June 2022 Bitwise Investor Letter

San Francisco • Jun 10, 2022

In This Issue: The Three Biggest Questions Investors Are Asking About Crypto Today

Note: Last month we relaunched the Bitwise Investor Letter, our monthly look at the biggest themes shaping the crypto market plus the latest updates on Bitwise. If you're not receiving this letter directly but would like to subscribe, please click here.

Market Overview

Dear Investors,

A bear market. Recession. Crypto winter.

Whatever you call it, the crypto markets are going through a rough period. The Bitwise 10 Large Cap Crypto Index—the leading index in crypto—was down 24% in May and has fallen 40% for the year.

During times like these, it’s natural to wonder what your peers are thinking.

Are they buying? Selling? Do they think we’ve hit bottom yet?

It can be lonely in a bear market if you're trying to navigate solo.

One of the best parts of my job is that I get to speak with a huge number of professional investors about crypto. In May, for instance, I spoke at four conferences and three webinars; hosted three 10-person advisor dinners; and sat down at 28 one-on-one meetings with financial advisors and family offices.

Across these events, I engaged with more than 1,000 financial professionals and fielded hundreds of questions. In this month’s Investor Letter, I thought I’d share the three most common questions I received from these investors in May, along with my answers.

Question #1: Is now a good time to buy?

This was by far the most common question I received.

That might seem obvious—what else would people want to know in a bear market?—but to me, it was incredibly interesting. To explain why, some context is useful.

Bitwise was founded in 2017. In 2018, crypto fell more than 80% in a brutal, relentless sell-off. As I did last month, I hit the road in Q4 2018 and spoke with hundreds of investors about crypto. The conversation, however, was different. In 2018, no one asked me if it was a good time to buy. Instead, everyone wanted to know if crypto would survive: Will the government ban crypto? Will institutions ever enter the market? Could crypto just disappear?

Crypto was in a very different place in 2018. Decentralized finance (DeFi) basically didn’t exist; no one talked about non-fungible tokens (NFTs); and there were no $1 billion crypto venture capital funds. Wall Street institutions like JPMorgan and Goldman Sachs still mocked the space.

Today, the conversation has shifted. Christie’s is auctioning NFTs for millions of dollars; BlackRock and Fidelity have launched crypto-related equity ETFs; nearly 50% of financial advisors own crypto in their personal accounts; crypto VCs invested nearly $12 billion in crypto startups last quarter alone; and JP Morgan has called crypto its favorite alternative asset, ranking it above real estate.

The conversation has shifted from “Will crypto exist?” to “Is now a good time to buy?” That’s a categorical change. It suggests that this crypto winter may be shorter than past winters, and that the ensuing rebound could be stronger still.

So does that mean now is a good time to buy?

Maybe. Big picture, I’m more optimistic today than I’ve ever been. Key fundamental metrics like developer activity, wallet adoption, venture capital investment, regulatory progress, and institutional investment are strong.

But today’s capital markets continue to be driven by macro forces, not by crypto’s fundamentals. It’s entirely possible that a hawkish Fed could lead to another leg down in risk assets, including crypto.

