July 2022 Bitwise Advisor Letter

San Francisco • Jul 12, 2022

In This Issue: On Crypto Cycles, and What Could Stop This Bear Market and Ignite the Next Bull Run

Market Overview

We are in the midst of a brutal crypto bear market.

Consider these two facts: June was the worst month in bitcoin’s history (-40%), and Q2 2022 was the worst quarter for crypto in more than a decade (-59%).

The media has been quick to pick up on this trend and extrapolate it down to zero.

Sure, they say, crypto has had pullbacks before. But this time it’s different.

It’s easy to understand the appeal of this message. Bear markets are hard, and this is arguably the most vicious bear market in crypto’s history. But while the intensity of the decline is remarkable, if you zoom out just a bit, the contours look shockingly familiar.

Consider the table below, which shows the annual returns of bitcoin since it started trading in 2011.

The four-year cyclicality of crypto jumps off the page. If you’re wondering why you didn’t sell at the end of 2021, you’re not alone: Hindsight is 20/20.

But rueing the past as you consider this pattern will not help. Instead, you should look to the future. Because the drivers of crypto’s cyclicality show you where to look if you want to find the next potential big bull market.

What Causes Crypto’s Cycles

The most common explanation for crypto’s cyclicality is that it is driven by bitcoin’s halving cycle. Every four years, like clockwork, the amount of new bitcoin being produced falls in half. This makes bitcoin more scarce, which, the theory goes, makes the price go up.

I wish this were true.

If the bitcoin halving actually drove prices, and you could count on the four-year return pattern to persist, investing would be easy. Just wait until the end of this year, pile in, and then wait for three years before you sell. Eventually you’ll be a billionaire.

Alas, it’s not that easy.

Even if it does have an impact, the halving theory can’t explain the entirety of crypto cycles for multiple reasons:

It’s only bitcoin. Why would the bitcoin halving influence the price of other crypto assets?

Halvings don’t sync with big price moves. For instance, bitcoin halved in 2016, but crypto spiked one year later, in 2017. When bitcoin halved again in 2020, prices moved sharply upward. Why are the halvings sometimes aligned with price moves and sometimes not?

It should be priced in. The timing of bitcoin halvings has been known (plus or minus a few days) since bitcoin was created. Assuming the crypto markets are even vaguely efficient, the impact should be priced in.

While halvings matter to some degree, they can’t and don’t explain the vast majority of crypto’s historical returns.

So what does?

A Radical Theory: Crypto’s Price Rises When It Creates Products People Want

I have a much simpler view of what drives crypto’s cyclicality: Prices rise when the industry discovers products people want to use.

In 2011 and 2013, crypto’s first big up years, the product that people wanted to use was bitcoin itself. 2011 was the first year that bitcoin traded, and 2013 was the first year that the general public could broadly access it. 2013 positioned bitcoin as a mainstream investment.

In 2017, the story was different. Ethereum was created in 2015, offering a more flexible blockchain than bitcoin. Entrepreneurs spent years figuring out what to do with its new capabilities. In 2017, they found a killer app: the initial coin offering (ICO). It turns out you could use the Ethereum blockchain to raise money for new projects, in a manner similar to an initial public offering (IPO).

While ICOs operated in a regulatory gray area and were often of dubious quality, they were also highly popular: Investors poured more than $4.5 billion into ICOs in 2017.

The 2020 boom—which actually stretched from March 2020 to November 2021, a period when bitcoin rose from roughly $5,000 to more than $68,000—was driven by multiple products landing at once.

Stablecoins, decentralized finance (DeFi), and non-fungible tokens (NFTs) all came into bloom during this period. Consider that from March 1, 2020 through November 30, 2021:

Stablecoin total market cap rose from $7.5 billion to more than $147 billion, an almost 20-fold increase;

DeFi’s total value locked jumped from roughly $842 million to $246 billion, a nearly 300-fold increase; and

Monthly NFT trading volume increased from effectively $0 to more than $2 billion.

