March 2023 Bitwise Investor Letter

San Francisco • Mar 8, 2023

In This Issue: Why the Crypto Picture Is Too Close To See

Market Overview

Dear Investors,

As a kid, I loved the paintings of Georges Seurat.

Seurat was a “pointillist,” which basically means he painted with dots. What I loved about his paintings was that if you got up close to them, they didn’t make sense; all you could see was a jumbled mess of colors. But if you stepped back, those seemingly random colors snapped into form.

The lesson I took from them is that, sometimes, you can be too close to see.

It’s a lesson I’ve been thinking about as I’ve tried to digest recent news in crypto. For quite some time, refreshing the news feed each morning has felt like walking into a haunted house on Halloween. You never know what’s around the corner.

In the past month alone, we’ve seen:

The SEC shut down Kraken’s staking service, calling it an illegal security offering and issuing a $30 million fine;

The New York State Department of Financial Services effectively shut down creations in Binance’s $13 billion stablecoin, BUSD, citing various risks;

The Federal Reserve, FDIC, and OCC warned banks for the second time this year to steer clear of crypto companies, leading many to worry about a coordinated effort to cut crypto out of the traditional banking system;

The SEC proposed dramatic new rules around crypto custody, shifting the ground beneath a cornerstone of our industry;

The IMF laid out plans for supranational crypto regulations as it looks to “safeguard monetary sovereignty.”

It never seems to end.

As I sit down to write this letter, Silvergate Bank—once the primary bank for most crypto companies—has issued a “going concern” notice, having been brought to its knees by a bank run, arcane accounting rules, poor decisions, and bad timing.

Add in FTX, Celsius, Voyager, Three Arrows Capital, BlockFi, Genesis, and LUNA … the picture looks like a senseless mess of threats, crackdowns, and failures.

And yet.

Take one step back and you’ll see something remarkable. Despite all this, crypto prices are up 35% this year. Back away further and they’re up 350% over the past three years. Pull back ten years and the price of bitcoin (the only crypto asset with a 10-year track record) is up roughly 25,000%.

In other words, stand at a certain distance and you’ll see that crypto is in a decade-plus-long bull market, and it has been climbing a wall of worry.

Sometimes, you can be too close to see the big picture.

The same sense of perspective can bring the current regulatory situation into focus. The regulatory climate facing crypto today is harsh, but we’ve faced bigger challenges before:

In 2021, China banned crypto entirely, canceling crypto’s largest market at the time;

In 2021, a poorly written clause in Congress’ Infrastructure Bill almost rendered all crypto applications unworkable;

In 2018, the SEC almost completely shut down the initial coin offering (ICO) market, at the time the only major application on the Ethereum blockchain;

In 2014, multiple Congressional leaders called for an outright ban of crypto in the U.S. (here’s one example).

None of this is to dismiss the troubles of today, and it’s only natural to fixate on the difficulties when the market is down from its highs. In fact, on-chain data suggests a majority of investors are holding crypto at a loss. But ignoring the long-term trend can cause investors to miss the long-term opportunity.