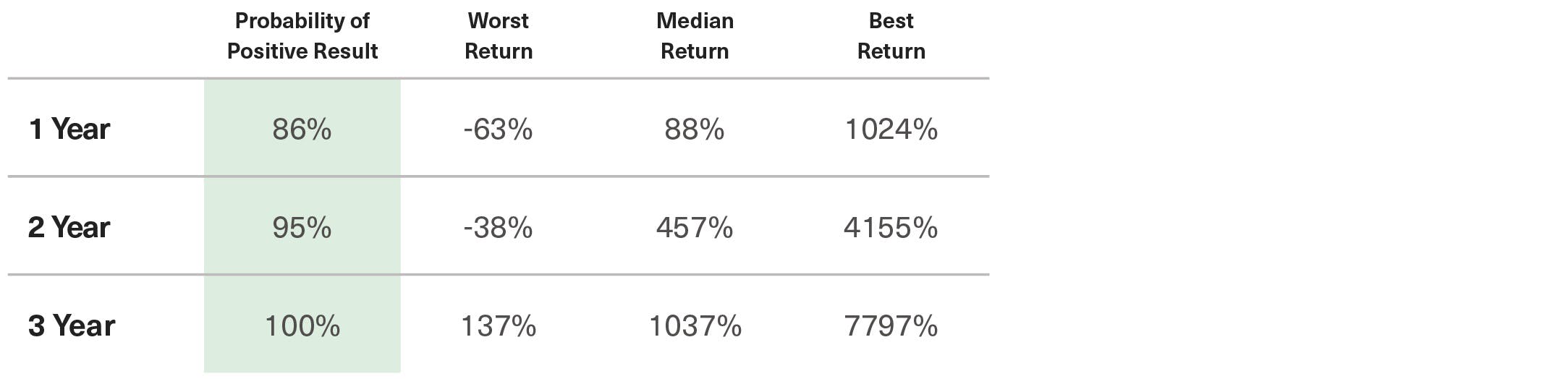

That said, history suggests that buying crypto when markets are already down 50% is, on average, a good bet. The table below shows the “win rates” along with the one-, two-, and three-year returns for investors who made an allocation to crypto on a day when crypto was trading 50% or more off its highs, using all available data since January 1, 2014.¹

(1) I use 2014 as the start of the modern era of crypto investing because the first professional crypto fund in the world launched in 2014. Before that, crypto wasn’t broadly accessible for professional investors.

Investors who bought when the market was down 50% or more and held for one year profited 86% of the time, with a median return of 88%. But that investment wasn’t without risk and volatility: In the worst-case scenario, that one-year investment fell an additional 63%—which hurts.

If you extend out to three years, things improve, with a 100% win rate and a median return of 1037%.

There’s no assurance things will repeat, of course: Past performance is no guarantee of future results. But the historical data suggests that, for those with a long-term time horizon, investing when the markets are down sharply has been a good bet.

Question #2: What do you worry about?

When I look at crypto, I see a breakthrough technology that promises to reshape the financial system in fundamental ways. Naturally, people want to know: What could go wrong?

Advisors asked this at every meeting I took in May. My answer was simple: bad regulation.

This risk was on full display last month, when the U.S. House of Representatives held a hearing to discuss a proposal by crypto exchange FTX.

The derivatives market is one of the richest, clubbiest, and highest-margin corners of Wall Street. The CME Group—the largest derivatives exchange in the U.S.—reported an 87% gross margin in its last quarter. These high take rates are made possible by a complex and layered regulatory structure that forces investors to deal with multiple intermediaries: futures commission merchants (FCMs), clearinghouses, and so forth.

In the hearing, FTX founder Sam Bankman-Fried argued for a radical reinvention of this system. Because crypto markets are inherently digital, trade 24/7/365, and settle nearly instantly, crypto derivatives exchanges have never embraced the intermediated model. Investors can open accounts directly with the exchange, and software can automatically monitor and claim collateral if needed. There is, they say, no need for FCMs, clearinghouses, or lengthy settlement times. Good news for investors, less so for derivatives exchanges.

The hearing centered around whether FTX should be able to use this direct and more efficient model, or if regulators should require the standard layers of bureaucracy to insulate investors from unanticipated bad outcomes.

The answer to me is obvious: Derivatives exchange profits are too high and need disruption. But that doesn’t mean it will happen. Established exchanges have the incentives and deep lobbying connections to fight against the change. If unsound regulation and lobbying blunts or delays the advantages crypto offers, crypto will suffer.

I don’t think this is the likely path. There is an emerging pro-crypto lobby in Washington, and at Bitwise, our conversations with legislators have taken a notably pro-crypto turn over the past six months. But over-regulation and financial industry lobbying are risks worth keeping an eye on.

Question #3: What will make crypto go mainstream and enter our everyday lives?

