A (Mostly) Jargon-Free Guide to Ethereum’s Quantum Leap — Part 2: Scalability Improvements

San Francisco • May 23, 2022

This is the second half of our series covering the Ethereum upgrade. Although both halves can be read independently, those who wish to have a fuller understanding of the whole process can find the first installment, which covers The Merge, here.

One of the biggest stories in crypto over the last two years has been the massive growth in demand for applications that are built on top of blockchains, a handful of which support millions of transactions a month.

Most of these applications have been built on Ethereum due to the blockchain’s functionality, network effects, and competitive advantage as the first decentralized application ecosystem. The growth in Decentralized Finance (DeFi), Non-Fungible Token (NFT) marketplaces, and gaming applications has led to a surge in demand for space on the Ethereum blockchain, which, in turn, has caused network congestion during periods of high activity.

It is enormously important for Ethereum to increase its capacity to handle more transactions and eliminate this congestion. This column will cover how developers have been addressing this challenge, and discuss how a planned upgrade to Ethereum would put this problem in the rearview mirror.

Scalability is the term used in blockchain design to discuss the capacity of a network to keep functioning properly and affordably as the number of transactions increase. This is a well-documented challenge for crypto networks. In fact, the question of scalability was raised in the very first response to the email in which Bitcoin was introduced to the world by its creator, Satoshi Nakamoto, back in 2008.

The Ethereum blockchain can only handle so many transactions before it gets congested and transaction fees start to increase. However, arbitrarily increasing the capacity of the network could prevent some network participants from keeping up, thus making it increasingly centralized over time. Ethereum’s commitment to keeping decentralization and security at the forefront of its development has meant that the network has had to compromise on scalability.

Consequently, for many years, researchers and developers have explored better methods by which decentralized blockchains can scale. We are now in an exciting time in which many of the potential solutions that have been in research and development mode for years are starting to materialize.

