May 2022 Bitwise Advisor Letter

San Francisco • May 6, 2022

In This Issue: Strong Fundamentals, Weak Prices

Market Overview

The old criticism of crypto was that it’s all speculation and no fundamentals. Today, the opposite is true: Crypto’s fundamentals are strong, but the speculative excitement has disappeared.

Consider what happened last week: Fidelity announced it was making bitcoin available in 401(k)s … and crypto traded down.

This story is all too familiar. From the Biden Executive Order to the planned Ethereum upgrade, crypto has made incredible progress across many measures—regulatory, venture capital, and more—and yet crypto performance has been lackluster in 2022.

This is frustrating for investors. But understanding what’s behind it is key to grasping what happens next.

What's Going On

The strength of crypto’s fundamentals are undeniable. Consider:

Venture Capital Activity

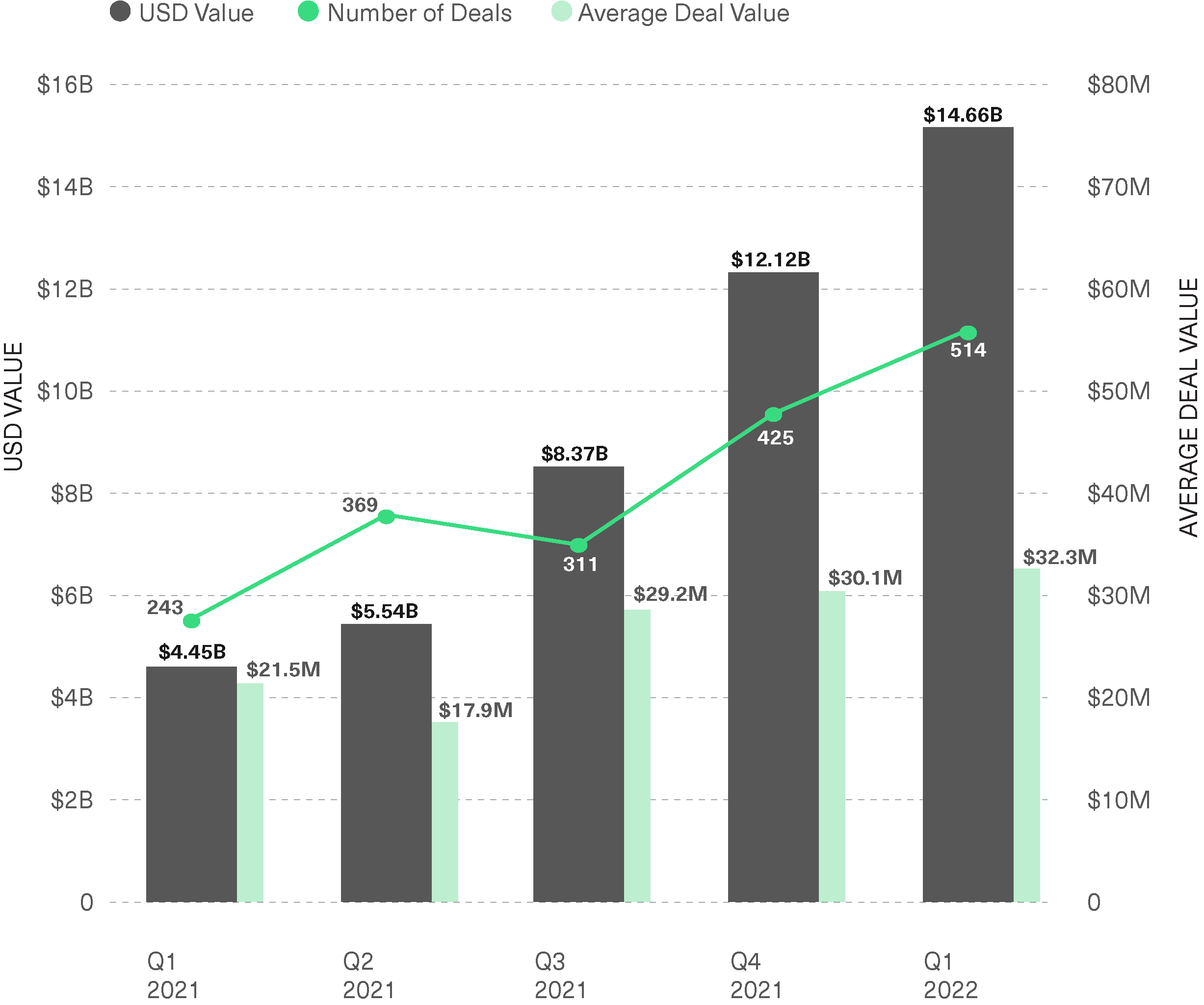

Venture capitalists poured a record $14.7 billion into crypto-related firms in Q1 2022, up 230% year-over-year.