The last question I got time and again on the road was: “What will make crypto go mainstream?”

This question stems, I think, from a frustration I feel at times myself. If you’ve spent time studying crypto, you can clearly imagine what the future will look like: a financial world that’s more efficient and frictionless, and that enables us to do new things.

We’ve had mainstream moments in crypto—like when Fidelity embraced bitcoin’s role in 401(k)s, or when the NFT boom put crypto at the center of the arts world for a while. But often, it feels like there is a gap. It can be hard sometimes to imagine your friends and colleagues downloading non-custodial wallets or interfacing with DeFi protocols.

And that’s because I don’t think they will. As I explained on the road, when crypto goes mainstream, a lot of its technical underpinnings will be abstracted away. In some cases, it’s already happening.

Think of how this works in traditional finance. For instance, if you have a Charles Schwab account, Schwab rolls up your idle cash at the end of each day and invests it in a money market mutual fund. That fund is run by a team of investment professionals, dressed in suits, who come into the office each day and use investors’ cash to buy Treasuries, commercial paper, and other bond-like instruments, searching for yield.

In the crypto world, Coinbase is the closest equivalent to Schwab: essentially a brokerage website that you use to trade crypto assets. But if you have a few hundred dollars in your Coinbase account, it doesn’t roll into a money market account. Instead, for investors outside the U.S., you can push a button and roll that money into Compound.

Compound is a DeFi protocol. It takes (digital) cash and essentially does the same thing a money market fund does: invests it in yield-seeking opportunities. It owns different things and carries additional risks compared to a money market fund, but the end goal is the same: to earn a yield on idle cash. The difference is that Compound is a software program; there are no employees in Oxfords making allocation decisions. It’s just a protocol, powered by blockchain.

As a user, there’s little difference between your experience at Schwab and your experience at Coinbase. But behind the scenes, one is built on TradFi rails and the other on a DeFi bullet train. And historically, the DeFi approach has led to higher yields.

I think a lot of crypto will be like this: delivering efficiency behind the scenes, with the technical complexity washed away by slick front ends.

(It’s worth noting, of course, that this service is only available to Coinbase customers outside the U.S. Currently, policymakers won’t allow it in U.S. markets, which speaks to the regulatory risks I referenced above).

Conclusion

Looking back on my trips in May, I’m left with the sense that crypto has made undeniable progress in recent years. Bull market or bear, crypto is an asset class that has proven itself worthy of the growing attention it’s receiving from financial advisors, family offices, and institutional investors alike.

These professional investors still have lots of questions, and good ones at that. But the tone has shifted from idle skepticism to active curiosity, and many are lining up to allocate when the time comes.

Matt Hougan

Chief Investment Officer

Notes From the Research Desk

Our research team captures some of crypto’s biggest themes and highlights in a word (or so).

Where are investors flocking in the bear market?

One thing I’ve been paying attention to during this bear market is the relative performance of different crypto assets. Bitcoin dominance, a popular metric that measures bitcoin‘s market share of all crypto assets, is up to 46% from a multi-year low of 39% in January. This makes sense: Investors tend to flock to the most established assets during periods of market uncertainty. What I find interesting is that almost all of this market share gain came from smaller assets and very little from Ethereum. In other words, Ethereum is holding its own. I think this is another indication that Ethereum—the backbone of DeFi, NFTs, stablecoins, and other key applications—is establishing itself as a must-have for crypto investors.

David Lawant

Director of Research

Fidelity to double crypto staff, add Ethereum

In a big show of confidence in crypto’s long-term outlook, in May Fidelity Investments announced plans to double the size of its 200-person crypto team and expand its crypto offerings to include Ethereum. Historically, Fidelity’s crypto offerings have only included bitcoin exposure. Crypto-wise, Fidelity is a bellwether for the institutional community, so the fact that they’re doubling down on the space in a bear market is big news. And the fact that they’re acknowledging their clients’ desire for exposure beyond bitcoin says a lot about where crypto is heading.

