The Third Wave of DeFi: How the Challenges of 2021 Laid the Groundwork for DeFi's Next Potential Bull Run

San Francisco • Feb 2, 2022

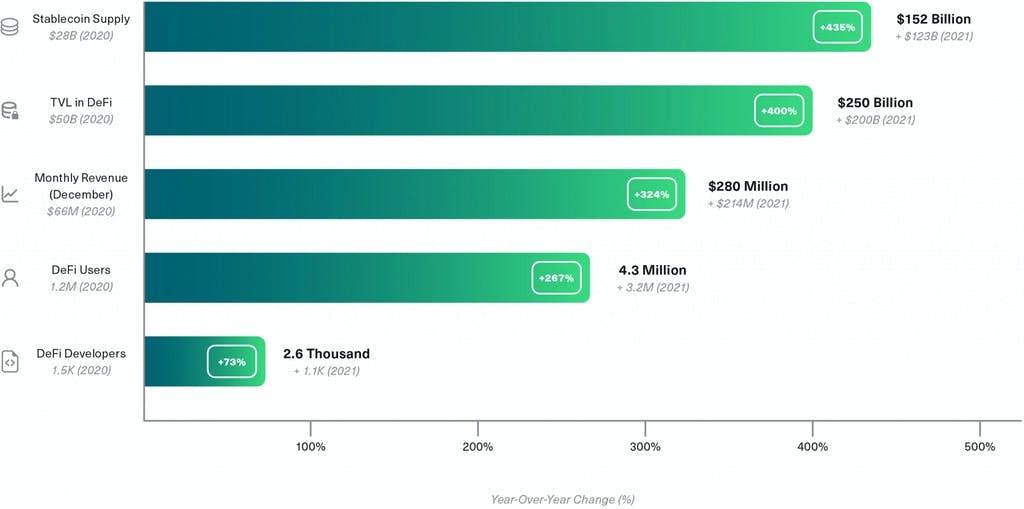

The last 12 months have been transformational for DeFi. The sector grew by triple-digit rates by almost every adoption metric. However, some notable headwinds ranging from regulatory concerns to infrastructural limitations transformed the initial excitement into a somewhat disappointing year for investors.

But skeptics beware. Like many disruptive technologies, DeFi has been propelled by new waves of adoption, which have been emerging every couple of years. And the challenges that have negatively impacted prices in the near term could be the catalysts that set in motion the next major wave for DeFi.

Let’s explore.

The first wave of DeFi introduced novel use cases for programmable money, like MakerDAO’s decentralized stablecoin DAI and Bancor’s Automated Market Maker (which has been working better than the traditional order book system for some trading applications). But in 2017 DeFi was brand new, and usage of these applications was relatively niche.

The second wave began with the “DeFi Summer” of 2020. Entrepreneurs and developers empowered by DeFi’s earlier developments explored new corners of what was possible in a decentralized and composable financial world. They introduced other financial primitives to DeFi like governance tokens, user incentives, and decentralized insurance and asset management applications.

These innovations brought increasing user stickiness and capital retention, from users and developers to capital deployed (TVL) and monthly revenue. Not to mention the stark improvement we’ve seen in the stability of protocols and stablecoins during times of extreme volatility.

DeFi’s Adoption Metrics Soared in 2021, Despite Disappointing Price Performance

Evolution of select industry adoption metrics in 2021 over 2020

Yet regulatory and scaling limitations arose in 2021 and prevented DeFi from achieving the escape velocity that market participants and investors had hoped for. Instead, interest shifted towards newer market segments, like NFTs and high-throughput blockchains, both of which delivered outstanding returns.

However, there’s a new transition currently taking place.

As a testament to the adage that the seeds of the next market cycle are sown in the challenges of the last, we are now seeing the first inklings of the third adoption wave. Developers and entrepreneurs have already been working feverishly on overcoming the obstacles mentioned above.