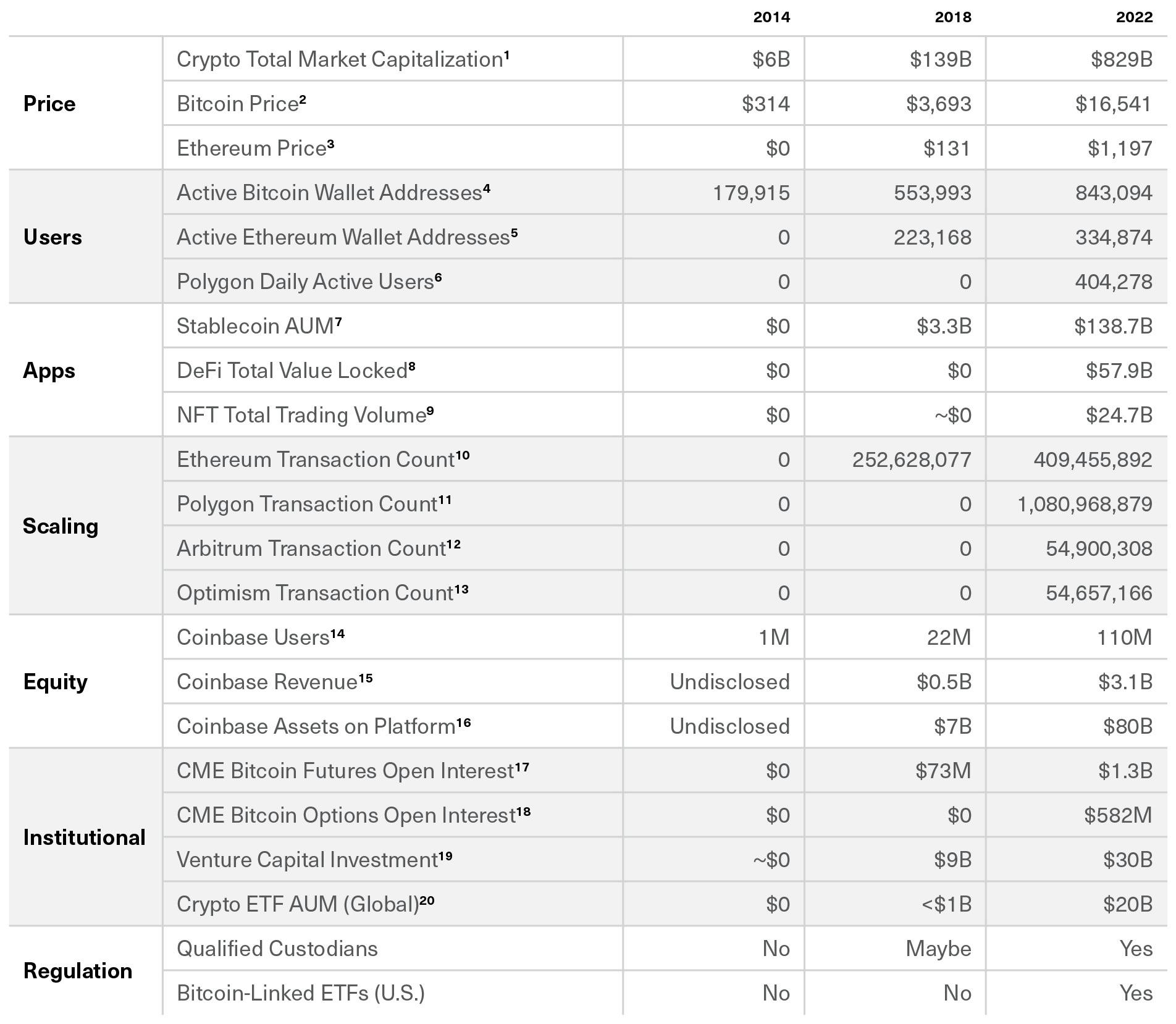

Towards that end, I’ve been speaking recently with financial advisors about the value of looking at crypto on a cycle-over-cycle basis, rather than year-over-year. In other words, to recognize that crypto is cyclical, and to compare crypto today to similar bear markets like 2018 and 2014, rather than the bull market peak of 2021.

When you do that, you see impressive growth.

In 2014, crypto was a $5.5 billion industry, and the best-known custodian was Mt. Gox, a website that started as a place for teenagers to trade Magic: The Gathering cards.

In 2018, crypto was a $130 billion industry, and the best-known custodian was Kingdom Trust, an eight-year-old firm based in Kentucky that also provided custody for investments like cattle and fishing rights.

Today, crypto is a $800 billion industry, and the best-known custodians include Fidelity (a 77-year-old firm with $12 trillion in assets under advisement), Coinbase (a publicly traded company with 110 million users), and Bank of New York (a firm founded in 1794 that counts Alexander Hamilton among its founding shareholders).

Where will we be in 2026?

