Five Fundamental Metrics To Evaluate Ethereum

San Francisco • Nov 30, 2022

Every asset class has go-to fundamentals that investors use to evaluate its health, and crypto is no exception.

Earlier this month, our colleagues Ryan Rasmussen and Gayatri Choudhury analyzed the Six Fundamental Metrics To Evaluate DeFi Assets. Today, we turn our attention to Ethereum, the world’s second-largest blockchain by market cap.

Below are the five fundamental metrics Bitwise uses to evaluate Ethereum on an ongoing basis. These serve as a starting point for investors seeking to understand Ethereum’s user and developer activity, the growth of its application ecosystem, and other key factors.

1. Revenue

Ethereum is the leading platform for decentralized applications. Many of the most popular crypto applications—including most Decentralized Finance (DeFi) projects, non-fungible tokens (NFTs), and stablecoins—are built on Ethereum.

Users pay a fee to settle transactions on the Ethereum network. This fee can vary with overall network demand, because the blockchain can only process a certain number of transactions at a time. When the demand to settle transactions rises—perhaps because an application built on Ethereum is experiencing strong user growth—transaction fees rise, and so does revenue.

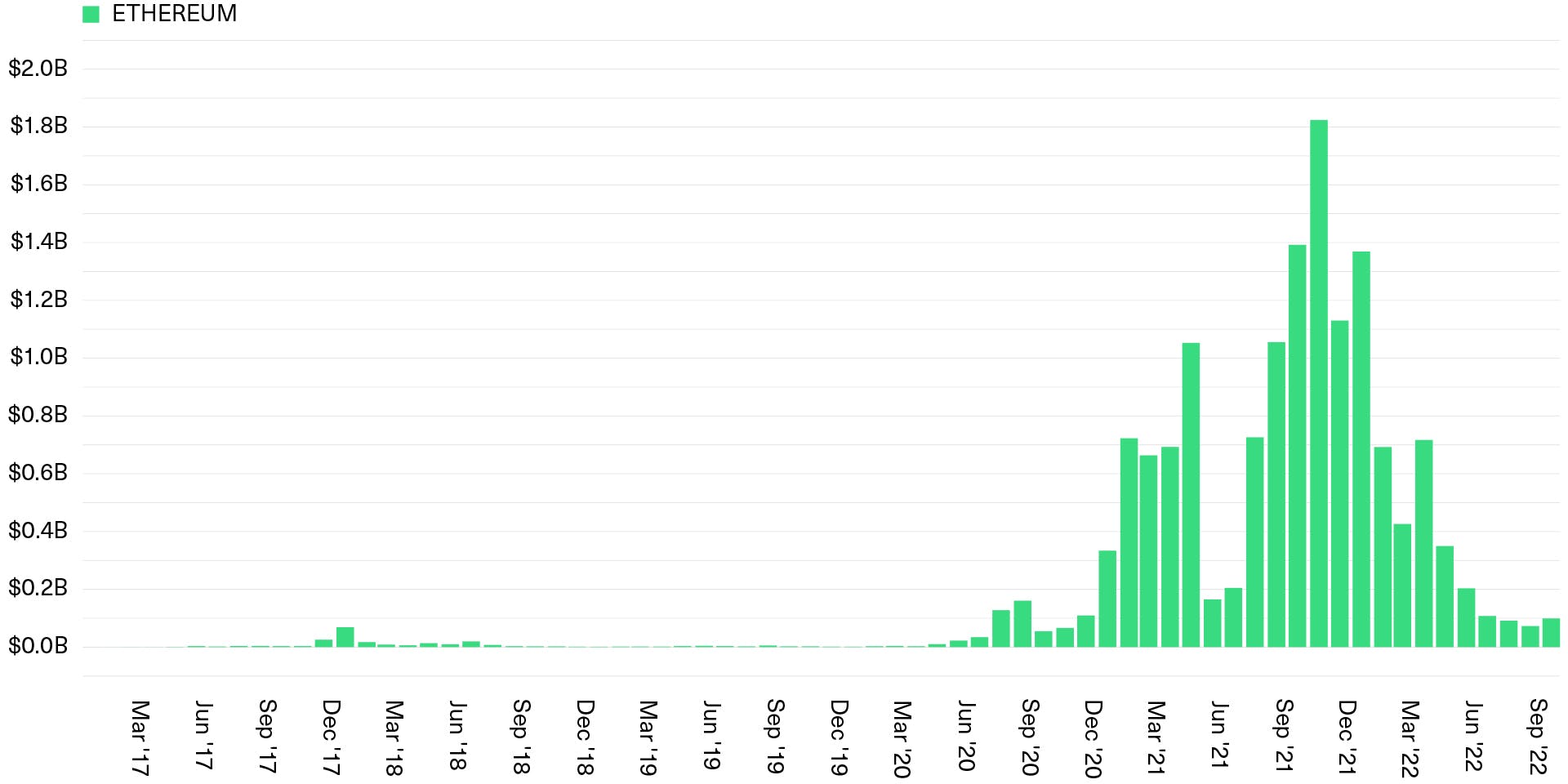

As the figure below shows, the revenue generated by Ethereum has charted a volatile course over the past few years. From near zero in 2019, monthly revenue peaked at ~$1.8 billion in November 2021, as DeFi, NFTs, and stablecoins experienced exponential growth.

Ethereum Has Generated Almost $15 Billion in Cumulative Revenue

Ethereum monthly revenue (USD billions) from January 2017 to October 2022

Revenue has declined sharply during the current bear market, dropping to $99.2 million in October 2022. That statistic can be viewed as a glass half-empty or half-full: It’s a 94% decline from the November 2021 peak, but also a 1,761% increase from the levels seen at the bottom of the 2018 crypto winter (in December of that year).

The long-term outlook for revenue depends on many things, but chief among them is whether we see the launch of new applications built on Ethereum that excite users.

2. Profit

Revenues are one thing, skeptics say, but what about profits?

