February 2023 Bitwise Investor Letter

San Francisco • Feb 7, 2023

In This Issue: Bear Trap or Bull Run? What January’s Strong Returns Mean for Crypto in 2023

Market Overview

Dear Investors,

The crypto market had a fantastic January.

After falling 67% in 2022, the Bitwise 10 Large Cap Crypto Index closed January up 39%. All ten assets in the index posted double- or triple-digit returns, including market leaders Bitcoin (+40%) and Ethereum (+32%). Solana, which fell 94% last year thanks to its entanglements with FTX, led the way by rising 138%, defying critics.

The positive momentum extended to crypto equities, which posted similarly spectacular returns. The Bitwise Crypto Innovators 30 Index—our benchmark for crypto-related equities—rose 61%. Coinbase, the most recognized name in the index, gained 65%. (In last month’s Investor Letter, we predicted Coinbase would rise 100% in 2023; we didn’t think it’d get most of the way there in January alone!)¹

The question on everyone’s mind now is whether this rally is real. Is it a “bear trap,” certain to reverse as quickly as it occurred? Or is it the start of something big—a new bull market that will extend for years?

In this month’s Investor Letter, we weigh both sides of the argument and lay out why we think the long-term bull case is even more convincing than the market realizes.

The Bear Case: Why January’s Returns Could Reverse Quickly

Let’s first examine the bear case.

There are two primary reasons to believe that January’s gains could be just a flash in the pan.

Reason 1: Crypto’s History Is Full of Bear Traps

Crypto has a long history of bear market traps: swift market recoveries that spark excitement and entice new investors, only to quickly reverse course.

We saw a great example of this last year. The price of bitcoin fell 52%, from $68,780 to $33,184, between November 2021 and January 2022. Soon after, the market recovered, and bitcoin rallied 43% to $47,313 by early April. Ultimately, this turned out to be a bear trap: Bitcoin soon resumed its downward trajectory, plunging an additional 60% to $18,730 by the end of June.

We saw a similar pattern in the early days of 2018. After hitting a high of $20,089 on December 17, 2017, bitcoin fell 68% to $6,526 on April 1, 2018. It then rallied to hit $9,965 on May 5, a 57% gain. But the joy was short-lived: Bitcoin fell for a painful eight consecutive months before bottoming at $3,191 in December 2018, a drop of 68%.

The lesson is clear: You can’t always trust a sharp V-shaped recovery.

Reason #2: As Always, Risks Abound

Beyond historical price patterns, there are plenty of unique challenges facing crypto today.

For starters, the shadow of 2022 lingers over crypto. The FTX collapse and resulting turmoil claimed another victim in January when Genesis Global, the largest crypto lender, filed for bankruptcy. The company faces billions in potential losses. This bankruptcy has entangled Gemini, the well-known crypto exchange and custodian, which has hundreds of millions of dollars of customer assets tied up at Genesis; both companies are facing an SEC lawsuit as a result. Meanwhile, crypto banking giant Silvergate saw a classic “run on the bank” in Q4, with customers withdrawing 68% of all deposits as people worried about its future. Regulatory questions are emerging too. Continued trouble for these firms would create serious challenges for the entire industry and could drive crypto asset prices lower.

Meanwhile, regulators are circling. In January, the Federal Reserve, FDIC, and OCC issued a joint statement warning about the risks that crypto poses to the banking industry. Also, the White House released its own “Roadmap to Mitigate Cryptocurrencies’ Risks,” encouraging more regulatory and legislative enforcement. As we’ve long maintained, good regulation can be a boon to long-term performance, but hasty or ill-advised policy can be a headwind.

And then there are other idiosyncratic risks for 2023. Smart people in crypto are worried about blow-ups at unregulated institutions like Tether and Binance; there are concerns we could see significant selling of bitcoin if the Mt. Gox bankruptcy is finally processed this year as planned; and many share similar worries about price pressures on Ethereum after a planned technological upgrade that will allow staked ETH to be withdrawn and sold in late Q1.