Rollups: Ethereum’s Main Answer to Scalability Bottlenecks

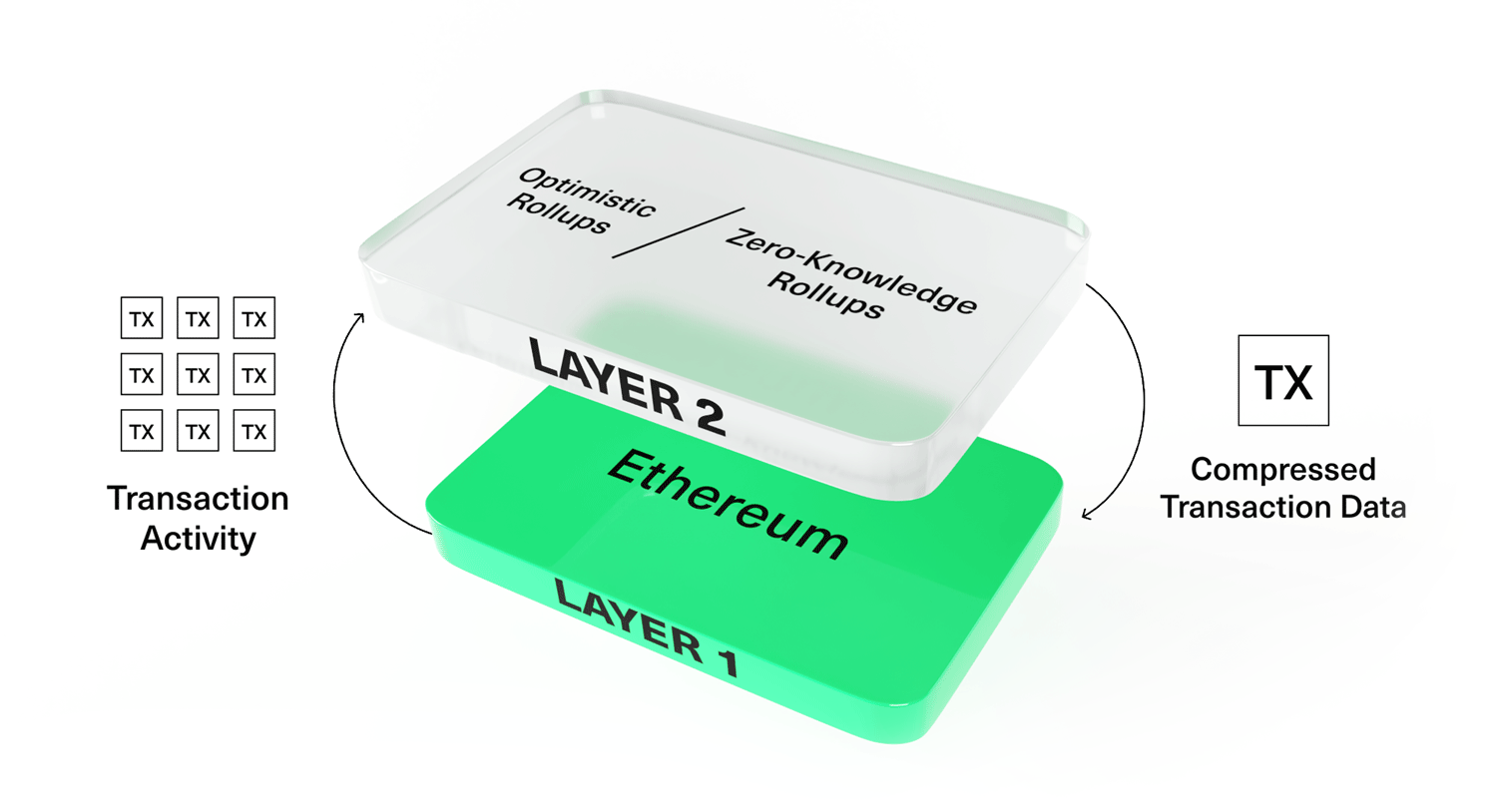

The first part of Ethereum’s scalability improvements are centered around a technology called rollups. The magic of rollups lies in their ability to batch a large number of transactions off the blockchain on a separate layer (that’s why they are also called “layer 2” solutions, in contrast to Ethereum’s “layer 1”), and only settle them on the Ethereum blockchain periodically. In that sense, rollups work somewhat like a bar tab: Instead of a customer at a bar swiping their credit card after each order, the bartender will keep a running bill that can be settled all at once.

Rollups Handle Transaction Activity on Layer 2 and Then Store the Compressed Transaction Data on Layer 1

Rollups fall under two categories: "optimistic" and "zero-knowledge."

Optimistic Rollups

Optimistic rollups were the first attempt to scale Ethereum, and they remain an important part of the ecosystem today.

Optimistic rollups work by initially assuming all transactions batched and subsequently settled on Ethereum are honest (that’s where the term “optimistic” comes from). To prevent potentially fraudulent transactions from being added permanently to the blockchain, optimistic rollups add two security mechanisms: a seven-day period in which invalid transactions can be contested by other network verifiers, and a requirement that those validating transactions post a bond, which can be confiscated in case an invalid transaction is detected, or if someone incorrectly claims a legitimate transaction is invalid. As a result, all users are incentivized to act in the interest of the network.

The two main optimistic rollup solutions that are already available are Arbitrum, which is the market leader, and Optimism, which was the first project to launch its own token and allow investors to have direct exposure to this technology.