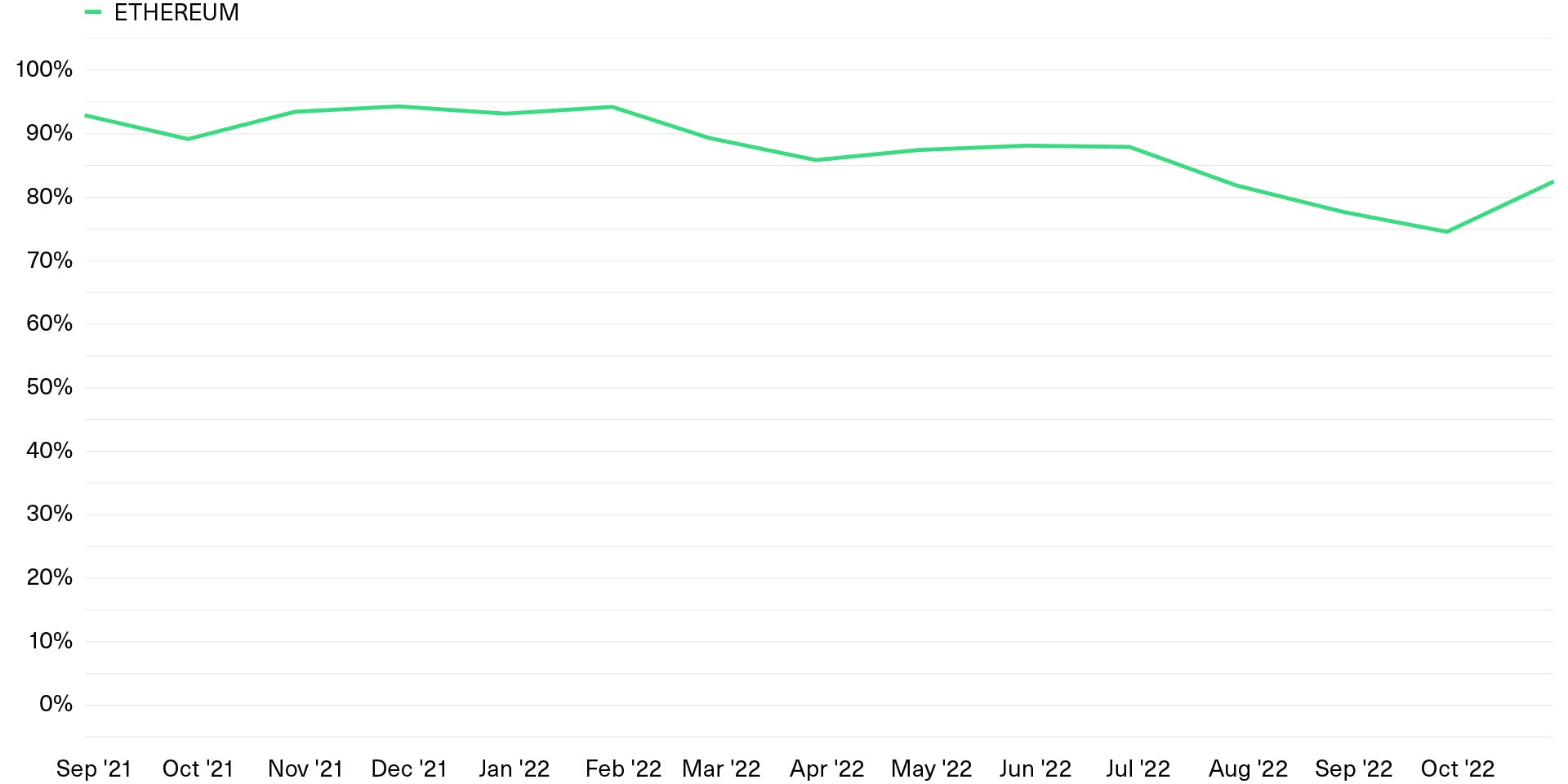

Well, Ethereum has those too. In, fact, Ethereum has a very high profit margin: Historically, 80-95% of Ethereum’s revenues have consisted of “profits” that directly benefit ETH investors.

Here’s how it works.

The fees users pay to process transactions on the Ethereum network consist of two parts: the “base fee” and the “priority fee.” The base fee is a required fee for every transaction, whereas the priority fee is an optional fee that some users pay to ensure that their transactions are processed first by the network. The base fee is adjusted periodically by code based on the level of demand to use the Ethereum network.

Base fees constitute Ethereum’s version of “profit” because all base fees are “burned” by the network, or permanently removed from circulation. This burning function acts much like a stock buy-back, lowering the total amount of ETH that exists and thereby increasing the value of the ETH that remains.¹

By contrast, priority fees are paid to Ethereum validators, which are the entities tasked with processing transactions and securing the network. These fees do not benefit ETH holders.

It is worth noting that the process of burning the Ethereum base fee was only implemented on August 5, 2021. Prior to that, all fees went to those who maintained the network, and Ethereum therefore had no “profit.” But Ethereum should be able to maintain its high profit margin going forward.

A Strong Majority of Ethereum’s Revenue Constitutes Profits for ETH Holders

Base fee as a percentage of monthly revenue generated by the Ethereum network from August 5, 2021 to October 31, 2022

Note: Data for August 2021 begins on the 5th, the day the burn mechanism was implemented.