Against this backdrop, the Fed is still hiking interest rates and recession fears linger. It’s safe to say there is plenty to worry about this year.

The Bull Case: Why January’s Returns May Be the Start of Something Big

And yet … I’m convinced the bulls will win out.

Maybe not in a straight line—there is too much risk to expect prices to march higher without interruption. But as we look at the data, we are increasingly confident in crypto’s long-term trajectory, and we believe that prices will end the year higher than they began.

Here’s why.

Reason 1: Rumors of Crypto’s Death Were Wildly Exaggerated; Just Look at the Fundamentals

One big reason? People simply got too bearish in 2022 and put negative sentiment ahead of fundamentals.

At the tail end of 2022, spectators far and wide declared the “death of crypto” (see, for instance, here, here, and here). But these pronouncements never actually lined up with reality.

In a cyclical asset like crypto, investors should expect both prices and fundamentals to ebb and flow over time. The big test is whether you see progressively higher highs and progressively higher lows. In other words, from cycle to cycle, is the market growing or falling? And when you ask this about crypto, the data is clear: The market is growing.

Fast.

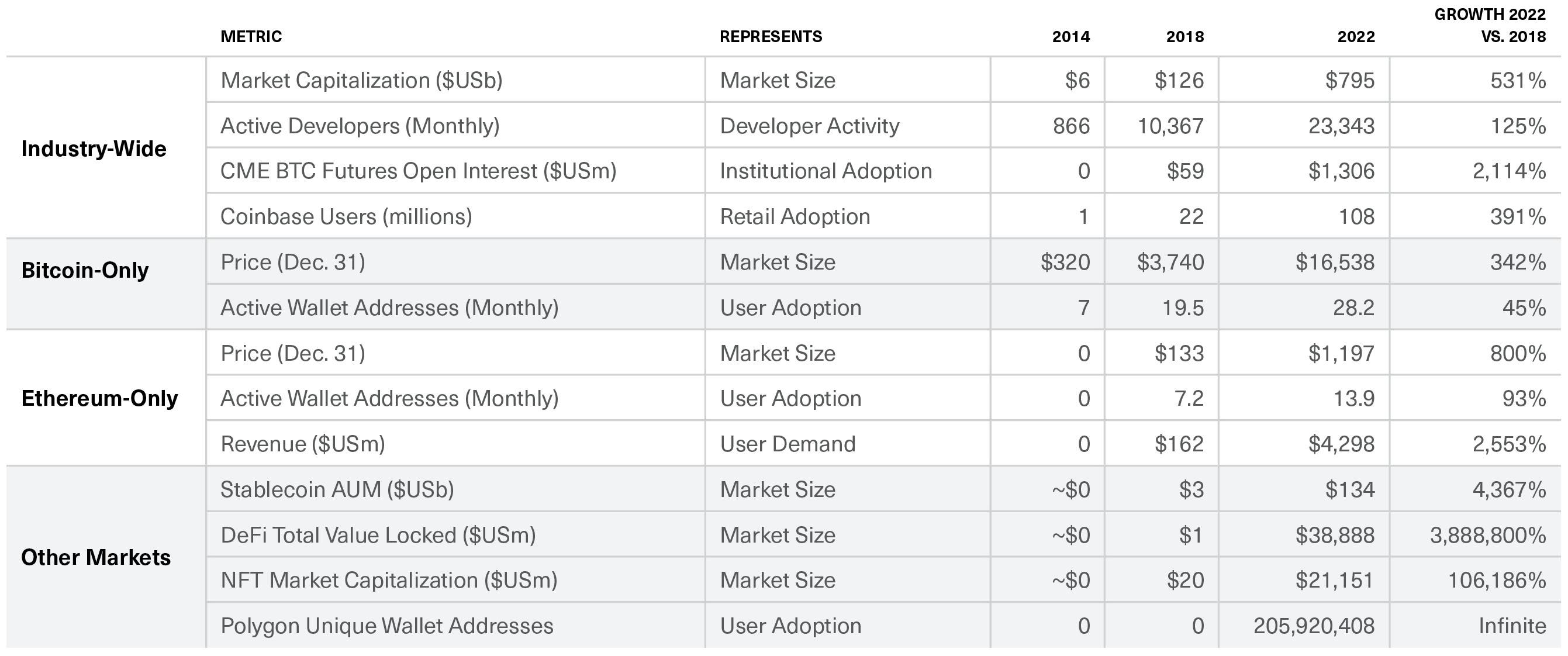

The table below examines key statistics for crypto at year-end 2022 vs. year-end 2018 and 2014, the bottom of the past two cycles.

Crypto Fundamentals: Cycle-vs-Cycle

