December 2022 Bitwise Investor Letter

San Francisco • Dec 6, 2022

In This Issue: The Most Common Questions in Crypto Right Now

Market Overview

Dear Investors,

Bear markets can be isolating. As prices fall and headlines swirl, it’s natural to worry that you are missing out on something. What are other investors thinking?

One of the great parts about my job is that I get to speak with hundreds of investors at conferences, on webinars, and in one-on-one meetings. For this month’s Investor Letter, I want to share the most common questions I’m hearing from investors about crypto today, as well as my answers.

I hope you find it helpful.

Question 1: What happened at FTX?

A classic fraud.

FTX was an offshore, largely unregulated crypto derivatives exchange that primarily served international customers. Customers deposited money at FTX and used the platform to trade. Instead of safeguarding client assets, as it was supposed to, FTX “lent” them to a hedge fund founded by FTX’s CEO, Sam Bankman-Fried. That hedge fund made highly speculative trades using significant leverage and, according to reports, lost all the money.

FTX is now bankrupt, and customers are left with essentially nothing.

Question 2: Why should I trust in crypto after FTX?

It’s important to think about what worked and what failed in the recent crisis.

One thing clearly didn’t work: trusting unregulated offshore entities with your money. In retrospect, turning your money over to a crypto derivatives exchange that set up shop in the Bahamas specifically to avoid U.S. regulation was a bad idea. Hindsight, of course, is 20-20.

But two things worked exceptionally well over the past year.

First, regulated institutions performed soundly. To date, no regulated U.S. custodian has lost customer assets, and U.S.-domiciled crypto-trading venues like Coinbase and Kraken have operated as designed.

Second—and more importantly—actual crypto applications like DeFi apps have proven their mettle. While FTX was freezing customer funds, DeFi exchange Uniswap saw increased trading volume. In fact, at the peak of the crisis, it briefly eclipsed Coinbase, processing $3.5 billion in trades in a single day. Meanwhile, lending platforms like Aave managed loans with no losses and no withdrawal halts for customers—a remarkable result considering the crisis, and one that compares favorably to any traditional bank and prime brokerage in the world.

Before November, it was fair to ask how DeFi would manage a high-volatility stress test. It turns out the answer is “perfectly.”

Question 3: Are you saying there is no fallout from FTX?

Not at all. There is significant fallout, both short- and long-term.

In the short term, FTX’s collapse is unquestionably bad for crypto. It led to the forced selling of many crypto assets by investors facing margin calls. It drove firms like BlockFi into bankruptcy and disrupted operations at crypto lenders and prime brokerages like Genesis. Bitcoin’s price fell from roughly $20,000 to $15,700. More importantly, it raised fear, uncertainty, and doubt in the minds of many investors. This, naturally, will cause them to sit on the sidelines. I suspect it will take 6-12 months for the air to fully clear.

In the long term, however, FTX’s impact looks different. The most obvious long-term impact is the speed with which new regulations will be introduced into the crypto market. Regulators and legislators will not sit idly by given the high-profile nature of the collapse.

But while some are worried about this—regulation made in haste is not always well crafted—we strongly believe that greater regulatory clarity will be significantly positive for crypto.

Ironically, FTX’s collapse may accelerate the development of the next bull market in crypto.

Question 4: Wait a second. FTX’s fall could be a good thing?

In a narrow but very important way, yes.

For the past decade, crypto has been on a journey from a largely unregulated past to a robustly regulated future. We are currently in the middle of that journey.

The recent crisis reinforced the benefits of sound regulation. Regulated U.S. custodians like Fidelity and Coinbase Institutional kept client assets safe, while unregulated offshore entities like FTX collapsed.

One challenge the industry faces, however, is that current regulations only stretch so far. Reach beyond the most basic services and you enter a regulatory gray zone, which stifles innovation and/or pushes investors into riskier options.

For this industry to reach its full potential, we need stronger regulations. Specifically, we need stronger regulations around stablecoins, so investors can have full confidence in their solidity. We need greater regulation of spot crypto-trading venues so investors know assets on those platforms are safe. We need greater rules around disclosures so investors can make better decisions with a full understanding of risk. And we need better regulation around investment products so investors can access crypto in familiar formats like ETFs, rather than being forced into more complex and often more expensive vehicles.

A lack of regulatory clarity in these spaces keeps institutional investors on the sidelines, as they can’t fully underwrite crypto’s risks. It stifles innovation, since talented engineers don’t know the parameters of what they can or cannot build. And critically, it confines the potential benefits of crypto’s disruptive technology to a niche market. We can’t, for instance, expect to see the creation of decentralized stock exchanges that can settle stock transactions instantly without the strong regulatory framework that would allow them to exist.