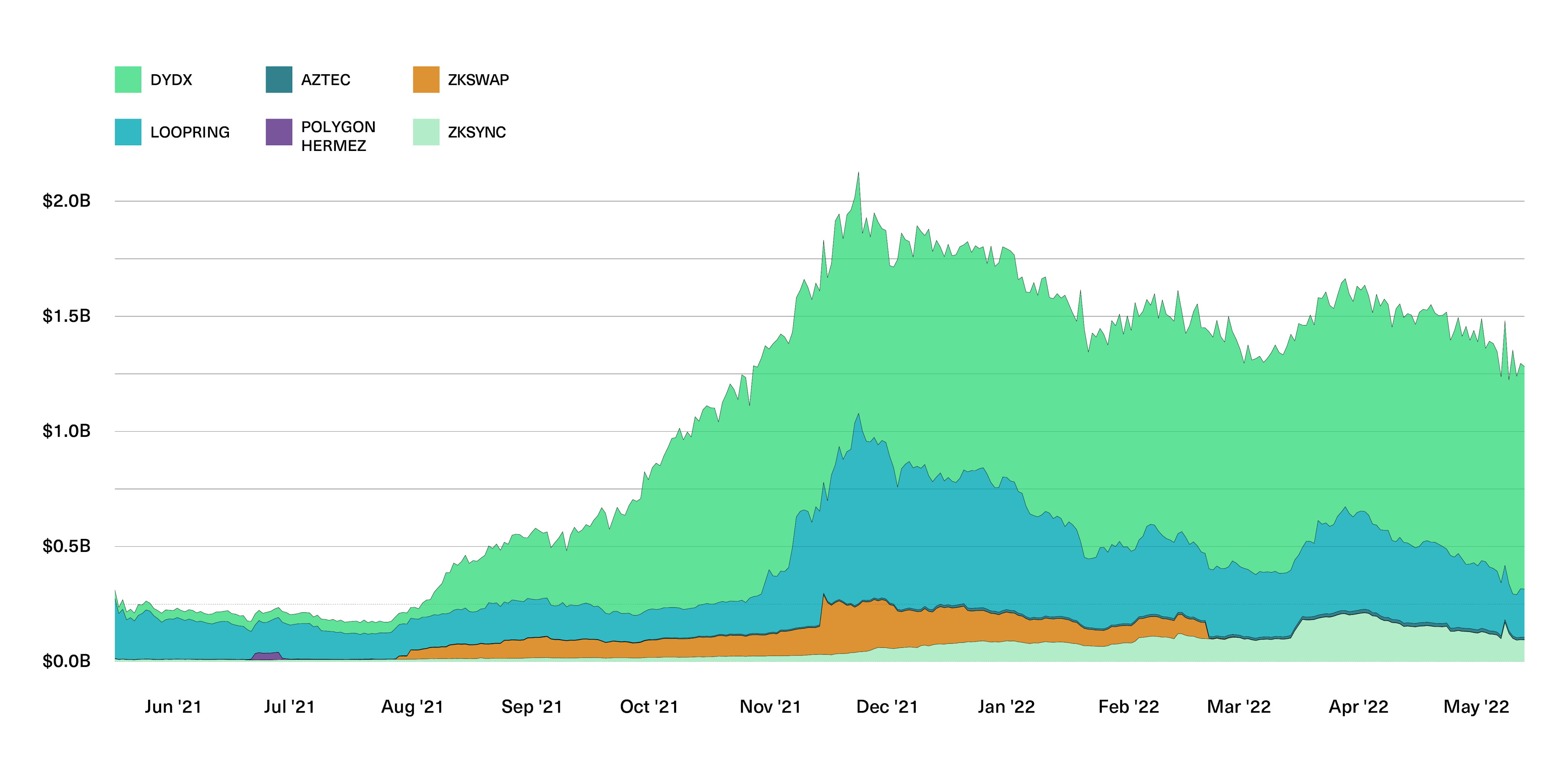

Billions of Dollars Were Deployed on Optimistic Rollups Over the Past Year, Notably on Arbitrum and Optimism

Capital deployed (Total Value Locked) on Ethereum optimistic rollup scaling solutions, in USD billions, as of May 15, 2022

Zero-Knowledge Rollups

The challenge with optimistic rollups is that they introduce a dispute period that slows down the settlement process. Zero-knowledge rollups (“ZK-rollups”) do away with this problem by using a cutting-edge cryptographic technique that allows participants to post a transaction and prove that it is valid at the same time.

The advantage of this method is that it’s more efficient and secure than optimistic rollups. On the other hand, ZK-rollups are still relatively novel and extremely complex. Because the cryptographic proofs that guarantee the validity of a transaction take a lot of computing power to process, unlike Ethereum or optimistic rollups, they are currently not the best fit for all use cases.

Different zero-knowledge rollup solutions vary in the inner details, and projects like StarkEx, zkSync, and Polygon are already testing them in the real world. Going forward, we expect to see more applications adopt these solutions to the point that they’ll become a big part of Ethereum’s future.