In our view, the following three trends are leading the way to bring about the third adoption wave in DeFi:

#1: Congestion and Extremely High Gas Fees

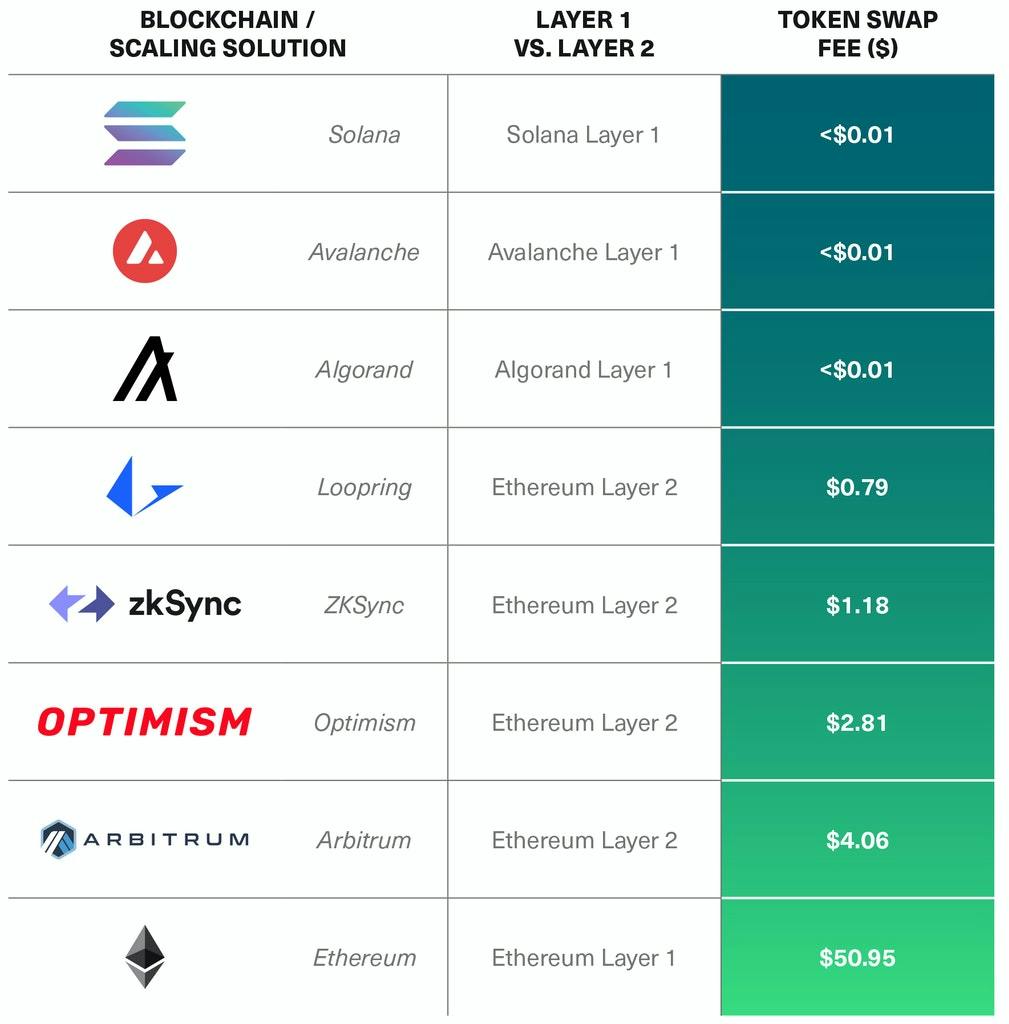

DeFi fell victim to its success in 2021: The explosive adoption the industry experienced led to massive network congestion and exorbitant transaction fees. Today, for instance, it costs more than $50 to execute a trade on the Ethereum network, making DeFi activities impractical for many users. A core promise of DeFi is to make financial transactions cheaper and more efficient, and high gas fees render that concept ironically moot.

Unlike inflation, however, this pain is likely to be transitory; one of the biggest stories in DeFi last year was the market responding to this challenge with massive innovation. Specifically, the rollout of Ethereum scaling solutions such as Arbitrum and Optimism—and the growth of high-throughput blockchains like Avalanche and Solana—have created new and cheaper rails for DeFi to operate on.

