Crypto Equities Q2 2022 Earnings Wrap: Weak Earnings, Strong Execution

San Francisco • Aug 31, 2022

The second quarter of 2022 was one of the most tumultuous quarters in crypto’s history. Not surprisingly, Q2 earnings season for crypto equities reflected that instability. The industry largely missed consensus estimates for both revenue and EPS due to a combination of crushing crypto market price action, non-cash items mostly related to crypto asset holdings, and other company-specific events.

Underneath the surface, however, there is good news. A close look at the results shows strong execution by leading crypto equities despite the pullback in prices. In addition, many crypto management teams seem increasingly optimistic about the future: According to sentiment analysis from market intelligence company AlphaSense, the Q2 earnings calls from the management teams of the top 10 constituents of the Bitwise Crypto Innovators 30 Index showed an improvement over the previous quarter in 50% of cases.

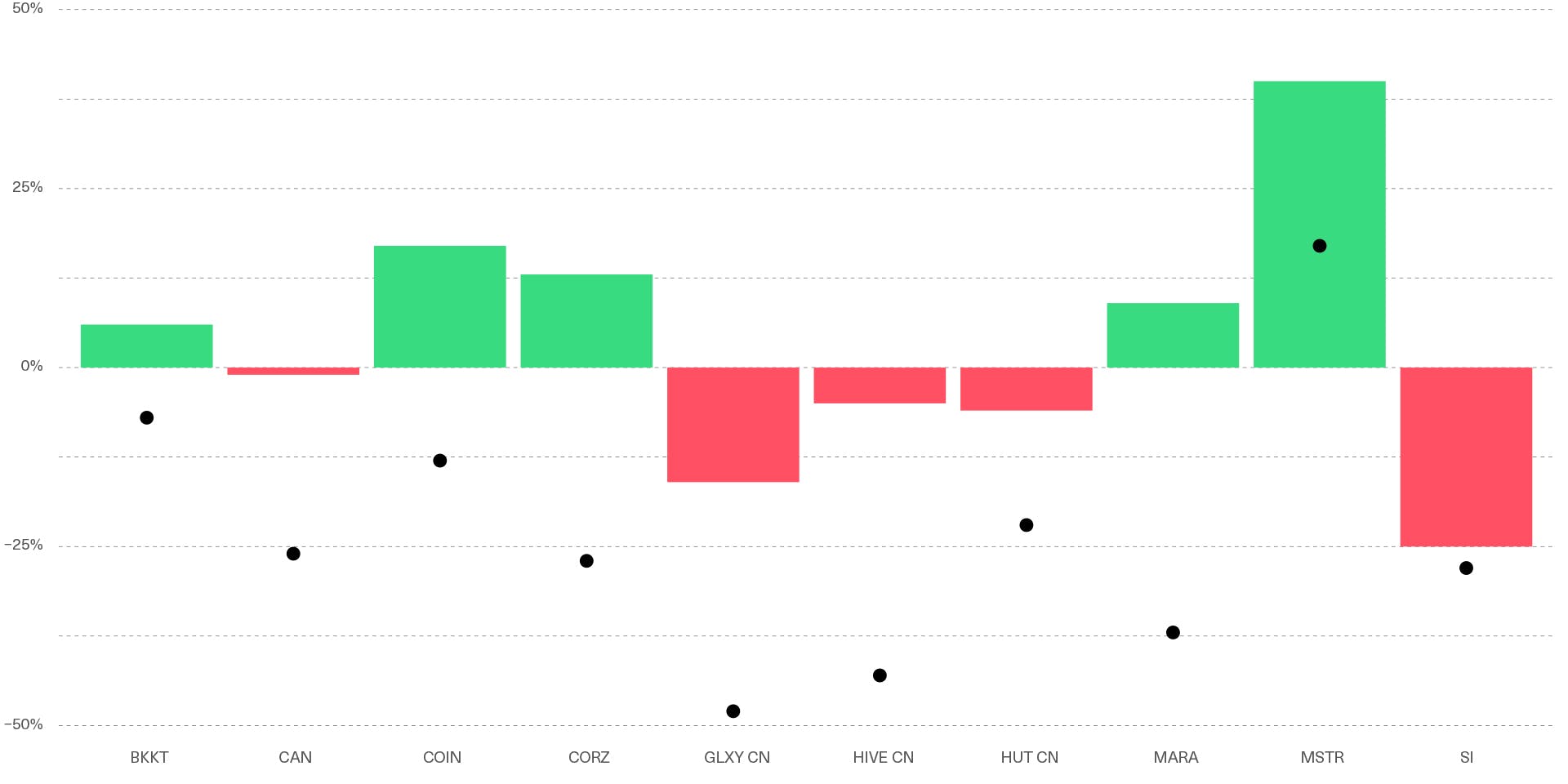

Sentiment of Q2 Earnings Calls Is Still Negative but Improved Over Q1 for Some

Sentiment score of Q2 earnings call (black dots) and delta vs. previous earnings call (bars, green as positive and red as negative) for the top 10 constituents of the Bitwise Crypto Innovators 30 Index

This combination may explain why, despite missing estimates for earnings, crypto stocks have rallied strongly since earnings season began. Since July 15 (the unofficial start of earnings season), the Bitwise Crypto Innovators 30 Index is up a whopping 28.3%, versus 8.7% for the S&P 500 and 10.4% for the Nasdaq 100. That’s remarkable considering that 12 out of the 15 pure-play constituents of the Bitwise Crypto Innovators 30 Index that have reported saw their analyst consensus full-year 2022 EPS estimates revised downwards, according to data from FactSet.

Below, we highlight the key takeaways from this earnings season and update our outlook going forward.

The Five Key Insights From the Q2 2022 Earnings Season

1) Despite Coinbase’s (COIN) USD$1.1 billion loss in Q2, magnified by non-cash items, it continues to execute effectively to further expand its dominance.