Source: Market Capitalization and Price data from CoinMarketCap.com. Active Developers data from Electric Capital Developers Report. CME Bitcoin Futures Open Interest from Bloomberg. Coinbase Users from BusinessofApps.com. Bitcoin and Ethereum active wallet addresses from TheBlock. Ethereum revenue from Token Terminal. Stablecoin AUM from CoinMetrics. DeFi TVL from DeFiLlama. NFT Market Capitalization from NFTio.go. Polygon Unique Wallet Addresses from Polygonscan. All data as of December 31, 2022.

Critics might quibble with one or two data points, but it is hard to look at this table and see anything but growth. From 2018 to 2022:

Crypto’s market capitalization rose 531%

The number of crypto developers more than doubled

Open interest in CME bitcoin futures rose more than twentyfold

Ethereum’s revenue rose 2,553%

Stablecoins went from a $3 billion market to $124 billion

I could go on. Retail users, institutional users, DeFi, Layer 2s … no matter what statistic you look at, the cycle-over-cycle growth is extraordinary.

While past performance does not guarantee future results, of course, all the data we can find suggests that the long-term fundamentals of crypto continue to grow cycle-over-cycle, and we can’t find a good reason to believe that “this time will be different.”

Reason #2: Crypto’s Four-Year Cycle Is Intact

We can, however, identify very specific reasons to believe we either have entered or will enter a major bull market soon … and why it could be the largest yet.

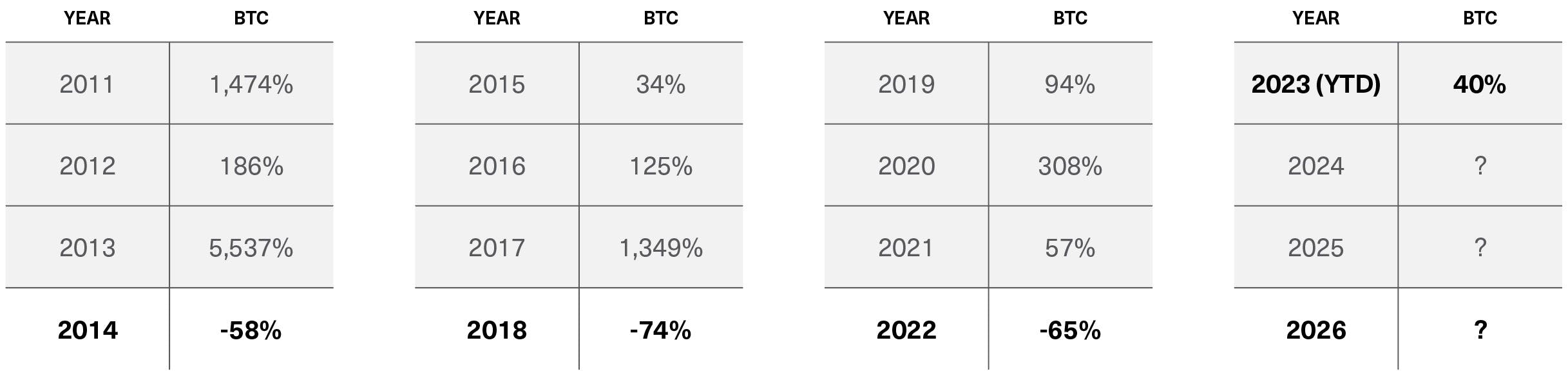

As we’ve discussed before, crypto has historically moved in four-year cycles, with three up years followed by a year of retrenchment. To date, 2023’s return pattern fits perfectly into this framework.