Coinbase launches Web3 DeFi wallet, a potential game changer

DeFi and Web3 might have just had a “Netscape” moment. The first popular internet browser made it much easier for everyday people to use the world wide web and is widely credited with bringing the internet mainstream. This past month, Coinbase rolled out a new wallet and decentralized application ("dapp") browser to a small subset of its users. The new service is designed to make using DeFi protocols, NFTs, and other decentralized applications feel easy. Before this, users had to rely on unfamiliar tools from unfamiliar names—things like MetaMask and Trust Wallet—to access the space. And while there’s no guarantee that one of the largest firms in crypto creating a portal to the dapp world will spur big adoption, Coinbase’s 100 million clients are not a bad place to start.

Juan Leon, CFA

Senior Investment Strategist

Luna’s meltdown holds a silver lining

The biggest story in May was the meltdown of Luna and the algorithmic stablecoin UST, which wiped out tens of billions of dollars of investor wealth. We were never fans of Luna. Although it was one of the largest crypto assets in the world, we never allowed it to enter the Bitwise 10 Large Cap Crypto Index, precisely because of the risks that became evident during the meltdown. As the market recovers, there is at least one interesting learning: One of the largest stablecoins in the world suffered a Lehman Brothers-like demise and ... nothing broke. There were no bailouts, systemic risk, or contagion effects. DeFi’s risk management systems worked as advertised. People lost money, and the market cleared and moved forward. That’s cold comfort to people who lost money, but points to the underlying strength of not only DeFi but also crypto in general.