Well, we don’t know. But industries with momentum tend to sustain momentum, particularly if that momentum is fueled by strong fundamentals. And no matter what you look at in crypto—users, revenue, developers, venture capital investment, etc.—the cycle-over-cycle growth is undeniable.

Crypto Fundamentals: Cycle-Over-Cycle

(1) Source: CoinGecko. Data as of 12/31 each year.

(2) Source: CoinGecko. Data as of 12/31 each year.

(3) Source: CoinGecko. Data as of 12/31 each year.

(4) Source: Glassnode. Data as of 12/31 each year.

(5) Source: Glassnode. Data as of 12/31 each year.

(6) Source: Polygonscan. Data as of 12/31 each year.

(7) Source: The Block. Data as of 12/31 each year.

(8) Source: The Block. Data as of 12/31 each year.

(9) Source: DappRadar for 2022. Data is full-year. There is no data available for 2014, but trading was de minimis.

(10) Source: The Block. Data as of 12/31 each year.

(11) Source: The Block and Block Explorers. Data as of 12/31 each year.

(12) Source: The Block and Blockscan. Data as of 12/31 each year.

(13) Source: The Block and Blockscan. Data as of 12/31 each year.

(14) Source: BusinessofApps.

(15) Source: Coinbase. Data as of year-end.

(16) Source: Coinbase. Data as of year-end.

(17) Source: Bloomberg. Data as of last trading day of the year.

(18) Source: Bloomberg. Data as of last trading day of the year.

(19) Source: The Block. Data as of 12/31/2022.

(20) Source: 2018 data from TrackInsight. 2022 data from Investor Intel.

Here’s another way to think about it: What might a column for 2026 look like in the chart above? If you were plotting out numbers, what factors would you consider? And what role might the market’s historical forces play in that assessment?

Of course, past isn’t always prologue. It’s fair at moments like this to ask if the decade-plus long trends that have sustained crypto will reverse: If regulators will actually try (and succeed at) killing the industry; if the current pattern of regulation-by-enforcement will create a chilling effect on entrepreneurs; or if the macro environment, with interest rates at 5% and inflation looking sticky, will suppress crypto prices for the long term.

But those same questions would need to be asked alongside several others. Among them, why is crypto still here and growing? Amid all its challenges and setbacks, what should investors make of ever-improving blockchain technology, greater institutional adoption, rising developer counts, growth in mainstream usage, massive VC investment, and yes, even improved regulatory standards?

It can sometimes feel radical to be bullish on crypto, and to predict that this disruptive technology will continue to edge its way into the mainstream. But it's actually just a bet on historical trends continuing.

As we’ve seen, your perception of crypto’s future—and whether you see a jumbled mess or something meaningful taking shape—depends more than anything on your vantage point.

Matt Hougan

Chief Investment Officer

P.S. Going forward, we will be publishing this letter on a quarterly basis, providing a more in-depth and long-term view of market trends.

Events

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email investors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

Conferences

Barron’s Independent Summit 2023 | March 15-17 | Dallas, TX

Titan Investors RIA Dinner | March 30 | Philadelphia, PA

DACFP Bitwise Organized Field Dinner | March 30 | Washington, DC

FRA Sub-Advised Funds Forum | April 3-4 | New York, NY

Notes From the Research Desk

Coinbase Introduces a Developer-Friendly Layer 2 Network With the Launch of “Base”

On February 23, Coinbase announced the launch of its own Ethereum Layer 2 blockchain named Base. Promoted as a low-cost, developer-friendly way for anyone to build decentralized applications, the protocol is designed to help bring the next billion users to Web3.

Layer 2 solutions were developed to improve the scalability of foundational Layer 1 blockchains like Ethereum. Layer 2s perform transactions for a fraction of the time and cost of Layer 1s while offloading congestion and removing bottlenecks on the main network. Ethereum Layer 2 networks include major players like Polygon, Arbitrum, and Optimism, the latter of which Coinbase chose as the open-source architecture to power Base.

