum, NFTs, DeFi, and crypto equities … along with 50 charts on some of the most interesting stories in crypto today.

Select Media Appearances

Fortune: Ethereum and the censorship question (Matt Hougan)

TechCrunch: The SEC and long-needed clarity in crypto regulation (Katherine Dowling)

Polygon Alpha Podcast: An interview with Matt Hougan and Ryan Rasmussen (Matt Hougan, Ryan Rasmussen)

Yahoo! Finance: Crypto markets brace for The Merge (Matt Hougan)

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.