June 2022 Bitwise Advisor Letter

San Francisco • Jun 10, 2022

In This Issue: The Biggest Questions Investors Are Asking About Crypto Today

Market Overview

Whatever you call it, the crypto markets are going through a rough period. The Bitwise 10 Large Cap Crypto Index—the leading index in crypto—was down 24% in May and has fallen 40% for the year.

During times like these, it’s natural to wonder what your peers are thinking. Are they buying? Selling? Do they think we’ve hit bottom yet?

It can be lonely in a bear market, trying to navigate solo.

One of the best parts of my job is that I get to speak with a huge number of professional investors about crypto. In May, for instance, I spoke at four conferences and three webinars; hosted three 10-person advisor dinners; and sat down at 28 one-on-one meetings with financial advisors and family offices.

Across these events, I engaged with more than 1,000 financial professionals and fielded hundreds of questions. In this month’s Investor Letter, I thought I’d share the three most common questions I received from these investors in May, along with my answers.

The Big Question: Is Now a Good Time To Buy?

This was by far the most common question I received.

That might seem obvious—what else would people want to know in a bear market?—but to me, it was incredibly interesting. To explain why, some context is useful.

Bitwise was founded in 2017. In 2018, crypto fell more than 80% in a brutal, relentless sell-off. As I did last month, I hit the road in Q4 2018 and spoke with hundreds of investors about crypto. The conversation, however, was different. In 2018, no one asked me if it was a good time to buy. Instead, everyone wanted to know if crypto would survive: Will the government ban crypto? Will institutions ever enter the market? Could crypto just disappear?

Crypto was in a very different place in 2018. Decentralized finance (DeFi) basically didn’t exist; no one talked about non-fungible tokens (NFTs); and there were no $1 billion crypto venture capital funds. Wall Street institutions like JPMorgan and Goldman Sachs still mocked the space.

Today, the conversation has shifted. Christie’s is auctioning NFTs for millions of dollars; BlackRock and Fidelity have launched crypto-related equity ETFs; nearly 50% of financial advisors own crypto in their personal accounts; crypto VCs invested nearly $12 billion in crypto startups last quarter alone; and JP Morgan has called crypto its favorite alternative asset, ranking it above real estate.

The conversation has shifted from “Will crypto exist?” to “Is now a good time to buy?” That’s a categorical change. It suggests that this crypto winter may be shorter than past winters, and that the ensuing rebound could be stronger still.

So does that mean now is a good time to buy?

Maybe. Big picture, I’m more optimistic today than I’ve ever been. Key fundamental metrics like developer activity, wallet adoption, venture capital investment, regulatory progress, and institutional investment are strong.

But today’s capital markets continue to be driven by macro forces, not by crypto’s fundamentals. It’s entirely possible that a hawkish Fed could lead to another leg down in risk assets, including crypto.