Developers who decide to build applications on Base will benefit from Coinbase’s ecosystem, including product integrations, easy fiat onramps, and access to the 110M+ users and $80B+ assets on the exchange. Additionally, Base could provide traditional finance institutions with a regulatory-compliant platform for creating tokenized versions of real-world assets, potentially unlocking what BlackRock CEO Larry Fink has described as the “next generation for markets.” Ultimately, the launch of Base marks another big milestone on Coinbase’s mission to onboard more than one billion users into crypto.

Juan Leon, CFA

Senior Investment Strategist

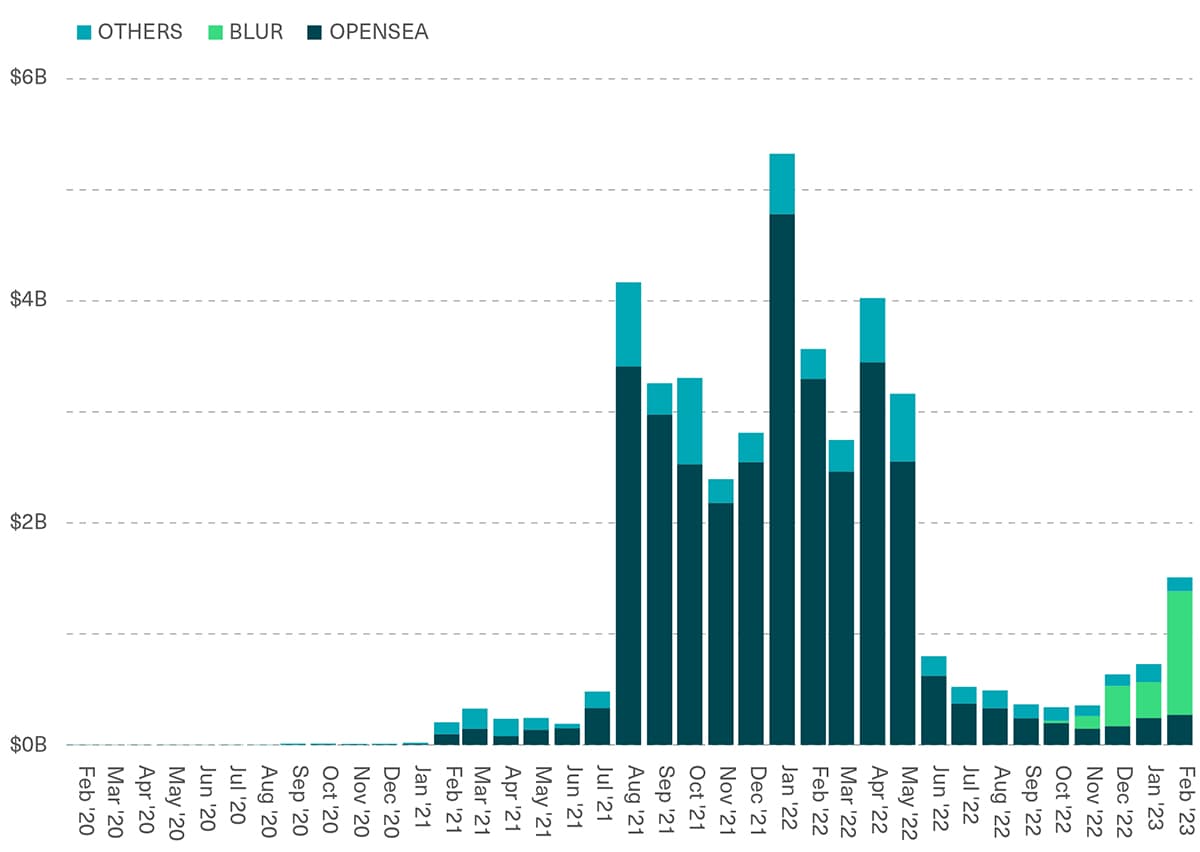

NFT Marketplace Showdown: Blur Eats OpenSea’s Lunch in February

OpenSea has boasted an impressive 80% market share of Ethereum NFT marketplaces' trading volume for the past two years—until now.