At Bitwise, we believe the next crypto bull market will be the biggest yet—and that it will be sparked by the moment crypto goes mainstream and starts impacting the day-to-day lives of millions. But that can only happen when clear regulatory guidelines are in place. By accelerating the progress of that regulation, FTX’s collapse may end up strengthening crypto’s foundations.

Question 5: Did Bitwise trade or custody assets on FTX?

No. Here’s why.

Bitwise uses institutional trading desks to keep assets safe during trading and to minimize exposure to exchanges. Using crypto exchanges to trade introduces risk, as doing so creates exposure to the exchange’s inherent risks.

Bitwise instead uses well-established over-the-counter trading desks where assets do not need to leave custody until settlement occurs, allowing trades to settle directly with third-party custodians. We have used these procedures for multiple years without incident and are proud of our approach to keeping client assets safe.

When trading on exchanges is necessary, Bitwise only works with U.S.-domiciled entities (like Coinbase) and limits the total exposure.

Question 6: What important news has flown under the radar during the FTX mess?

A lot, actually.

At Bitwise, we are particularly interested in areas where the price action in crypto doesn’t match the fundamentals. One area where that appears to be true is Ethereum. There are two significant developments that deserve our attention.

First is supply. A little over two months ago, the Ethereum blockchain went through its “Merge.” The upgrade shifted the blockchain from proof-of-work to proof-of-stake. Among other impacts, it dramatically reduced the inflation rate of the Ethereum network. In fact, at the time of this writing, the total amount of ETH in the world is roughly the same as it was at the time of the Merge, 77 days earlier. Under the old proof-of-work system, there would have been an additional 900,000+ ETH created, worth well north of $1 billion. This dramatic reduction is supportive for prices, and the value will compound over time.