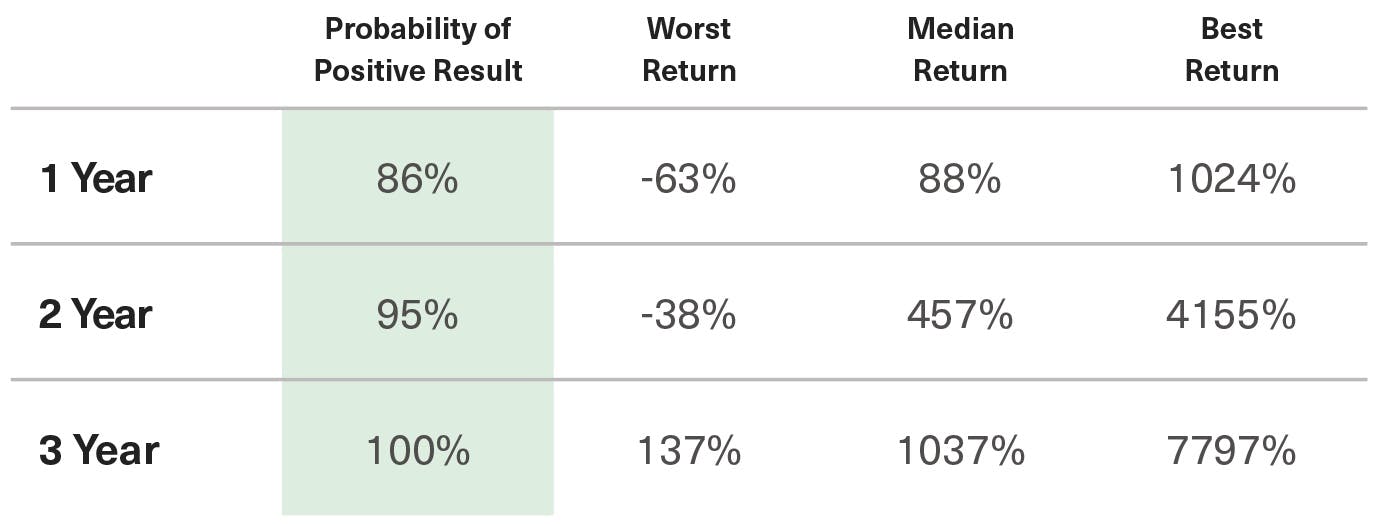

That said, history suggests that buying crypto when markets are already down 50% is, on average, a good bet. The table below shows the “win rates” along with the one-, two-, and three-year returns for investors who made an allocation to crypto on a day when crypto was trading 50% or more off its highs, using all available data since January 1, 2014.¹

(1) I use 2014 as the start of the modern era of crypto investing because the first professional crypto fund in the world launched in 2014. Before that, crypto wasn’t broadly accessible for professional investors.

Investors who bought when the market was down 50% or more and held for one year profited 86% of the time, with a median return of 88%. But that investment wasn’t without risk and volatility: In the worst-case scenario, that one-year investment lost an additional 63% of its value—which hurts.

If you extend out to three years, things improve, with a 100% win rate and a median return of 1037%.

There’s no assurance things will repeat, of course: Past performance is no guarantee of future results. But the historical data suggests that, for those with a long-term time horizon, investing when the markets are down sharply has been a good bet.

Matt Hougan

Chief Investment Officer

Notes From the Research Desk

Where are investors flocking in the bear market?

One thing I’ve been paying attention to during this bear market is the relative performance of different crypto assets. Bitcoin dominance, a popular metric that measures bitcoin‘s market share of all crypto assets, is up to 46% from a multi-year low of 39% in January. This makes sense: Investors tend to flock to the most established assets during periods of market uncertainty. What I find interesting is that almost all of this market share gain came from smaller assets, with very little from Ethereum. In other words, Ethereum is holding its own. I think this is another indication that Ethereum—the backbone of DeFi, NFTs, stablecoins, and other key applications—is establishing itself as a must-have for crypto investors.

David Lawant

Director of Research

Fidelity to double crypto staff, add Ethereum

In a big show of confidence in crypto’s long-term outlook, in May Fidelity Investments announced plans to double the size of its 200-person crypto team and expand its crypto offering to include Ethereum. Crypto-wise, Fidelity is a bellwether for the institutional community, so the fact that they’re doubling down on the space in a bear market is big news. And the fact that they’re acknowledging their clients’ desire for exposure beyond bitcoin says a lot about where crypto is heading.

Luna’s meltdown holds a silver lining

The biggest story in May was the meltdown of Luna and the algorithmic stablecoin UST, which wiped out tens of billions of dollars. We were never fans of Luna. Although it was one of the largest crypto assets in the world, we never allowed it to enter the Bitwise 10 Large Cap Crypto Index, precisely because of the risks that became evident during the meltdown. As the market recovers, there is at least one interesting takeaway: One of the largest stablecoins in the world suffered a Lehman Brothers-like demise and ... nothing broke. There were no bailouts, systemic risk, or contagion effects. DeFi’s risk management systems worked as advertised. People lost money, and the market cleared and moved forward. That’s cold comfort to people who lost money, but it points to the underlying strength of crypto.