Blur, a new NFT marketplace that launched in October, quickly rose to the number one spot. The marketplace, which advertises zero-fee trading, accounted for 74% of the $1.5 billion in NFT trading volume in February, while OpenSea's market share fell to 18%.

But Blur has more than just low-fee trading in its corner. In February, Blur rewarded its early adopters by airdropping BLUR tokens to its users (worth ~$2,943 per user, on average). And they've indicated more will be rewarded to users in the future, creating a user stickiness that's causing OpenSea to sweat. Of course, the real long-term test will be user behavior after the entire BLUR airdrop is behind us. But in the meantime, BLUR has managed to attract users to familiarize themselves with the platform.

Monthly Trading Volume on Ethereum NFT Marketplaces (USD in billions)

Source: Bitwise Asset Management with data from The Block as of February 28, 2023

Ryan Rasmussen

Head of Research

Subscription and Services Revenue Was Coinbase’s Earnings Cushion, but Will Regulators Allow It?

Coinbase reported Q4 2022 earnings and saw net revenues up 5% Q/Q and down 57% Y/Y. Transaction revenues came in lower (-12% Q/Q, -66% Y/Y), while Coinbase’s subscription and services revenue came in higher (34% Q/Q, 53% Y/Y). Subscription and services revenue, which includes interest income from the USDC stablecoin and Proof-of-Stake yields, made up 47% of Q4 revenue and 25% of 2022 full year revenue. Revenue diversification with an emphasis on stickier earnings from subscription services has been part of Coinbase’s long-term efforts, especially in the current bear market where lower crypto prices hurt transaction revenues.

However, the recent regulatory crackdown on the crypto industry runs the risk of negatively impacting subscription and services revenues. The SEC forced Kraken, one of the world’s largest crypto exchanges, to shut down its staking service in the U.S. in a $30 million settlement, alleging it was an illegal securities offering. Coinbase’s stock traded lower on this news, despite their staking product being fundamentally different. With intermediated staking services under scrutiny and regulation surrounding stablecoins being released in the near term, the regulatory landscape is something to monitor.