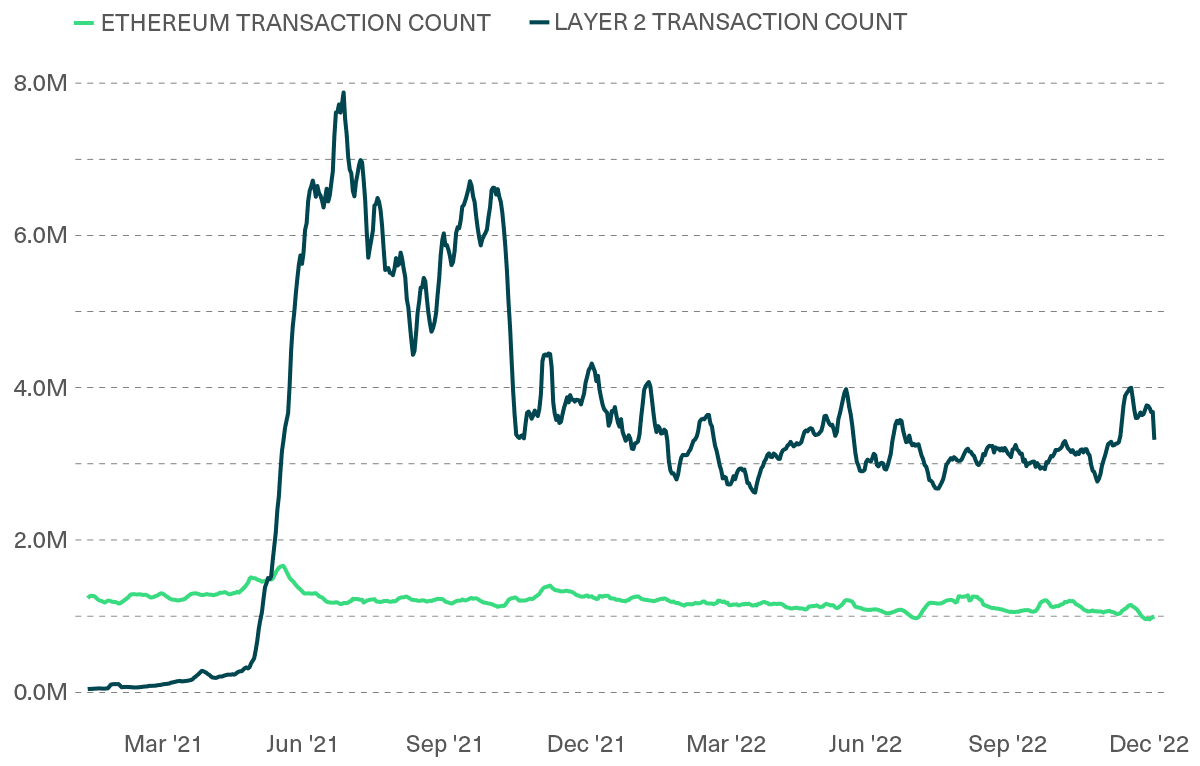

The second development is the growth of Layer 2 networks like Polygon. Layer 2s allow Ethereum users to process transactions more quickly and at a lower cost than using the main blockchain. Nearly everyone in the Ethereum ecosystem believes they will be critical to Ethereum’s long-term growth.

Layer 2s have seen significant adoption by many users in the past few months. As one example, JPMorgan recently used Polygon to settle a currency trade on the blockchain. The table below shows the growth in the Layer 2 ecosystem.

Daily Transaction Counts for Ethereum and Layer 2 Protocols (Seven-Day Moving Average)

Source: Bitwise Asset Management with data from The Block and Blockscan from January 8, 2021 to December 1, 2022

Note: Layer 2 Protocols include Polygon, Optimism, and Arbitrum

This growth is really exciting, as it is required if crypto is to reach mainstream-level adoption in the future.

Question 7: What are you most excited about in crypto right now?

One of the things that I’ve been thinking about a lot recently is how small the entirety of crypto is. According to CoinMarketCap.com, all crypto assets have a combined market valuation of just under $900 billion. That’s about half the size of Microsoft, or a little more than twice that of LVMH, the luxury goods brand that makes fancy purses and champagne.

Yet crypto arguably occupies a much larger mindshare than either. Why? Because people recognize how disruptive and significant it could be.

It’s a top item on the regulatory agenda in Washington because it has the potential to rewrite how finance works. It’s on the front page of The New York Times because it could change everything from social networks to collectibles to the foundations of the internet. It’s a lead item on the research agenda for institutional investors, financial advisors, and venture capital investors because they know that, if it is successful, it could be a life-changing investment.

With that framing, what I’m most excited about right now is the potential to learn, in the very near future, just how much crypto can deliver.

Thanks to improvements in blockchain technology, like Layer 2 networks, crypto can now (or will soon be able to) support the level of activity required to sustain mainstream applications. Thanks to the influx of venture capital money over the past two years, crypto now has a large enough cohort of developers to build not just one or two, but many breakthrough applications. And thanks to the increased regulatory clarity that we are likely to get in the coming months, crypto could soon sit atop a policy platform solid enough to allow it to truly scale.

...

I hope these questions and answers are helpful as you navigate this challenging, but promising, period in crypto’s journey.

Matt Hougan

Chief Investment Officer

Events

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email investors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

Conferences

GTE Wealth Forum | December 4-7 | Charleston, SC

Bitwise Financial Forum | December 8 | San Francisco, CA

Barron’s Advisor 100 Summit | January 18-20 | Salt Lake City, UT

Titan Coral Gables Retreat | January 31-February 1 | Coral Gables, FL

Notes From the Research Desk

Is the Sun Setting on Solana? The FTX Storm Hasn’t Cleared Up Enough To Tell

Alameda Research and FTX had deep ties with Solana (SOL). At one point, they collectively held ~11% of Solana’s total supply. Concerns around their entanglement—and potential forced sales of the asset—contributed to the ~55% SOL price drawback in November. So now the market is asking: Can it recover?

The answer comes down to whether developers and users find Solana’s unique characteristics appealing. In the week following FTX’s bankruptcy, Solana was one of the top four Layer 1 blockchains for developers to build on—despite the sharp price drop. Usership is also relatively healthy: Solana remains home to the second-largest NFT ecosystem and ranks in the top 10 for DeFi (even after ~70% of the capital deployed across Solana’s DeFi applications was wiped out). Top rankings are positive, but ultimately, rebounding growth rates will make the difference between a sunrise and sunset for Solana.

Silvergate, the Leading Bank to Crypto Firms, Battles FTX Contagion

Silvergate Capital (NYSE: SI) has been under intense focus from the market since FTX’s bankruptcy filings disclosed the failed exchange was a Silvergate client. The firm has issued multiple statements in attempts to pacify investor woes, noting that FTX counted for less than 10% of its deposits and that it had no lending relationship with the entity. The firm noted that it has no losses on bitcoin-backed loans, which are overcollateralized by 2.5x as of Q3 results, and that it has little existing credit exposure to BlockFi or Genesis.