Bitcoin Annual Returns Since 2011

Source: Bitwise Asset Management. Data from January 1, 2011, through January 31, 2023. Performance information is provided for informational purposes only. Returns reflect the return of bitcoin itself, and not of any fund or account, and do not include any fees. Backward-looking performance cannot predict how any investment strategy will perform in the future. Future crypto cycles may not be four years long; the four-year increment is based on historical data for illustrative purposes and is not a prediction of future results. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events, or a guarantee of future results.

These cycles are not accidental. They are sparked by major innovations: The creation of and ability to access bitcoin sparked the 2011 cycle, the creation of Ethereum sparked the 2015 cycle, and the creation of NFTs, stablecoins, and DeFi sparked the 2019 cycle.

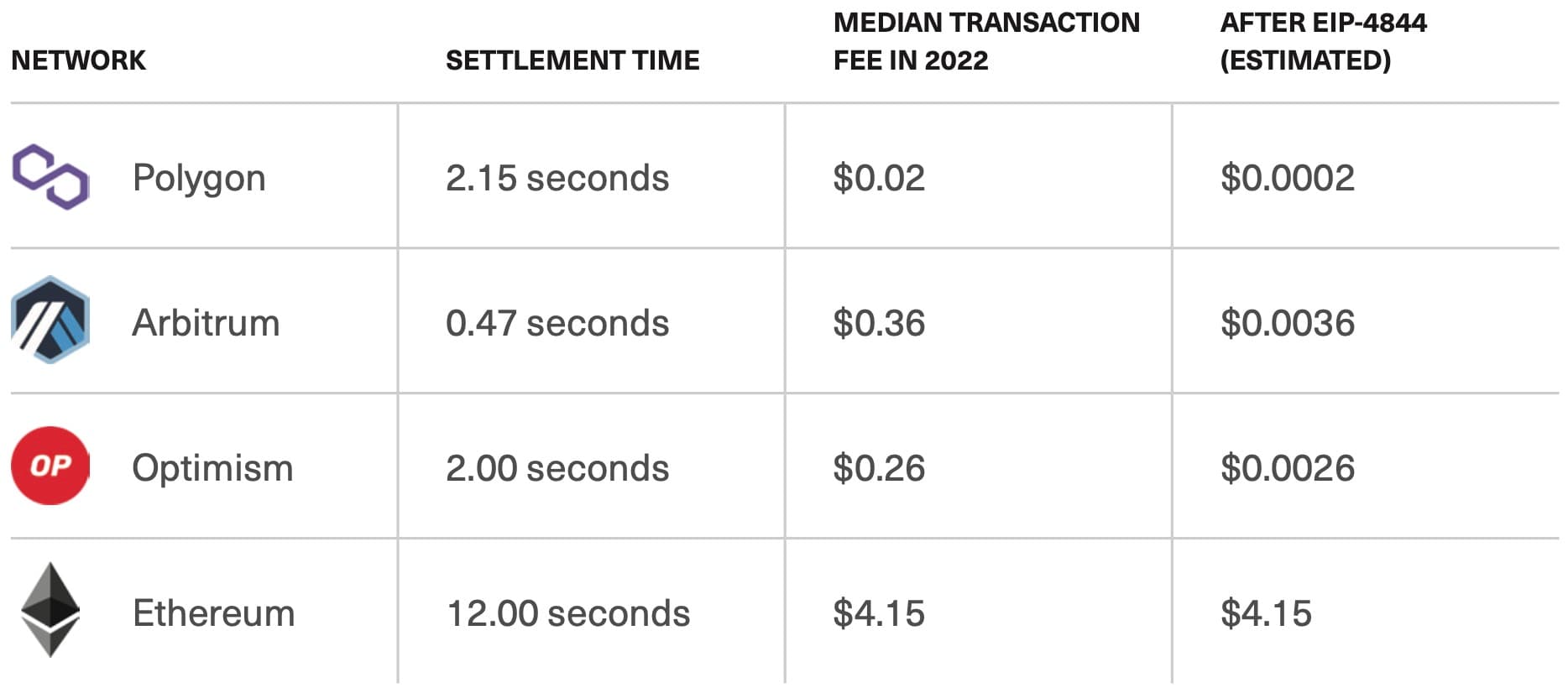

In 2023, the technological advance that has the market talking is the development of Layer 2 networks and scaling solutions. These solutions make it exponentially cheaper, faster, and easier for people to transact on blockchains.

In our predictions for 2023, we noted that the median cost of a transaction on Ethereum in 2022 was $4.15, while emergent Layer 2s cut that fee to as low as $0.02. Later this year, a planned upgrade of the Ethereum blockchain could slash those Layer 2 fees to less than $0.001.

Put simply: Blockchains are getting better.

Median Transaction Fee: Ethereum and Top Scaling Solutions

Source: Bitwise Asset Management with data from Token Terminal, Etherscan, Optimistic.etherscan.io, and Arbiscan as of December 31, 2022. Please see important disclosure information at the end of this document. Performance information is provided for informational purposes only. Past performance is no guarantee of future returns.

The implications are huge.

Some of the most interesting potential mainstream applications of crypto—micropayments, gaming, decentralized social networks, mainstream DeFi—are simply impossible if you have to pay $4 for every transaction. They become quite attractive, however, if transactions are effectively free.

We believe the collapse in fees to use blockchains like Ethereum will finally allow crypto to go mainstream.