3. Users

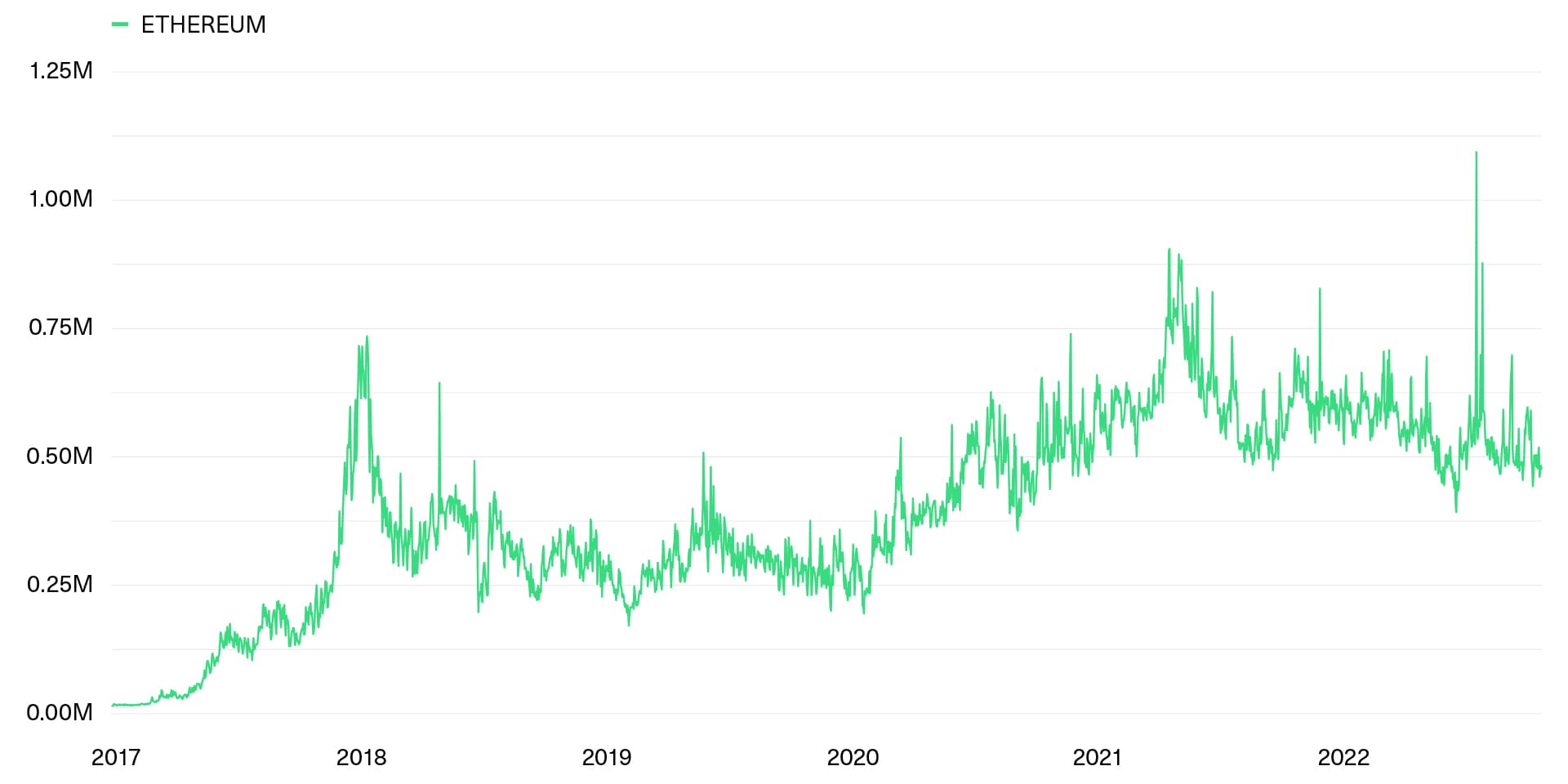

To interact with a blockchain, a user must have a cryptographic wallet which comes with an associated address. As soon as the wallet participates in a successful transaction, either as a sender or recipient, the address is deemed “active.” The number of unique addresses that are active on a given blockchain is therefore a critical metric to gauge the level of adoption.