Ryan Rasmussen

Head of Research

Performance

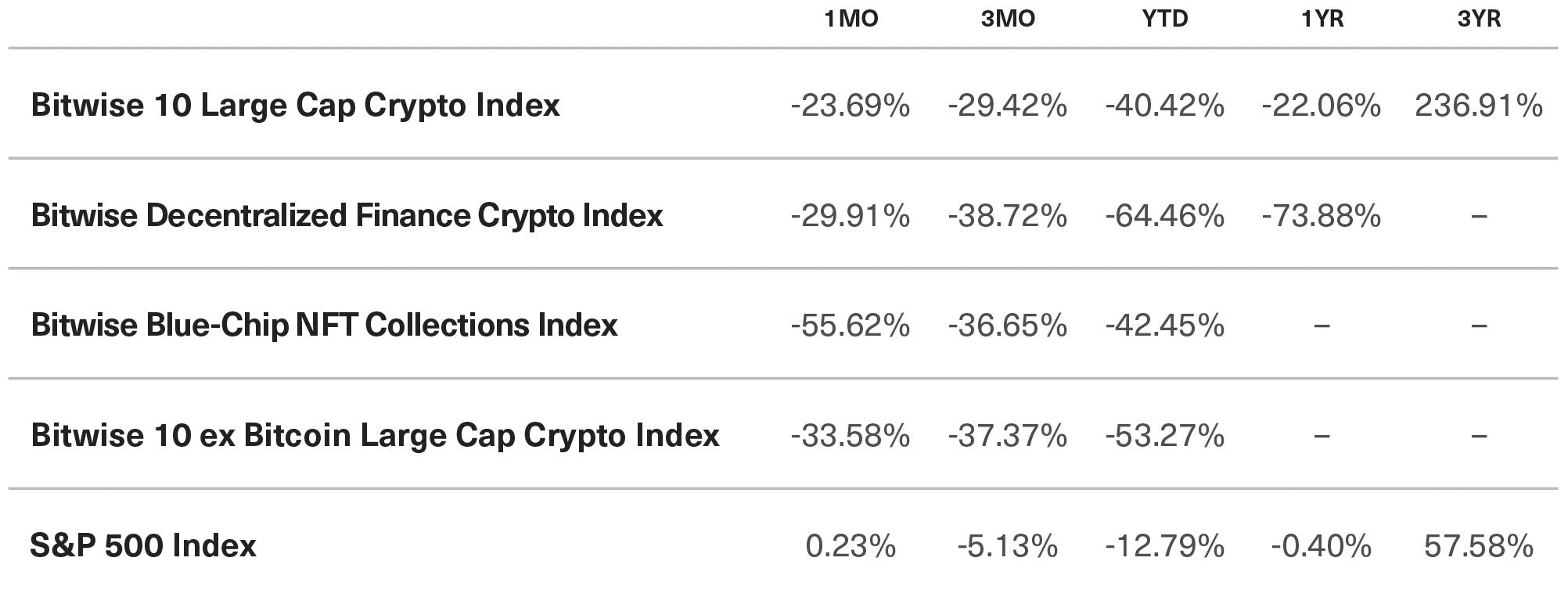

Crypto extended its year-to-date losses in May, as the Luna meltdown added pain to an already challenging macroeconomic environment.

The Bitwise 10 Large Cap Crypto Index fell 24%, leading to a loss of roughly 40% in 2022. The decentralized finance (DeFi) market fell almost 30%, extending its losses to nearly 50% over the year. The NFT market fell even more during the month, shedding 55% and driving the index performance to negative territory for 2022.

Benchmark Performance as of May 31, 2022

Source: Bitwise Asset Management with data from IEXCloud.

Notes: It is not possible to invest directly in an index. Past performance is no guarantee of future results. The Bitwise 10 Large Cap Crypto Index captures the 10 largest eligible crypto assets by free-float-adjusted market capitalization. The Bitwise Decentralized Finance Crypto Index is designed to provide investors with a clear, rules-based, and transparent way to track the value of the rapidly emerging Decentralized Finance space. The Bitwise Blue-Chip NFT Collections Index is designed to broadly capture the investable market opportunity for the most valuable arts and collectibles NFT collections. The Bitwise 10 ex Bitcoin Large Cap Crypto Index captures the assets in the Bitwise 10 Large Cap Crypto Index, excluding bitcoin. The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What's New at Bitwise?

Noteworthy happenings and key milestones.

Bitwise Teams Up With Ball, Multicoin To Launch Metaverse Index

Recently, Bitwise joined forces with two of the world’s leading authorities on the Metaverse—thought leader Matthew Ball and crypto investment firm Multicoin—to create the world’s first Metaverse-themed crypto index. The Ball Multicoin Bitwise Metaverse Index is designed to hold up to 40 leading crypto assets powering the fast-growing Metaverse—a seamless, interconnected digital world that could redefine how we live, work, and play. A corresponding fund is available through Bitwise to qualified purchasers.

Select Media Appearances

Bloomberg: TerraUSD is the ‘Pets.com’ of our time

Fox Business: Crypto serves as ‘amazing tool’ for long-term investment

Axios: Bitcoin separates from other crypto in uncertain times

ETF Database: "The ground shook and the foundation held”: Bitwise on DeFi

CoinDesk: Multicoin Capital partners with Bitwise and Matthew Ball for Metaverse crypto index fund

Five Takeaways From Permissionless

If you didn’t make it to the Permissionless conference, have no fear: Our Research Team offered five key takeaways from one of the biggest crypto events of the year.

“Quick Takes”: One Question To Ask

In May, CIO Matt Hougan offered advice on how to make sense of recent volatility, posing the one critical question every crypto investor should ask.

The Latest Bite-Sized Educational Videos

In our latest series of 30-second educational videos airing on CNBC, Katherine Dowling talked about programmable money, shifting regulatory winds, and why crypto is like cayenne pepper.

We're Growing

Recently, we hit a new milestone: Bitwise hired its 70th employee in May! We’re proud of our growing team, whose hard work and broad expertise are advancing our mission to make crypto’s most compelling opportunities available to everyone.

Upcoming Conferences

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email investors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

Consensus | June 9-12 in Austin, TX

Insite | June 15-17 in Grapevine, TX

Titan RIA Retreat | July 20-21 in Newport, RI

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.