Ethereum Scaling Solutions Offer Fast and Low-Cost Alternatives

The token swap fee is the transaction cost associated with a token exchange.

Users and capital are already migrating to these solutions, which provide higher-speed transactions at a fraction of the historical costs. Previously priced-out users who want to trade a hundred dollars’ worth of crypto on Uniswap can now do so without paying the equivalent in fees. More importantly, developers who have ideas that are economically interesting with $1 transaction fees—but not $50 transaction fees—can now push those forward.

This cadence—development, congestion, further development, and so on—is a well-documented pattern in crypto called the application-infrastructure cycle. In this cycle, a surge in the usage of crypto applications leads to an infrastructure phase focused on building new platforms and products. This, in turn, leads to a rise in usage and broader consumer adoption, which funds the next wave of development, and so on.

With these scaling solutions now up and running at full speed, DeFi is getting closer to achieving its goal of bringing a more accessible and efficient financial system to a much broader public. This is critical in bringing the next 100 million users into DeFi and creating space for new financial innovations.

#2: Regulation and Permissioned DeFi

DeFi represents a fundamental challenge to many of the core building blocks of the existing financial regulatory structure. As a result, leading regulatory agencies have sometimes taken an opposing view towards DeFi protocols.

The regulatory pressure dialed up significantly in 2021 when the SEC threatened regulatory action against DeFi protocols that “operate outside of the perimeter” and made clear that DeFi protocols are “not immune to regulation.” There was also talk of aggressive regulation of stablecoins, protocols that facilitate the trading of synthetic derivatives, and more. These weighed on the market and impacted prices—financial advisors cited “regulatory uncertainty” as the #1 factor preventing them from allocating to crypto in client accounts.

One response to this trend is the rise of so-called “permissioned” DeFi, a layer built on top of existing DeFi applications designed to meet standard regulatory burdens by only allowing a subset of whitelisted users to participate. In June, Compound launched a compliance-friendly version of their protocol for businesses and financial institutions, called Compound Treasury. Meanwhile, Aave launched a similar product called Aave Arc, which went live recently with 30 financial institutions whitelisted by the crypto custodian Fireblocks.

Permissioned DeFi is poised to take off in 2022, much earlier than it would have without regulatory pressure. If it continues to gain traction, it can bring institutional-scale capital into the DeFi market in a meaningful way.

#3: The DeFi-ification of Everything

The last big story from 2021 that will impact DeFi’s trajectory in 2022 was the massive expansion of crypto’s surface area into the realm of NFTs, gaming, DAOs, the Metaverse, and other verticals.

For nearly all of these, DeFi acts as the financial backbone in one way or another.

For example, crypto gaming relies on DeFi to facilitate in-game activities like trading. At the same time, play-to-earn crypto games like DeFi Kingdoms combine gamification concepts with things like liquidity providing and yield farming, creating a funnel of assets into the DeFi ecosystem.

Similarly, services like NFTfi’s marketplace for NFT-collateralized loans enable borrowing against idiosyncratic assets, while DAOs turn to DeFi protocols for liquidity providing and lending to make markets for their governance tokens and generate yield on the assets held by their treasuries.

The growth and stickiness of new crypto verticals have a powerful amplifying effect on the expansion of DeFi. As the surface area of DeFi gets larger, the revenue generated by DeFi applications increases, and their ability to invest in future growth accelerates.

This third wave of adoption is likely to be the biggest one yet. After all, it’s still early days in DeFi. The 4.3 million DeFi users are the same number of users that the internet logged in 1991, and the $150 billion DeFi market cap is less than 1% of the $24 trillion legacy finance market.

This is not to say that DeFi does not have risks, of course. Regulatory clarity could get worse before improving, the possibility of technical or economic exploits will likely continue to loom large over many protocols, and new challenges are likely to arise.

But while it is impossible to know whether DeFi prices have already bottomed, especially in the uncertain current macroeconomic environment, the seeds of DeFi’s future success are now being sown. The hurdles from 2021 now look more like stepping stones than roadblocks.

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.