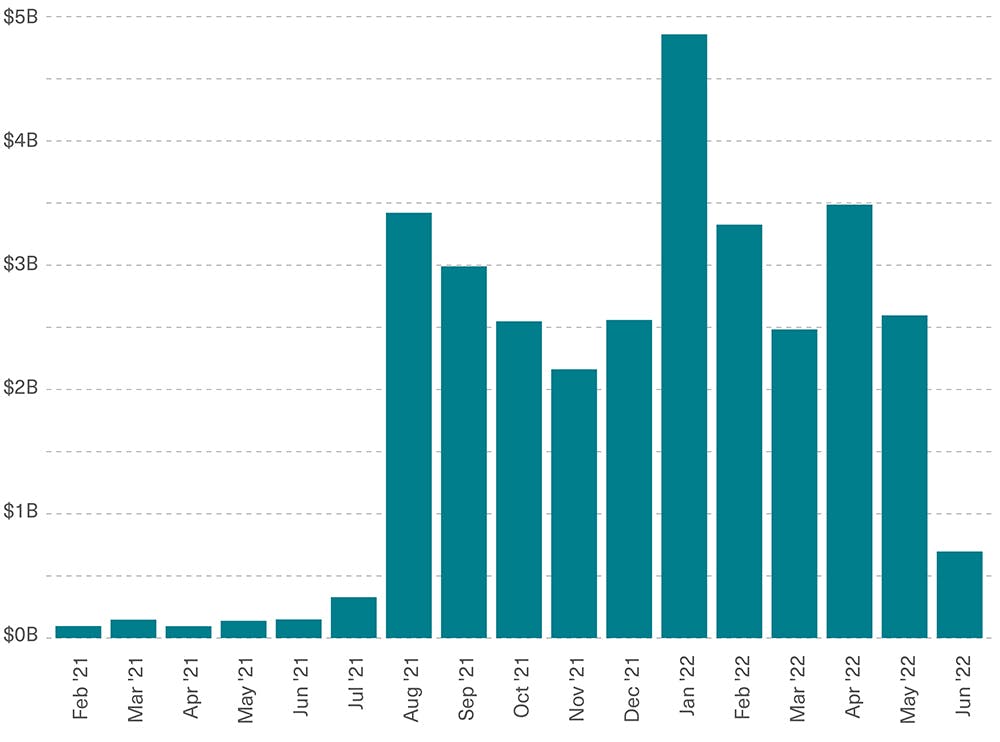

NFTs Stormed Into the Mainstream in August 2021

Monthly NFT Trading Volume on OpenSea* between February 2021 and June 2022 (USD billions)

Source: Bitwise Asset Management with data from Dune Analytics.

* Note: Data includes only Ethereum-based NFTs.

Unfortunately, just as quickly as these booms arose, they receded. In each case, we can point to a singular event that ended the bull run:

In 2014, the first application for approval to launch a spot bitcoin ETF in the U.S. was delayed indefinitely following negative feedback from the SEC. This dashed hopes that it would quickly become a mainstream asset, and prices collapsed.

In 2018, regulators cracked down and essentially ended the ICO market, sending crypto into a deep freeze.

In November 2021, the Federal Reserve switched from quantitative easing to quantitative tightening, sucking the wind out of the speculative fervor that had driven interest in NFTs and DeFi. Companies that had stretched their balance sheets too far found themselves in dire straits.

Critics will look at this list and ask, why bother? If the tide goes out as quickly as it comes in, investing is simply a game of chance, unmoored to actual value creation.

The answer, of course, is that historically each wave is bigger than the last.

Yes, crypto pulled back in 2014 … but bitcoin didn’t go away.

Yes, the ICO crackdown sent us into a crypto winter … but the ICOs acted as a proof of concept for the DeFi boom in 2020.

And yes, the risk-off environment has taken the starch out of the NFT and DeFi markets, but both are still significant. As are stablecoins. Moreover, the surrounding boom brought to the space billions in venture capital that should open the door to more building.

Where Do We Go From Here?

All of which brings us to today.

In the short term, crypto’s fate rests on the outlook for the macro environment and the ongoing crypto deleveraging process. But our simple mental model—that crypto’s cycle is driven by delivering products that people want to use—paints a much brighter picture. Looking out, not over two months but over two years, the preconditions for the next potential bull market are easy to spot.

You still have the core capabilities of crypto and blockchains: moving money and financial goods at the speed of the internet; allowing developers to program money like software; and creating digital property rights. On top of that, you have the $33 billion in venture capital that flowed into the crypto ecosystem in 2021; record numbers of developers operating in the crypto market; and an improving regulatory environment. In addition, the core technology behind the boom—blockchain itself—is improving quickly. Within the next few years, Ethereum’s throughput is expected to increase 1,000-fold or more. And already, alternative blockchains like Solana and scalability solutions like Polygon are lowering fees and improving bandwidth. This creates a playground for entrepreneurs to build the next big thing.

What could that be? It’s hard to say, but these are some areas I’m keeping an eye on:

Stablecoins: Among other uses, stablecoins provide access to dollars for challenged or emerging economies. With inflation running rampant in many areas of the world, one can imagine stablecoins swelling to $1 trillion or more in the coming years.