Despite the ups and downs in crypto over the last two years, the number of active addresses on Ethereum has consistently remained above 500,000 per day, and reached an all-time high of over 1.1 million in July 2022.²

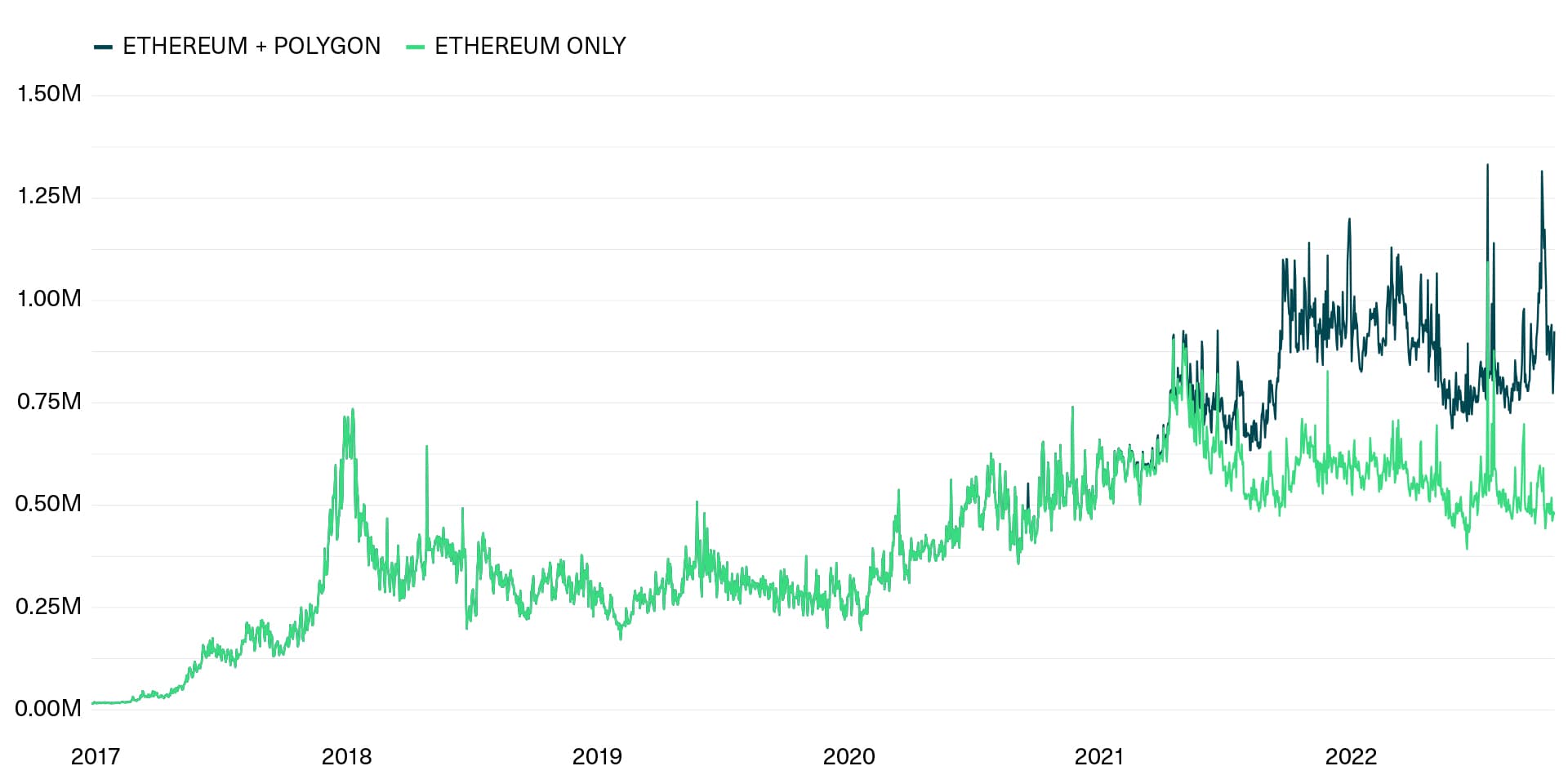

Ethereum Has Gained Significant Traction in Daily Users Despite Fluctuations in Market Conditions

Daily active addresses on the Ethereum network (millions)

Source: Bitwise Asset Management with data from Coin Metrics from 1/1/17 to 10/31/2022

Still, this chart provides just a part of the picture, since users who want to interact with Ethereum also have the choice of using “Layer 2s”: transaction–processing rails that are built on top of, and periodically settle transactions on, the Ethereum network.

