A (Mostly) Jargon-Free Guide to Ethereum’s Quantum Leap — Part 1: The Merge

San Francisco • Apr 1, 2022

This summer, Ethereum will reduce its energy consumption to less than 1% of what it consumes today, become a more deflationary asset on the back of a 75-90% reduction in new coin issuance, and introduce a new economic logic that will allow ETH holders to potentially derive up to 8-12% yields.

It’s the biggest story in crypto right now, and few are talking about it.

This change is part of a multi-year, multi-phase technological upgrade that aims to make the second-largest crypto network more secure, more sustainable, and more scalable while still retaining its current decentralized nature.1

The complex elements of the upgrade, coupled with the abundance of technical jargon, have caused many to steer clear—crypto natives included. But with the biggest part of the upgrade set to happen as early as June, it’s time for the broader public to pay closer attention.

We’ll cover the upgrade in two parts.

This column will focus on “The Merge”—the part of the upgrade happening this summer.

In a subsequent column, we’ll cover the planned future improvements and adjacent technologies that will allow Ethereum to process many more transactions in a cheaper and faster fashion.

The Upcoming Milestone: Unpacking “The Merge”

Every crypto network needs to decide how it chooses, in a decentralized manner, who gets to propose a new block of transactions that all participants will later validate. The original design of this mechanism is an approach called “proof-of-work” (PoW), which relies on computers doing complicated calculations with specialized machines that consume an enormous amount of energy.

Proof-of-work is well suited for certain technologies. Bitcoin, for example, uses PoW to help make its database extremely secure and decentralized. But for what Ethereum is seeking to achieve, there’s a better mechanism. This alternative is called “proof-of-stake” (PoS), which replaces energy-hungry machines with financial commitments from ETH holders—a process known as “staking.”

Ethereum currently relies on proof-of-work, but will switch to proof-of-stake this summer. The event that executes this shift is known as “The Merge.”

Ethereum’s preparation for this transition officially launched in December 2020 when a parallel proof-of-stake blockchain, known as the Beacon Chain, went live. Now completing what is expected to be one of its final testing phases, Ethereum will soon be ready to strip off its current proof-of-work mechanism and “merge” with the Beacon Chain. This will be followed by a “cleanup” upgrade to iron out some technical quirks down the line.

If this sounds akin to changing the engine of an airplane midair, that’s because it is, with the added difficulty of doing so without impacting any users. It’s one of the most ambitious technical undertakings in crypto to date.

What will this mean for Ethereum?

#1: Energy consumption will be reduced by 99%

Ethereum’s current energy draw under proof-of-work is equivalent to the electricity consumption of a mid-sized country. Proof-of-stake changes this radically by replacing the energy arms race process entailed in traditional proof-of-work with a random lottery and financial commitments. As a result, Ethereum’s energy consumption will only consist of that which is required to run software, representing less than 1% of the energy it consumes currently.