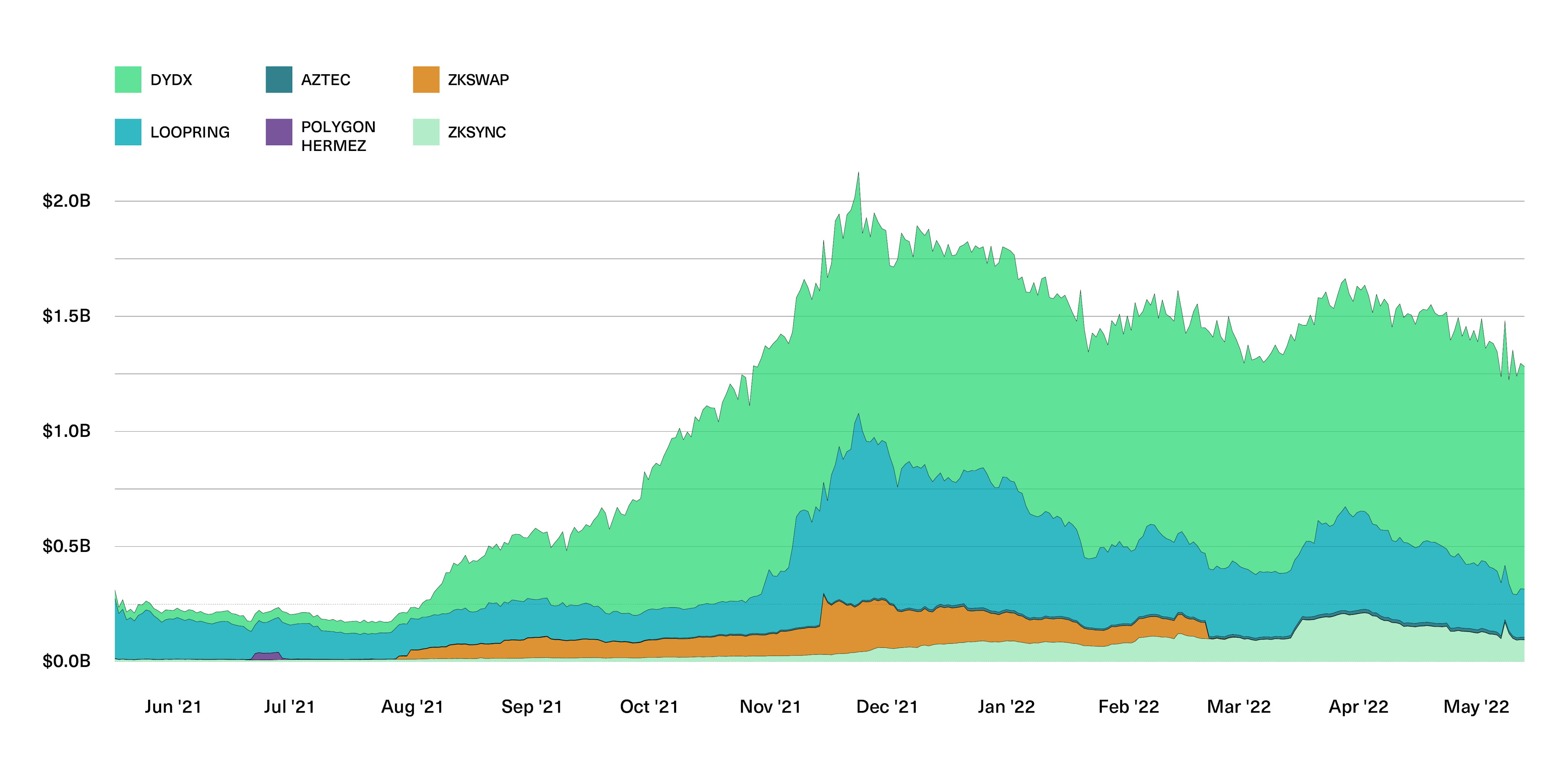

Zero-Knowledge Scaling Solutions Are Concentrated in Relatively Few Applications but Are Extremely Promising

Capital deployed (Total Value Locked) on Ethereum zero-knowledge rollup scaling solutions, in USD billions, as of May 15, 2022

Sharding: How Ethereum Will Boost Rollups

Rollups are valuable, but as a single-point solution they might not be enough. Overcoming the scalability challenge will also require an upgrade to Ethereum itself, called sharding, that will boost rollups even further.

The idea behind sharding is similar to adding additional lanes to a road in order to reduce congestion by splitting up the workload. Currently, Ethereum has one lane, or chain, on which all transactions are recorded. After sharding is complete, Ethereum will have 64 shards that function in parallel to one another, all connected by a central hub responsible for network coordination, called the Beacon Chain.

Unlike The Merge (the initial phase of the Ethereum upgrade that was covered in part one of this series), sharding will not be implemented in a single event. Instead, key aspects, especially the most complex ones, will gradually be released over time. In the first iteration, these new shards will only be able to store data, but not execute smart contracts or handle transactions. The decision of how many shards, if any, will have these capabilities will be taken up at a later date.