Ryan Rasmussen

Head of Research

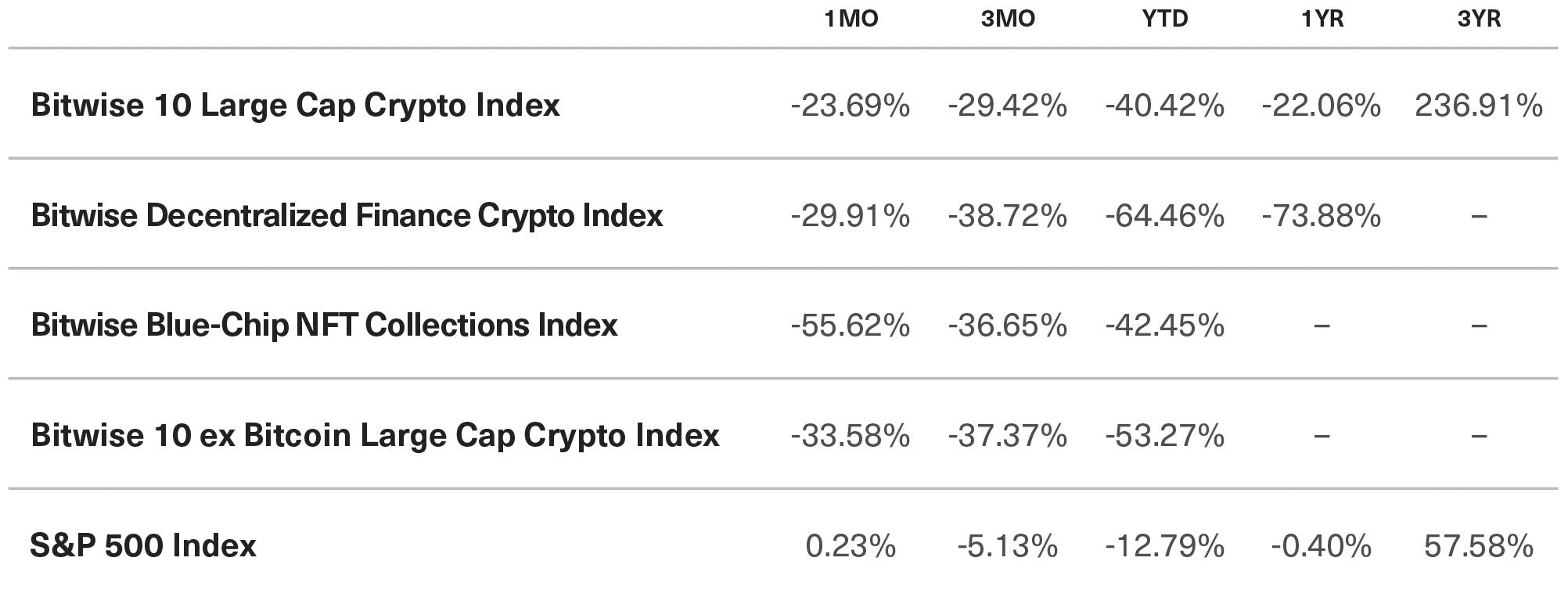

Benchmark Performance

As of May 31, 2022

Source: Bitwise Asset Management with data from IEXCloud.

Notes: It is not possible to invest directly in an index. Past performance is no guarantee of future results. The Bitwise 10 Large Cap Crypto Index captures the 10 largest eligible crypto assets by free-float-adjusted market capitalization. The Bitwise Decentralized Finance Crypto Index is designed to provide investors with a clear, rules-based, and transparent way to track the value of the rapidly emerging Decentralized Finance space. The Bitwise Blue-Chip NFT Collections Index is designed to broadly capture the investable market opportunity for the most valuable arts and collectibles NFT collections. The Bitwise 10 ex Bitcoin Large Cap Crypto Index captures the assets in the Bitwise 10 Large Cap Crypto Index, excluding bitcoin. The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What's New at Bitwise?

Noteworthy happenings and key milestones.

Bitwise Teams Up With Ball, Multicoin To Launch Metaverse Index

Recently, Bitwise joined forces with two of the world’s leading authorities on the Metaverse—thought leader Matthew Ball and crypto investment firm Multicoin—to create the world’s first Metaverse-themed crypto index.

Select Media Appearances

Bloomberg: TerraUSD is the ‘Pets.com’ of our time

Fox Business: Crypto serves as ‘amazing tool’ for long-term investment

Axios: Bitcoin separates from other crypto in uncertain times

CoinDesk: Multicoin Capital partners with Bitwise and Matthew Ball for Metaverse crypto index fund

“Quick Takes”: One Question To Ask

In May, CIO Matt Hougan offered advice on how to make sense of recent volatility, posing the one critical question every crypto investor should ask.

The Latest Bite-Sized Educational Videos

In our latest series of 30-second educational videos airing on CNBC, Katherine Dowling talked about programmable money, shifting regulatory winds, and why crypto is like cayenne pepper.

Upcoming Conferences

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email investors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

Consensus | June 9-12 in Austin, TX

Insite | June 15-17 in Grapevine, TX

Titan RIA Retreat | July 20-21 in Newport, RI

Bitwise Webinars

June 15 | RIA Channel

“The Outlook for Crypto Equities: High-Growth Stocks Trading at a Discount” — Register Here

June 28 | Bitwise Self-Hosted Webinar

“Why the Metaverse Needs Crypto: A Conversation Around the Ball Multicoin Bitwise Metaverse Crypto Index” — Register Here

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.