#2: ETH will be more scarce

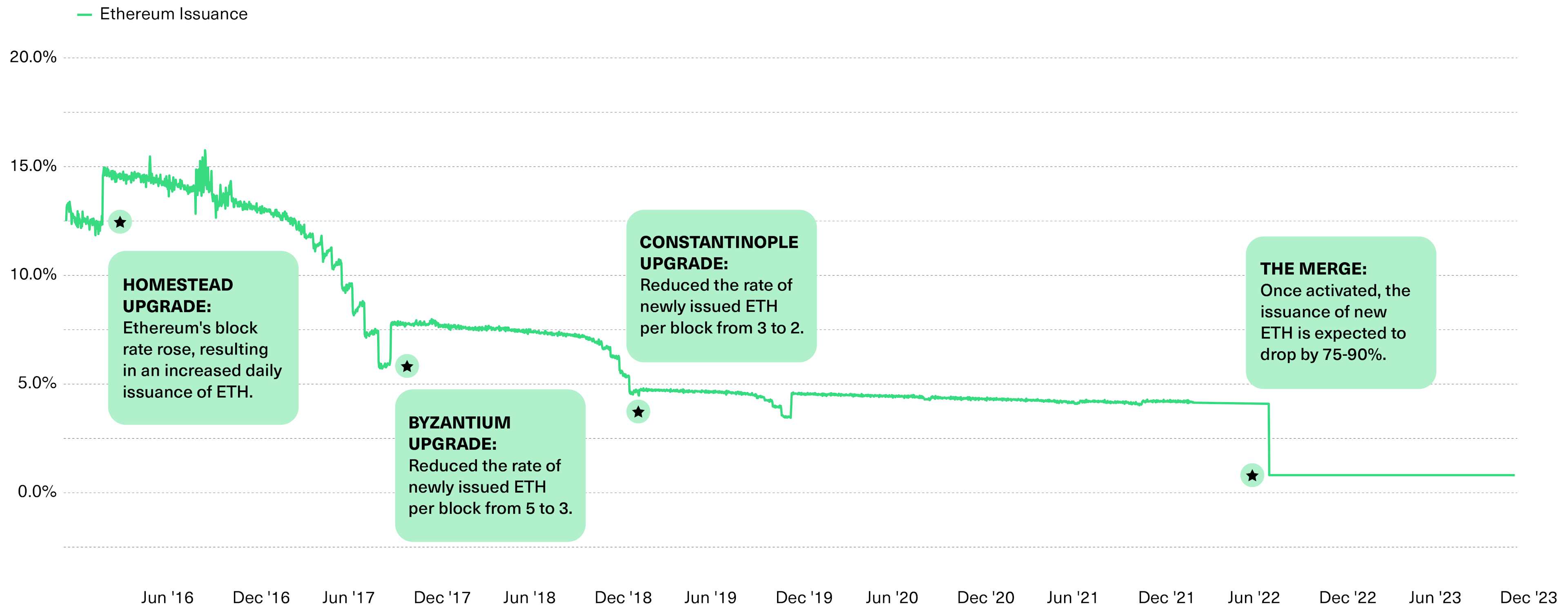

As seen in the chart below, Ethereum’s issuance rate has been decreasing over time due to network upgrades and increased participation. Ethereum currently issues a little over 4% of the total ETH supply per year in new coins to reward its current proof-of-work miners on the network and the early stakers on the Beacon Chain. After The Merge, the issuance rate will depend on how much of the total ETH supply is allocated towards validating transactions. Ultimately, it’s expected to drop significantly with a reduction in issuance in the 75-90% range.

After The Merge, the Issuance of ETH Is Expected to Drop by 75-90%

Historical and projected annualized issuance of ETH after The Merge (percent of total supply)*

#3: Stakeholders will be able to earn a yield on their ETH

One big incentive for ETH holders to participate in the staking process is the ability to generate a native yield on their ETH assets, a feature that is only available to miners under a proof-of-work scheme. The minimum threshold to stake ETH and support the network is 32 ETH, or approximately $100,000 at current prices. Those who have less than that can join pools that aggregate multiple users.

Yield for stakers will consist of two major components after The Merge.