The importance of this breakthrough is poorly understood by the public right now—there’s very little discussion of it in the media. But if you believe that crypto’s value is intrinsically tied to the power, speed, and versatility of its underlying technology, then vast improvements in blockchains are something to be excited about. We think this lies at the core of the 2023 bull market cycle, and that the public will catch on sooner or later.

Conclusion: Focus on the Long Term

One challenge in crypto is that the news flow is incredibly intense. Each week, and sometimes each day, it seems there are headlines proclaiming massive breakthroughs and equally massive threats.

I wrote this letter on February 2, for instance, and in the past 24 hours alone we’ve seen:

Financial services giant BNY Mellon hired a new Digital Assets CEO to accelerate its growth in the space.

Berkshire Hathaway’s Charlie Munger penned an op-ed in The Wall Street Journal arguing that crypto should be banned.

ARK Investments’ Cathie Wood reiterated her call for bitcoin to hit $1 million by 2030.

Silvergate’s stock rallied >25% as investor and client confidence returned, and then retraced after news of a regulatory probe.

The ranking member of the U.S. Senate Banking Committee listed “Developing a Framework for Digital Assets” as a top priority for 2023.

It can be tiring to keep track, and the blistering pace of news makes it easy for short-term sentiment to fluctuate wildly. For this and other reasons, prices can be volatile. We expect that to be the case this year, and we could yet see a significant pullback from current prices.

But for long-term investors, it pays to step back during these moments and look at the long-term data. When we do that, we see staggering cycle-over-cycle growth in almost every statistic that matters, and major technological breakthroughs in blockchain functionality. From that view, it’s hard not to be excited about what’s ahead.

Matt Hougan

Chief Investment Officer

(1) The Bitwise Crypto Innovators 30 Index is an equity index that provides focused exposure to companies that are building the future of the crypto-asset-enabled decentralized economy. As of January 31, 2023, the following were the 10 largest constituents of the Index: 9.95% Coinbase Global Inc. (COIN), 9.86% MicroStrategy (MSTR), 9.76% Galaxy Digital Holdings (GLXY CN), 5.70% Hut 8 Mining (HUT), 5.63% Hive Blockchain Technologies (HIVE), 5.36% Applied Blockchain (APLD), 5.30% Bitfarms (BITF), 4.61% Riot Blockchain (RIOT), 4.53% Northern Data (NB2 GR), and 4.37% Canaan Inc. (CAN).