Layer 2s provide value to the network by making transactions on Ethereum faster and cheaper, while benefiting from its robust security.

Take Polygon, Ethereum’s most recognized scaling solution. Since October 2021, the number of users interacting with this Layer 2 network has increased by almost 2x, and by 600x since October 2020—that’s a big deal.

The chart below aggregates Polygon’s daily active users with Ethereum’s to provide a more complete view of the traction the Ethereum ecosystem has gained.

Polygon Has Contributed Significantly to the Ethereum Ecosystem’s Traction Over the Past Year

Daily active addresses on the Ethereum and Polygon networks (millions)

Source: Bitwise Asset Management with data from Coin Metrics and PolygonScan from 1/1/17 to 10/31/2022

Note that this analysis provides a lower bound of total users considering that several other Layer 2 solutions exist as well.

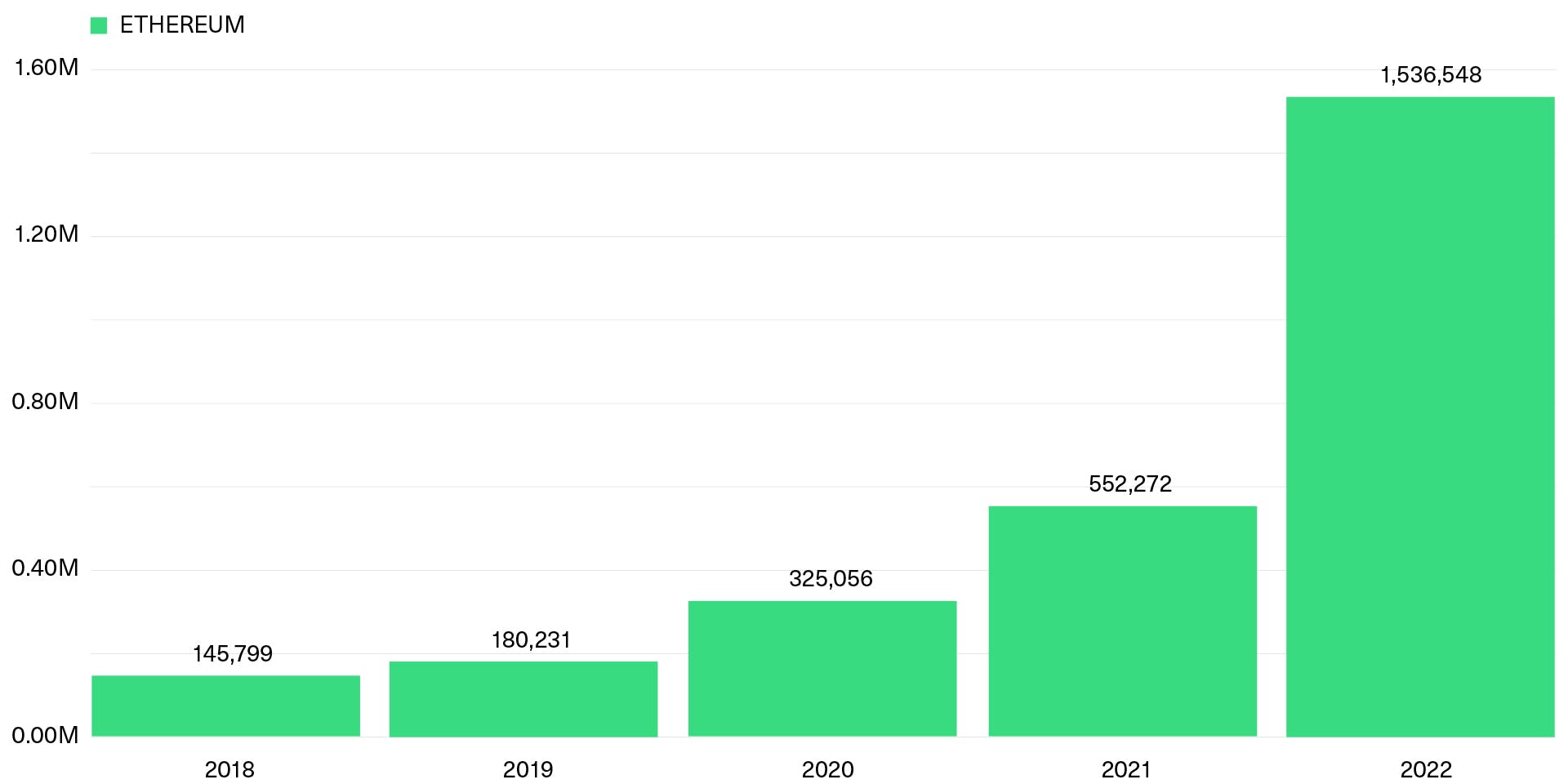

4. Application Developer Activity

The most important determinant of Ethereum’s future is how many “must-use” applications are built on it. While some must-use apps already exist and have gained significant traction—Uniswap, Aave, many stablecoins, etc.—bulls bet that more breakthrough apps will emerge in the future.

Fortunately, we can access data that gives us a hint about future application development: “Weekly SDK Installs'' tracks the number of downloads of two open source javascript libraries—ether.js and web3.js—that help developers interact with the Ethereum nodes. Downloading these libraries is a common step in the development of new applications, and therefore this measure can be viewed as one precursor of new app development.

Fortunately, this metric is one of the most bullish in the Ethereum ecosystem: As of Q3 2022, the number of weekly SDK installs has increased by over 175% compared to 2021, and over 950% since 2018. In other words, the bear market has not slowed new developer interest.

Weekly SDK Downloads Have Increased, Despite the Bear Market

Weekly downloads of ether.js and web3.js javascript libraries (millions)

Source: Bitwise Asset Management with data from the Q3 2022 Alchemy Web3 Developer Report