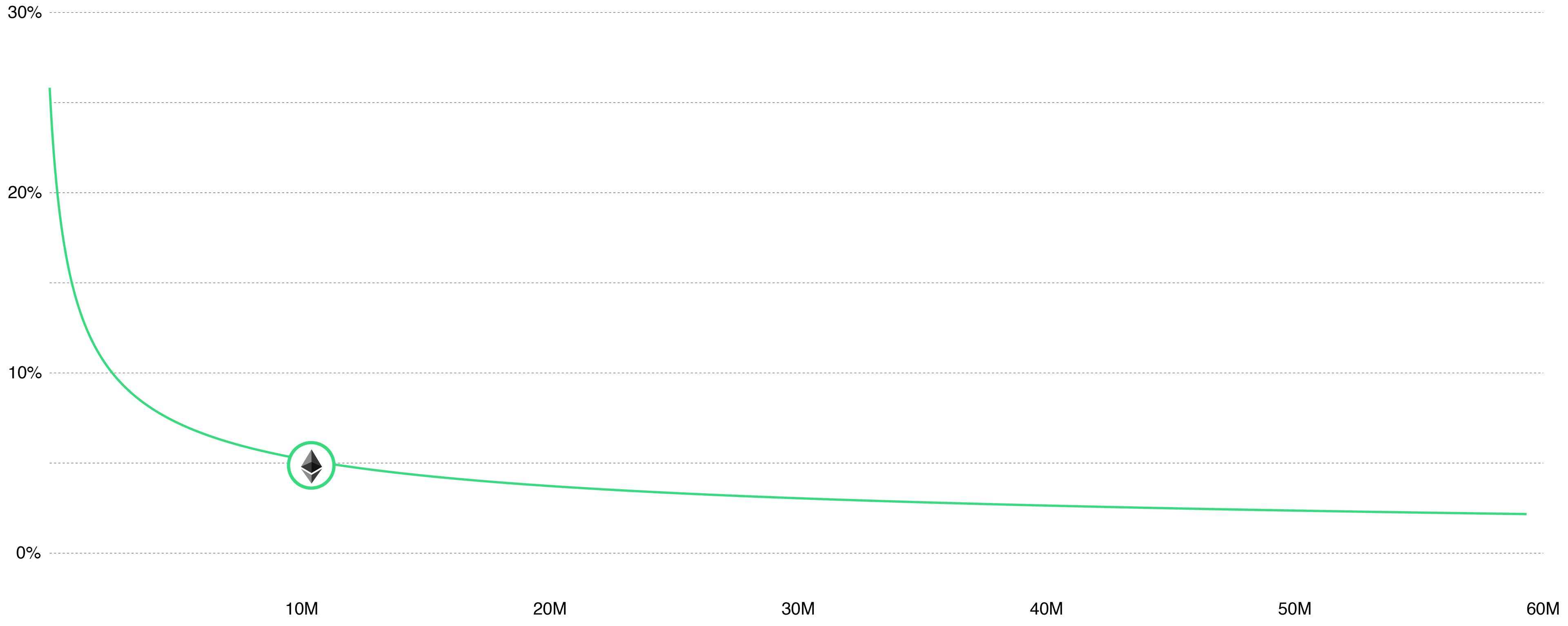

The first comes from newly minted ETH that is awarded to stakers and depends on the percent of the total ETH supply that is staked. As seen in the chart below, the yield declines as the amount of ETH staked increases. Under current market conditions, the annualized yield coming from this part of the process stands at about 4%.

ETH Holders Will Be Able to Generate a Native Yield on Their Assets

Implied annualized yield from ETH issued to stakers versus total ETH staked (as percentage of total ETH supply)

The second component of the yield will come from the portion of the transaction fees that is currently collected by miners under proof-of-work, and will instead be allocated to ETH holders who choose to participate in the staking process. This amount is harder to estimate because it depends on a number of indicators related to network usage. However, our best estimate is that this second component of the yield could be in the 4-7% range at the time of The Merge.

Adding both components mentioned above, the total combined annualized yield could reach up to 8-12% for ETH holders who choose to participate in the staking process. Although in the long run these yields could recede due to a higher percentage of the total ETH supply being allocated towards the staking process, it is still likely to remain at least in the 4-8% range.2

The Merge will lay the groundwork for the next stage in Ethereum’s evolution, which will allow the network to process orders of magnitude more transactions than it does today for a fraction of the cost. We’ll cover that part of the upgrade in a subsequent column.

Of course, such massive change does not come without risks. Despite the fact that The Merge has been researched for years and will be extensively battle-tested by the time it’s implemented, there is still risk of bugs or further delays that could impair confidence in the network for an extended period of time. Considering that the Ethereum ecosystem hosts thousands of applications, millions of users, and hundreds of billions of dollars in market capitalization, it is no surprise that, when asked about the date of The Merge, the typical answer provided by Ethereum developers is “When it’s ready.”

This will be the most significant upgrade crypto has yet to see. So, we at Bitwise, along with the overwhelming majority of the crypto community, are extremely excited about the day The Merge takes place, the first of two key milestones set to help the Ethereum ecosystem reach its full potential.

(1) This upgrade used to be known as “Ethereum 2.0,” a term that some still use. This terminology was dropped because it did not convey the right mental model: It hinted that Ethereum 1.0 comes before Ethereum 2.0, or that the newer version will supersede the older. As the upgrade roadmap evolved, the terminology shifted to “execution layer” (former Ethereum 1.0) and “consensus layer” (Ethereum 2.0), with the upgraded Ethereum becoming the combination of the two. For that reason, and also for avoiding excessive technical jargon, this piece does not use the “Ethereum 2.0” terminology.

(2) For those more interested to see how these yield calculations are derived, Ethereum developer Justin Drake keeps an updated spreadsheet https://docs.google.com/spreadsheets/d/1vrK5sY5ooq-F8dcyRhmmAJ5YtgkvWKWP3OfGCZIYxSA/edit#gid=0 of yield projections under different scenarios, which we used to derive the numbers mentioned in this column.

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.