Revenues came in at $803 million, shy of the consensus estimate of $831 million, while earnings missed big at -$4.98 EPS versus market expectations of -$2.47. The earnings miss was mainly driven by non-cash charges related to its crypto holdings and venture investments. The company remains strongly capitalized with nearly $6 billion in cash.

This quarter’s results are another reminder that COIN’s earnings power is leveraged to broader crypto market conditions. However, the company is still a giant with 103 million verified users and a reputation as the partner of choice for retail and institutional investors alike. As an example, the company inked a partnership last quarter with institutional asset management giant BlackRock to offer access to crypto through Aladdin. While earnings momentum remains weak, we believe COIN is well positioned to exit the crypto winter as an even more dominant player in crypto.

2) Despite the sequential drop in prices, miners still managed to grow revenues substantially YoY, while focusing on balance sheet health.

The three largest miners—Marathon Digital Holdings (MARA), Riot Blockchain (RIOT), and Core Scientific (CORZ)—reported an average 25% drop in revenue QoQ but an average increase of 72% YoY. The YoY results were driven by strong growth in installed hashrate (the amount of mining power these companies have in operation), which rose more than enough to offset the drop in prices.

The bitcoin price crash did have an impact on the headline earnings, with these three firms reporting an aggregate net loss of $1.4 billion in the quarter. Of note, however, this loss was almost entirely explained by non-cash impairment of $377 million in crypto asset holdings and $1.1 billion in goodwill and other intangibles. Absent these non-cash charges, these companies broke even despite the worst quarter for crypto prices in 10 years.

3) Miners raised cash this quarter in a variety of ways.

With prices down, miners were on the balance-sheet-bolstering warpath: MARA improved its liquidity position through a credit facility with Silvergate (SI), CORZ sold over 7,000 bitcoin to cover expenses, and RIOT raised almost $300 million via a share sale. The next few months may present opportunities for stronger players in the mining space to seize M&A opportunities and gain additional market share.

4) Silvergate (SI) and Signature (SBNY) posted reductions in both crypto deposits and loans, but continued to bring in new clients for their crypto platforms.