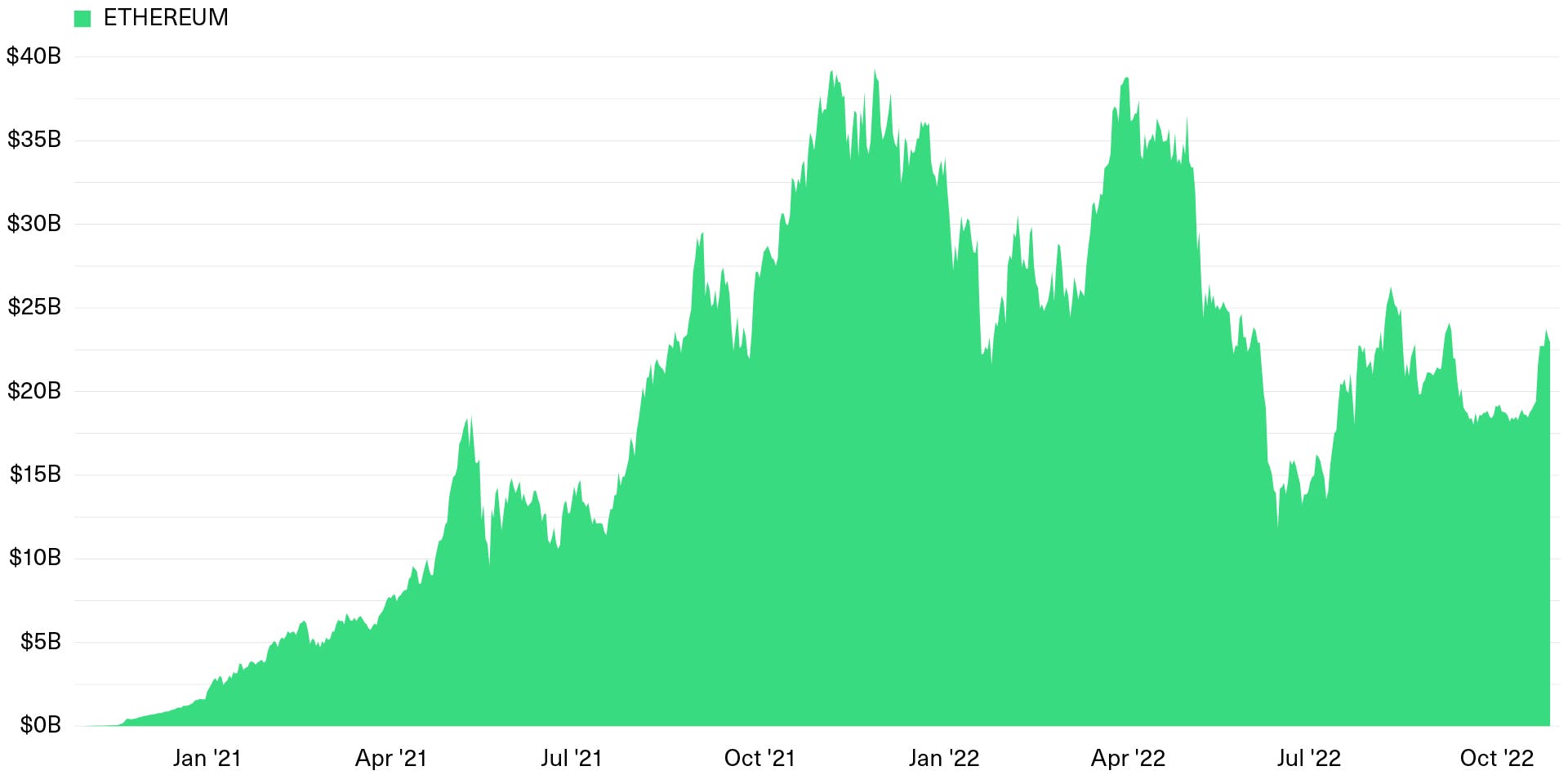

5. Network Security

A significant number of blockchains, including Ethereum, use proof-of-stake consensus mechanisms, meaning they rely on financial commitments in the form of the blockchain’s native asset in order to secure the network. The more of the asset that is “staked,” the more secure the network.

As of October 31, 2022, Ethereum has over USD $23 billion in staked ETH that is securing the network. This means that a malicious entity would have to hold over $11 billion in staked ETH in order to orchestrate a “51% attack” on the network—a high barrier. Moreover, if other network validators detect any malicious behavior, the attacker’s staked capital would get “slashed,” or removed from circulation. In this way, the total dollar value of staked ETH directly translates into network security.

It should be noted that this figure may overstate the market’s actual commitment to staking: Staked ETH is currently locked and cannot be unstaked, meaning some of the network’s staked assets are effectively frozen. The Ethereum blockchain will turn on the capability to unstake and withdraw staked ETH in the future. It will be important to monitor the amount staked once withdrawals are allowed.

There Is Currently More Crypto Staked on Ethereum Than on Any Other Blockchain

Cumulative ETH staked (USD billions) from December 2020 to October 2022

Source: Bitwise Asset Management with data from Dune Analytics

Conclusion

These five fundamental metrics are not a comprehensive list of the factors to consider when evaluating Ethereum. There are many other metrics worthy of consideration, including transactions processed per second, trading volume, and so forth. Our goal in sharing these metrics is to provide a foundational framework for investors to monitor Ethereum’s progress towards mainstream adoption.

Notes

(1) Note that these asset burns should be mentally offset against the small amount of new issuance of Ethereum that occurs on an ongoing basis. Users can track the “net issuance” of Ethereum—positive or negative—on websites like ultrasound.money.

(2) It is worth noting that the number of active addresses is not a perfect tool for measuring the number of users, as a single individual can have multiple active wallets. Still, it is a useful statistic for evaluating trends over time.

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.