DAOs: Decentralized autonomous organizations (DAOs) never really went mainstream in 2020 or 2021, but they offer a revolutionary way to organize groups of people behind economic activities. DAOs today remind me of NFTs in 2017 … present, but waiting for their moment to shine.

Institutional DeFi: DeFi apps like Uniswap and Aave have proven themselves over the past few years, but mostly for retail customers. Regulatory advances could open that up to much larger institutional markets.

Regulated crypto: Things are heating up in Washington, with progress on stablecoin regulation and rising hopes for comprehensive crypto regulation, including the possibility of bringing crypto exchanges inside the purview of the SEC.

Web3: Web3 is an umbrella term that captures a movement to build a new version of the internet. This evolved internet would be built on blockchain and would allow users to own their own data (as opposed to companies owning user data, as they do today).

Crypto gaming: Crypto gaming has grown in fits and starts over the past few years. Could a breakthrough boom be around the corner?

NFTs (beyond art): NFTs burst onto the scene in 2020, mostly as ownership devices for digital pictures. But NFTs can be used for much more than art: They can be applied to music streaming rights, medical records, and more.

Payments: Improvements in the throughput of public blockchains could finally allow crypto to provide a meaningful payments platform for real-world assets.

If this looks like a laundry list, that’s because it is. There is so much bubbling beneath the surface of the crypto bear market that it’s hard not to be excited about what’s next.

Every major bull market in crypto’s history has been started by a breakthrough product. This one is likely to be the same.

Matt Hougan

Chief Investment Officer

Notes From the Research Desk

Our research team captures some of crypto’s biggest themes and highlights in a word (or so).

What does a recession mean for crypto?

Once the shockwaves of the current crypto credit crisis settle down, I suspect the next question on investors’ minds will be, how does crypto fare in a recessionary environment?

While the jury is still out on whether a recession will come to the U.S., over the last month market consensus seems to be slowly moving in this direction. Economists from Bloomberg and Goldman Sachs, for instance, recently put the chances of a recession over the next 12 months at 38% and 30%, respectively, up from essentially zero a few months ago.

If this scenario materializes, I think an interesting question will be whether economic downturns, which tend to directly affect many companies' revenues and earnings, will also affect crypto. In normal times, crypto tends to respond most to fundamental drivers other than earnings, such as technological development, regulatory developments, and broader public adoption.

David Lawant

Director of Research

DeFi lenders: from outlaws to outliers

Amid a sweeping credit crisis, blue-chip DeFi lenders have emerged as crypto’s dark horse. While centralized crypto lenders like Celsius faced insolvency in recent weeks, decentralized lending protocols like Aave, Compound, and Maker proved resilient. And as crypto hedge funds like Three Arrows Capital were collapsing and ghosting creditors, DeFi lenders were autonomously processing margin calls and liquidations as designed. In fact, June’s $160 million in DeFi liquidations was in line with the monthly average—all at a time when centralized finance competitors were imploding. And while it’s true that DeFi assets have suffered alongside other crypto assets, there’s a bigger story: The resilience of leading DeFi lenders in extreme markets has shown the strength of their risk management systems.

Ryan Rasmussen

Head of Research

Storm clouds for miners … and silver linings

It’s been a tough month for crypto miners. The combination of rising energy costs, falling crypto prices, and hefty liabilities incurred during the bull run have put new pressure on the companies responsible for validating blockchain transactions and securing crypto networks.

One recent example: Marathon Digital Holdings (MARA) saw more than 75% of its mining operations halted after a major storm took out a power station in Montana, highlighting the critical importance of risk management. (The company expects some of the 30,000 rigs to come back online in early July.) And in June, publicly traded miners sold more bitcoin than they produced, a contributing factor to bitcoin’s 57% year-to-date decline.

There are a few silver linings, however: 1) As of Q1 2022, the cost of mining bitcoin for public miners ranged from roughly $6,000 to $18,000, which means most miners are still profitable or near breakeven at today’s prices; and 2) Many miners accumulated significant cash and bitcoin reserves during the run-up, giving them the clout to not only weather a downturn but continue building.