Events

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email investors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

Conferences

Titan Investors RIA Roundtable | February 9 | St. Louis, MO

Titan Investors Active Exchange | March 2 | New York, NY

Barron’s Independent Summit 2023 | March 15-17 | Dallas, TX

Notes From the Research Desk

Next Destination on Ethereum’s Roadmap: Shanghai

Since December 2020, Ethereum has been running on a proof-of-stake consensus mechanism. In this system, investors help secure and validate the blockchain by “staking” their ETH to the network; in exchange, they’re eligible to earn interest on their staked position. The caveat: Up until now, this investment has effectively been locked, with investors unable to access their staked ETH.

In March, that will change with the implementation of the long-awaited Shanghai upgrade, which will allow stakers to withdraw their staked ETH at will.

How will this affect Ethereum, considering that more than $27 billion of ETH (or 14% of the total supply) is currently staked? Some worry that an open gate will prompt investors to withdraw and sell ETH en masse, potentially pressuring prices. Others (including the team at Bitwise) take the opposite view. We believe opening up liquidity will attract more investors to the network.

Ultimately, the move marks a crucial step toward making Ethereum’s network more robust and efficient.

Juan Leon, CFA

Senior Investment Strategist

Will Silvergate Survive the Storm?

Silvergate Capital (NYSE: SI) has been under significant pressure during the recent crypto credit crisis. Over the past several months, investors, customers, and regulators alike have questioned the bank’s exposure to failed crypto companies, its legal liability from its relationship with FTX, and the health of its balance sheet.

The last item is perhaps the most concerning. In January, the company reported that total deposits from digital asset customers declined 68% in Q4 and announced multiple steps to streamline operations and reduce costs, including significant layoffs, write-downs, and the offboarding of non-core customers.

To its credit, Silvergate has managed to survive last quarter’s “run on the bank.” The firm’s balance sheet remains highly liquid, with cash and cash equivalents ($4.6 billion) exceeding digital asset deposits ($3.8 billion). But in the coming months, it will be crucial to see if Silvergate can restore investor and customer confidence in its long-term prospects.

Alyssa Choo

Crypto Research Analyst

How Scaling Solutions Are Leveling Up DeFi

The rise of Layer 2 scaling solutions are making DeFi applications cheaper and more attractive to use, which could lead to significant growth in the space.

For example, last month the cost to trade ETH for USDC using an Ethereum-based decentralized exchange was roughly $5.00. During the same period, the same transaction on GMX, a decentralized exchange built on the Layer 2 scaling solution Arbitrum, was $0.15, or less expensive by a factor of 33!

That kind of reduction in cost makes DeFi competitive with institutional-scale centralized applications, and it should pave the way for continued adoption in the future.