Sixty-four shards, or lanes, might not sound like much, and as a stand-alone improvement they would not be sufficient to solve Ethereum’s scalability problem. However, the extra data space that sharding provides to the network, combined with rollups, will allow Ethereum to handle orders of magnitude more transactions than it does today at a fraction of the cost.

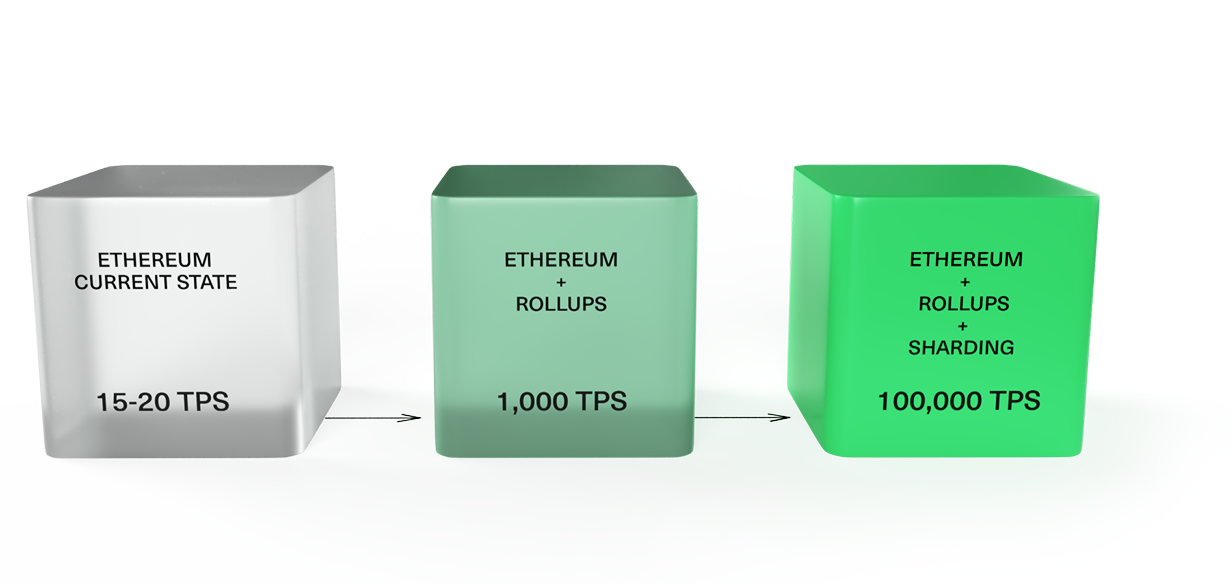

The Combination of Rollups and Sharding Will Increase Ethereum’s Throughput by Orders of Magnitude

Estimated average transactions per second (TPS) after each phase of improvements

Scalability Is the Main Issue in Ethereum Currently, but These Solutions Point to a Bright Future

Breakthrough technologies usually don’t come to market ready to fulfill all their potential in their first iteration.

In the early days of the internet, for instance, bandwidth limitations made it impossible to stream video, engage in social media, or host Zoom-style conference calls. The internet was largely text-based, and limited to read-write formats, causing many to dismiss it as being of limited use.

But as bandwidth expanded, entrepreneurs found ways to build massive new applications that literally changed the world.

Crypto and blockchains are in a similar state. From one vantage point, we've been able to accomplish enormous proofs of concept with extremely low bandwidth, with major blockchains processing just dozens of transactions a second. Multiply that by even just one thousand, and many new doors open up.

These opportunities are crucial for Ethereum to maintain its market dominance as the host of the richest application ecosystem in crypto. But with user demand outpacing the implementation of scaling solutions, competing networks such as Solana, Avalanche, Polkadot, and others have emerged to fill this market void.

The combination of rollups and sharding have the potential to level the playing field against such competitors over the next few years. The jury is still out on what the competitive landscape for smart contract networks will look like, but it’s looking increasingly clear that this will be one of the most exciting rivalries in the history of technology.

Important Disclosures

This material represents the views of the author and does not represent the views of Bitwise Asset Management.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not currently backed nor supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies, stocks, or bonds.

Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks and risk of losing principal or all of your investment. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing.

Cryptocurrency trading requires knowledge of cryptocurrency markets. In attempting to profit through cryptocurrency trading, you must compete with traders worldwide. You should have appropriate knowledge and experience before engaging in substantial cryptocurrency trading. Cryptocurrency trading can lead to large and immediate financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price.

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.