Juan Leon, CFA

Senior Investment Strategist

Alyssa Choo

Crypto Research Analyst

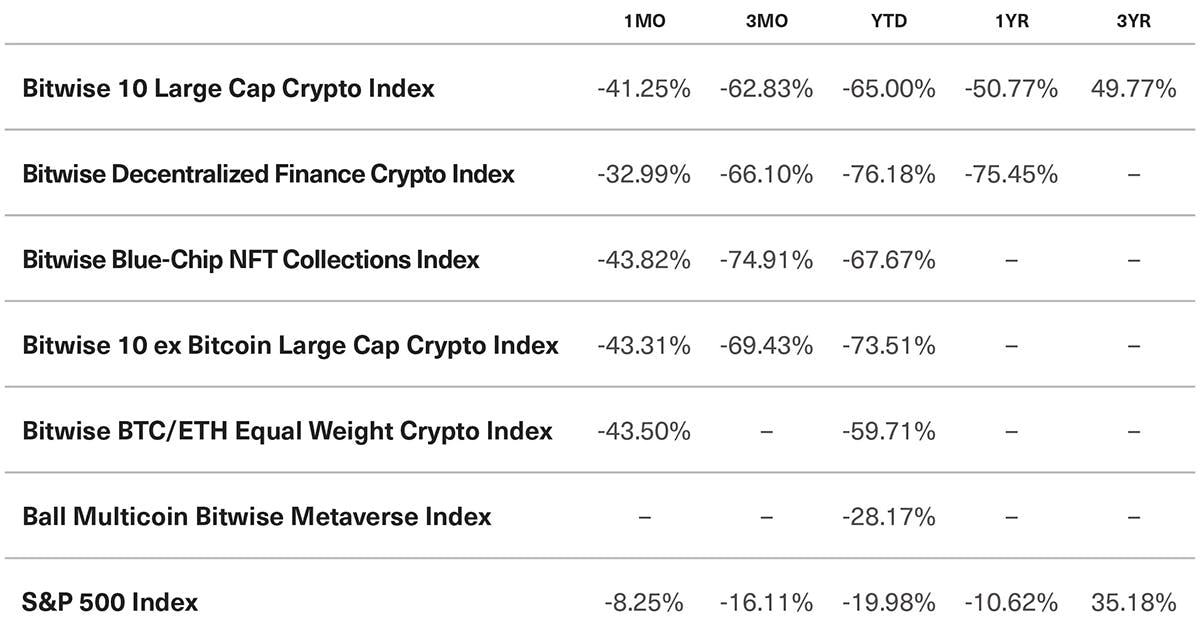

Benchmark Performance

As of June 30, 2022

* Indexes that incepted after January 1, 2022 display performance since inception in the YTD column. The Bitwise BTC/ETH Equal Weight Crypto Index incepted on April 18, 2022, and the Ball Multicoin Bitwise Metaverse Index incepted on June 6, 2022.

Source: Bitwise Asset Management with data from IEXCloud.

Notes: It is not possible to invest directly in an index. Past performance is no guarantee of future results. The Bitwise 10 Large Cap Crypto Index captures the 10 largest eligible crypto assets by free-float-adjusted market capitalization. The Bitwise Decentralized Finance Crypto Index is designed to provide investors with a clear, rules-based, and transparent way to track the value of the rapidly emerging Decentralized Finance space. The Bitwise Blue-Chip NFT Collections Index is designed to broadly capture the investable market opportunity for the most valuable arts and collectibles NFT collections. The Bitwise 10 ex Bitcoin Large Cap Crypto Index captures the assets in the Bitwise 10 Large Cap Crypto Index, excluding bitcoin. The Bitwise BTC/ETH Equal Weight Crypto Index captures the value of an equal-weighted index consisting of bitcoin and ethereum. The Ball Multicoin Bitwise Metaverse Index is designed to capture the investable market opportunity for crypto assets exposed to the emerging Metaverse. The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What's New at Bitwise?

Noteworthy happenings and key milestones.

The SEC Denied Our Spot Bitcoin ETF; We Responded

On June 29, the SEC rejected applications from Bitwise and Grayscale for spot bitcoin ETFs. It was a disappointing result, particularly considering the potential for ETFs to reduce costs, increase transparency, and raise investor protections.

READ MOREWhy Bitcoin Miners Deserve a Closer Look

What do bitcoin miners do? How are their businesses faring in the downturn? And why could some of them be well positioned to lead a bitcoin recovery? Our research team has answers.

READ MOREMore Quick-Hit Educational Videos

Our latest batch of 30-second videos on CNBC featured Bitwise CEO Hunter Horsley discussing a staggering statistic on crypto wallets, the reason there are 10,000 crypto assets, and why crypto indexes can be so powerful.

Select Media Appearances

CNBC’s Crypto World: Potential catalysts for a market rebound—and which altcoins show promise

Wealthtrack with Consuelo Mack: The compelling case for crypto (even now)

U.S. News & World Report: Katherine Dowling on the biggest problem in current regulatory discussions

Fortune: Is this the time to buy? Or are there more shoes to drop?

Upcoming Conferences

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email advisors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

DACFP Bitcoin Mining Virtual Conference | July 20

Titan RIA Retreat | July 20-21 in Newport, RI

Wolfgang Advisor Conference | July 21 in Wayne, NJ

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.