Alyssa Choo

Crypto Research Analyst

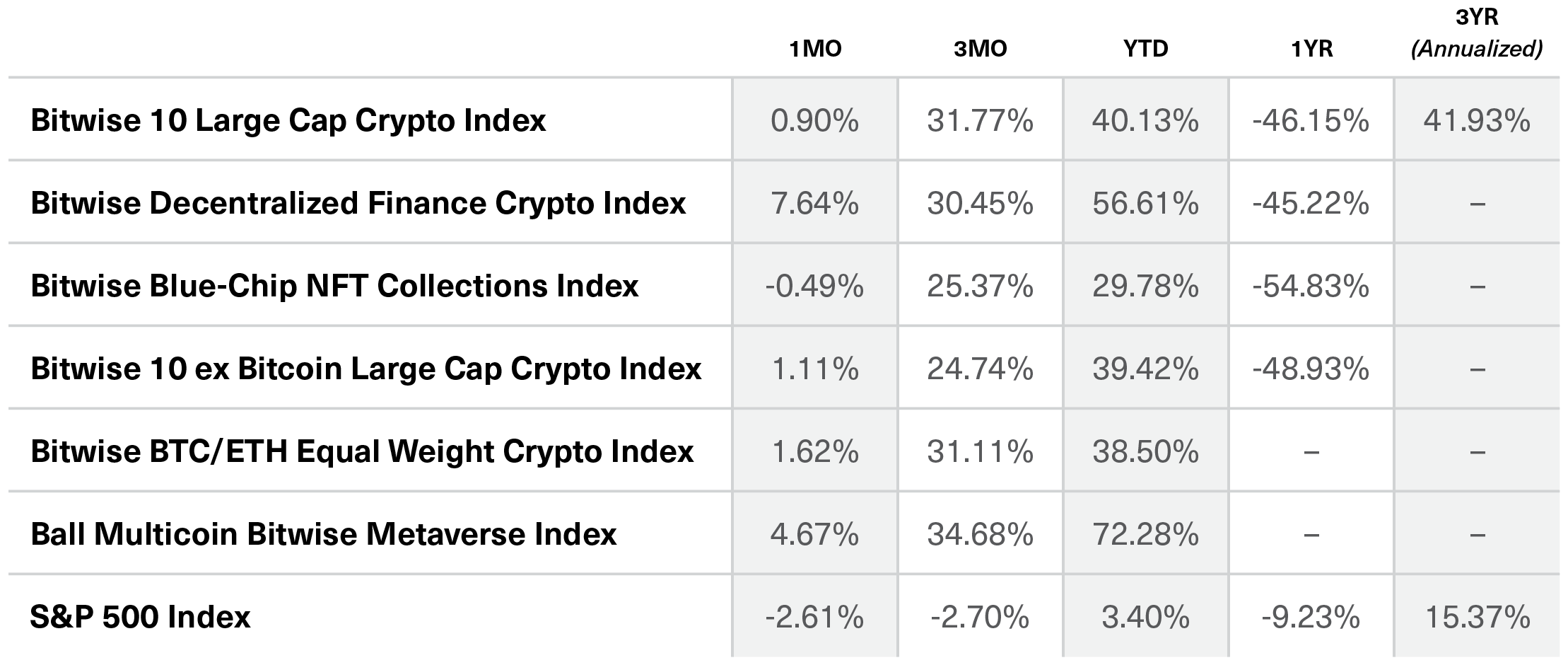

Benchmark Performance

As of February 28, 2023

Source: Bitwise Asset Management with data from Bloomberg. Performance of greater than one year is annualized.

Notes: It is not possible to invest directly in an index. Past performance is no guarantee of future results. The Bitwise 10 Large Cap Crypto Index captures the 10 largest eligible crypto assets by free-float-adjusted market capitalization. The Bitwise Decentralized Finance Crypto Index is designed to provide investors with a clear, rules-based, and transparent way to track the value of the rapidly emerging Decentralized Finance space. The Bitwise Blue-Chip NFT Collections Index is designed to broadly capture the investable market opportunity for the most valuable arts and collectibles NFT collections. The Bitwise 10 ex Bitcoin Large Cap Crypto Index captures the assets in the Bitwise 10 Large Cap Crypto Index, excluding bitcoin. The Bitwise BTC/ETH Equal Weight Crypto Index captures the value of an equal-weighted index consisting of bitcoin and ethereum. The Ball Multicoin Bitwise Metaverse Index is designed to capture the investable market opportunity for crypto assets exposed to the emerging Metaverse. The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What’s New at Bitwise

The Professional Investor’s Guide to Crypto

Recently, Bitwise launched our Crypto 101 Library to provide professional investors with the resources to sharpen their crypto knowledge and answer top questions from clients and stakeholders. The library features a comprehensive master class on crypto essentials from Bitwise CIO Matt Hougan, along with curated materials for every step of the crypto investing journey.

Bear Trap or Bull Run?

Crypto’s positive momentum in January left one question on everyone’s mind: Is it a “bear trap,” certain to reverse quickly, or is it the start of a new bull market that will extend for years? Bitwise CIO Matt Hougan weighed both sides of the argument and explained why we think the long-term bull case is even more convincing than the market realizes.

The Survey That Will Have You Rethinking Your Views on Crypto

Together with VettaFi, a leading provider of analysis in the ETF space, we conducted our fifth annual Bitwise/VettaFi 2023 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets. The survey’s findings confirm what we heard in our conversations with thousands of financial professionals throughout 2022: Despite the market’s steep volatility, advisors' interest levels remain high.

Select Media Appearances

Forbes: Liquid staking takes DeFi by storm (Matt Hougan)

CoinDesk: The right kind of regulation is good for crypto (Teddy Fusaro)

Bankless: How financial advisors see crypto (Ryan Rasmussen)

Cointelegraph: The SEC’s crackdown on crypto staking (Matt Hougan)

Forbes: AI hype bleeds into crypto (Juan Leon)

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.