SI’s crypto customer deposits slipped around 6% QoQ but increased by 24% YoY. SBNY’s crypto deposits were down by $2.4 billion and were one of the main reasons behind the 5% QoQ drop in total deposits. On the loan side, both banks reduced their exposure sequentially: While SI posted a drop of 30% QoQ to $303 million, SBNY ended the quarter with no crypto loan exposure after its only $100 million collateralized loan was paid off.

On the flip side, both banks continued to add clients to their crypto platforms at a strong pace. SI grew its digital asset customer base, which now comprises 1,585 entities, by 5% QoQ and 30% YoY. Its real-time crypto settlement network SEN clocked $191 billion in transfers, representing 18% of total BTC and ETH spot trading volume. Although Signature does not disclose the number of clients in its platform, CEO Joseph DePaolo said in the earnings call that two more crypto exchanges will be starting on the network in Q3, which should bring in a large amount of deposits. Signet, its blockchain-based 24/7/365 payment solution, saw its highest quarter of transfer volume at over $254 billion. All in, both banks continue to be extremely well positioned in the crypto financial services infrastructure ecosystem.

5) Galaxy (GLXY:CAN) suffered a tough quarter, with big losses and failed M&A.

Not every company in the crypto markets executed well, of course. Integrated financial services firm Galaxy saw its net comprehensive loss in the quarter grow to $555 million, versus losses of $183 million and $111 million in Q2 2021 and Q1 2021, respectively. Unrealized losses in its trading and principal investment businesses—including highly publicized losses around the Terra blockchain’s collapse—overwhelmed the investment banking and bitcoin mining units, which both turned profits. Partners’ Capital stood at $1.8 billion and decreased by 27% QoQ, although things could have been worse: Crypto markets fell 56% for the quarter. The company remains highly liquid with over $1.5 billion as of the end of the quarter.

The biggest piece of news, however, was that Galaxy backed out of its $1.2 billion acquisition of leading crypto custodian BitGo, after BitGo failed to deliver 2021 audited financial results by July 31, 2022. BitGo is suing Galaxy for a $100 million “reverse break fee,” which Galaxy says it does not owe. The merger would have doubled Galaxy’s engineering headcount and would have allowed it to provide an in-house custody solution for clients, albeit at a cost that looks high given the current market positioning. In lieu of completing the acquisition the company is employing a more aggressive engineering talent acquisition strategy and offering an umbrella of third-party custody solutions to its clients.

Looking ahead: Absent Further Crypto Asset Price Pressure, We Expect Earnings Momentum To Gradually Recover From Here

Given the current condition of the crypto market, we expect short-term earnings momentum for the industry to remain soft. Coinbase, for example, expects Monthly Transacting Users (MTUs) and Total Trading Volume to be lower in Q3 versus Q2. Over the next 6-12 months, however, previous management guidance already by and large reflects these conditions. For example, Coinbase’s management still expects to operate within the $500 million EBITDA loss limit they previously set. Similarly, the three largest miners did not change their previous hash rate expectations significantly, suggesting they incorporated the possibility of present market conditions into their plans. This is not the case across the board, however: Argo Blockchain (ARBK) reduced its year-end hashrate guidance by 42% as its highly anticipated new Intel mining machines will take longer than expected to deliver.

Going forward, crypto price action will certainly continue to be a dominant factor for the bottom line of crypto equities. Barring major price movements in the underlying crypto asset prices, we expect the profitability of crypto equities to gradually recover from here as they now operate with a structure fine-tuned for today's market conditions. Balance sheet strength will also likely remain a key topic—both for the weaker players that might have to further constrain operations and for the players in an advantageous position, which might find interesting M&A or other growth opportunities to further expand their presence.

For many of the leading crypto equities companies, this is not their first crypto bear market and it might not be the last one. During previous bear markets they either established or significantly expanded their positions. For us, the main takeaway of the Q2 earnings season is the strengthening of our belief that they have an incredible opportunity to do it again.

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.