Despite these reassurances, Silvergate’s stock price was cut in half in November and is down around 80% YTD, while short bets against Silvergate have doubled this year. Some customers have pulled deposits, leading to worries about liquidity. However, the bank says that it is structured to protect itself from sizable outflows, as almost all of its assets are held in highly liquid securities that can be efficiently sold or borrowed against.

Note: Bitwise may have underlying investments with significant exposure to Silvergate Capital, which may influence the current performance outlook of this holding.

Alyssa Choo

Crypto Research Analyst

DeFi Stands Strong While CeFi Goes Belly-Up … Again

The implosion of FTX and the ongoing contagion that has spread to other centralized crypto companies, like BlockFi, is the second time in 2022 when the failure of centralized financial entities has proven the power of decentralized finance. A year ago, BlockFi, Celsius, and others were well-known and respected brands; today they’re bankrupt with unhappy customers and investors left holding the bag. And yet, DeFi protocols like Aave and Uniswap are going strong.

DeFi’s unique strength was on display when Celsius and Alameda fully repaid their loans on DeFi applications like Aave, even as they were freezing their own customers’ withdrawals and facing insolvency. How is that possible? Because software programs, not humans, operate DeFi applications. So when these CeFi entities broke their collateralization levels, the DeFi applications didn’t care if it was Sam Bankman-Fried—“the J.P. Morgan of our generation”—or Joe Schmoe defaulting on a loan; either way, the crypto applications reclaimed collateral … and protected their depositors.

Many have wondered how DeFi would perform under stress. We’ve now had that test (multiple times), and DeFi has come through shining, with no significant losses of customer funds. Imagine that!

Ryan Rasmussen

Head of Research

Benchmark Performance

As of November 30, 2022

Source: Bitwise Asset Management with data from Bloomberg. Performance of greater than one year is annualized.

Notes: It is not possible to invest directly in an index. Past performance is no guarantee of future results. The Bitwise 10 Large Cap Crypto Index captures the 10 largest eligible crypto assets by free-float-adjusted market capitalization. The Bitwise Decentralized Finance Crypto Index is designed to provide investors with a clear, rules-based, and transparent way to track the value of the rapidly emerging Decentralized Finance space. The Bitwise Blue-Chip NFT Collections Index is designed to broadly capture the investable market opportunity for the most valuable arts and collectibles NFT collections. The Bitwise 10 ex Bitcoin Large Cap Crypto Index captures the assets in the Bitwise 10 Large Cap Crypto Index, excluding bitcoin. The Bitwise BTC/ETH Equal Weight Crypto Index captures the value of an equal-weighted index consisting of bitcoin and ethereum. The Ball Multicoin Bitwise Metaverse Index is designed to capture the investable market opportunity for crypto assets exposed to the emerging Metaverse. The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What’s New at Bitwise

Six Fundamental Metrics To Evaluate DeFi Metrics

A widespread criticism of bitcoin is that it has no measurable fundamentals like cash flow or revenue. But this argument doesn’t extend to all of crypto. In this column, Crypto Research Analyst Ryan Rasmussen and Quantitative Crypto Research Analyst Gayatri Choudhury review six of the most important fundamental metrics that Bitwise uses to evaluate crypto assets in DeFi.

Five Fundamental Metrics To Evaluate Ethereum

As a follow-up to our DeFi metrics column, Bitwise research analysts Anais Rachel, Gayatri Choudhury, and Mallika Kolar turn our attention to the world’s second-largest blockchain and outline five fundamental metrics that Bitwise uses to evaluate Ethereum. These metrics serve as a starting point for investors who are looking to understand the health, growth, and possibilities of the Ethereum ecosystem.

Tax-Loss Harvesting in Crypto: A Big, Underexplored Opportunity

For investors looking at a loss on their crypto investments, tax-loss harvesting can be a silver-lining strategy. In our research team’s latest white paper, we explain how crypto’s distinct return and volatility profiles present a compelling reason for financial advisors to consider tax-loss harvesting.

Select Media Appearances

Bloomberg: Why Bitwise avoided the storm of FTX (Matt Hougan) [paywall]

TechCrunch: Lawyers see crypto regulation coming (Katherine Dowling) [paywall]

TD Ameritrade Network: How to access alpha in crypto (Jeff Park)

FinTech Growth Talk: FTX’s unethical business practices (Ryan Rasmussen)

Barron’s: Crypto’s survival depends on Washington (Matt Hougan) [paywall]

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.