Ryan Rasmussen

Head of Research

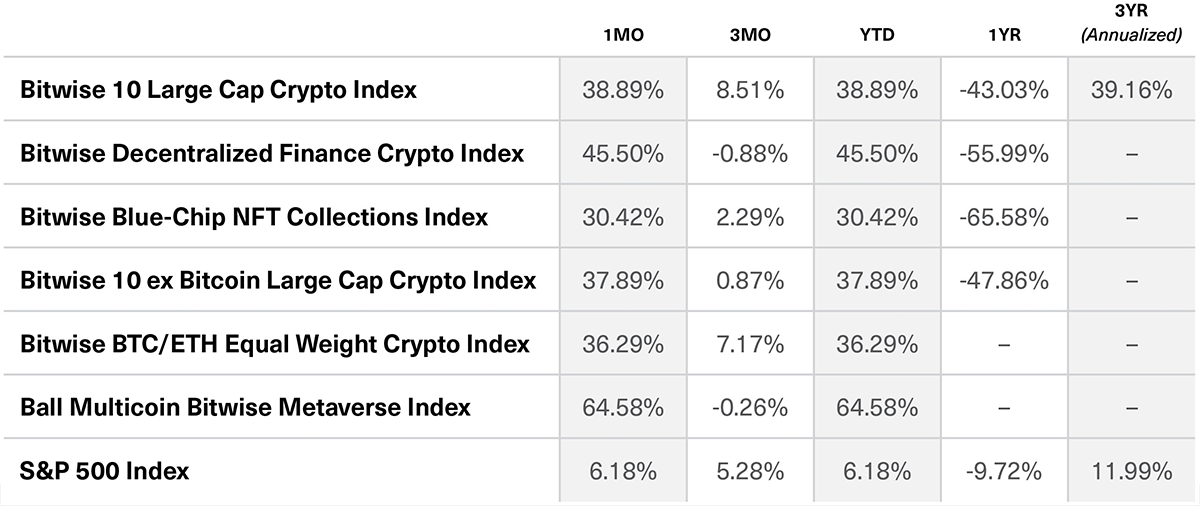

Benchmark Performance

As of January 31, 2023

Source: Bitwise Asset Management with data from Bloomberg. Performance of greater than one year is annualized.

Notes: It is not possible to invest directly in an index. Past performance is no guarantee of future results. The Bitwise 10 Large Cap Crypto Index captures the 10 largest eligible crypto assets by free-float-adjusted market capitalization. The Bitwise Decentralized Finance Crypto Index is designed to provide investors with a clear, rules-based, and transparent way to track the value of the rapidly emerging Decentralized Finance space. The Bitwise Blue-Chip NFT Collections Index is designed to broadly capture the investable market opportunity for the most valuable arts and collectibles NFT collections. The Bitwise 10 ex Bitcoin Large Cap Crypto Index captures the assets in the Bitwise 10 Large Cap Crypto Index, excluding bitcoin. The Bitwise BTC/ETH Equal Weight Crypto Index captures the value of an equal-weighted index consisting of bitcoin and ethereum. The Ball Multicoin Bitwise Metaverse Index is designed to capture the investable market opportunity for crypto assets exposed to the emerging Metaverse. The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What’s New at Bitwise

Bitwise/VettaFi 2023 Benchmark Survey of Financial Advisor Attitudes Toward Crypto

We recently partnered with VettaFi, a leading provider of analysis in the ETF space, to conduct the fifth annual Bitwise/VettaFi 2023 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets. The survey’s findings confirm what we heard in our daily conversations with thousands of financial professionals throughout 2022: While failures like FTX and the market’s steep volatility are cause for concern, advisors and their clients continue to allocate to crypto, and interest levels remain high.

The Year Ahead in Crypto: 10 Things To Watch in 2023

In this white paper, the Bitwise research team outlines ten key predictions (and one bonus prediction) for the year ahead in crypto. From crypto’s U-shaped market recovery to the rise of staked ETH and the next crypto company forced into bankruptcy, this report covers the most critical areas of the market for investors to consider in 2023.

Crypto Market Quarterly Review (Q4 2022)

Q4 was an incredibly difficult quarter for crypto. Now the question is, will we see a recovery in 2023? In this report, we put that question in context with analysis covering the impact of FTX’s collapse, Bitcoin’s historical four-year performance cycle, Ethereum’s first quarter since The Merge, and the biggest events across decentralized finance (DeFi), NFTs, crypto equities, and more.

Select Media Appearances

TechCrunch: Ethereum staking draws institutional interest (Matt Hougan) [paywall]

CoinDesk: Stablecoins may be first crypto-related legislation (Katherine Dowling)

Blockworks: Financial advisors mostly unfazed by 2022 volatility (Matt Hougan)

CNBC: Bitwise client count doubled last year (Matt Hougan)

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.