Venture Captial Inflows in Blockchain

Developer Activity

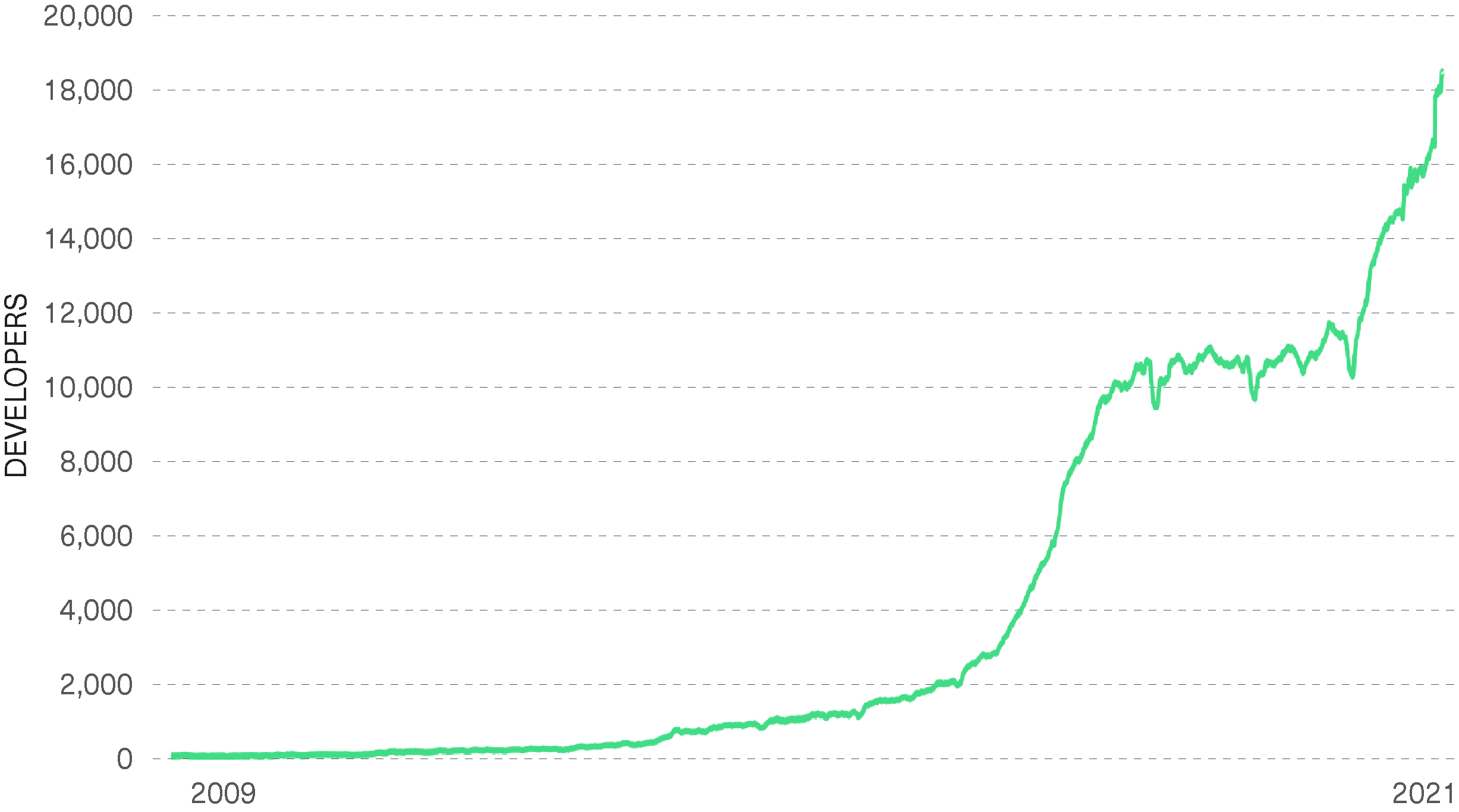

The number of developers working on crypto protocols is at an all-time high, up more than 80% since the start of 2021.

Monthly Active Crypto Developers

Regulatory Progress

Regulatory commentary today is focused on balancing regulation with the need to protect innovation—a positive sea change from just two years ago, when regulators focused on “cracking down” on crypto.

So Why Is Crypto Flat?

Given the strong fundamental progress, why are crypto prices flat?

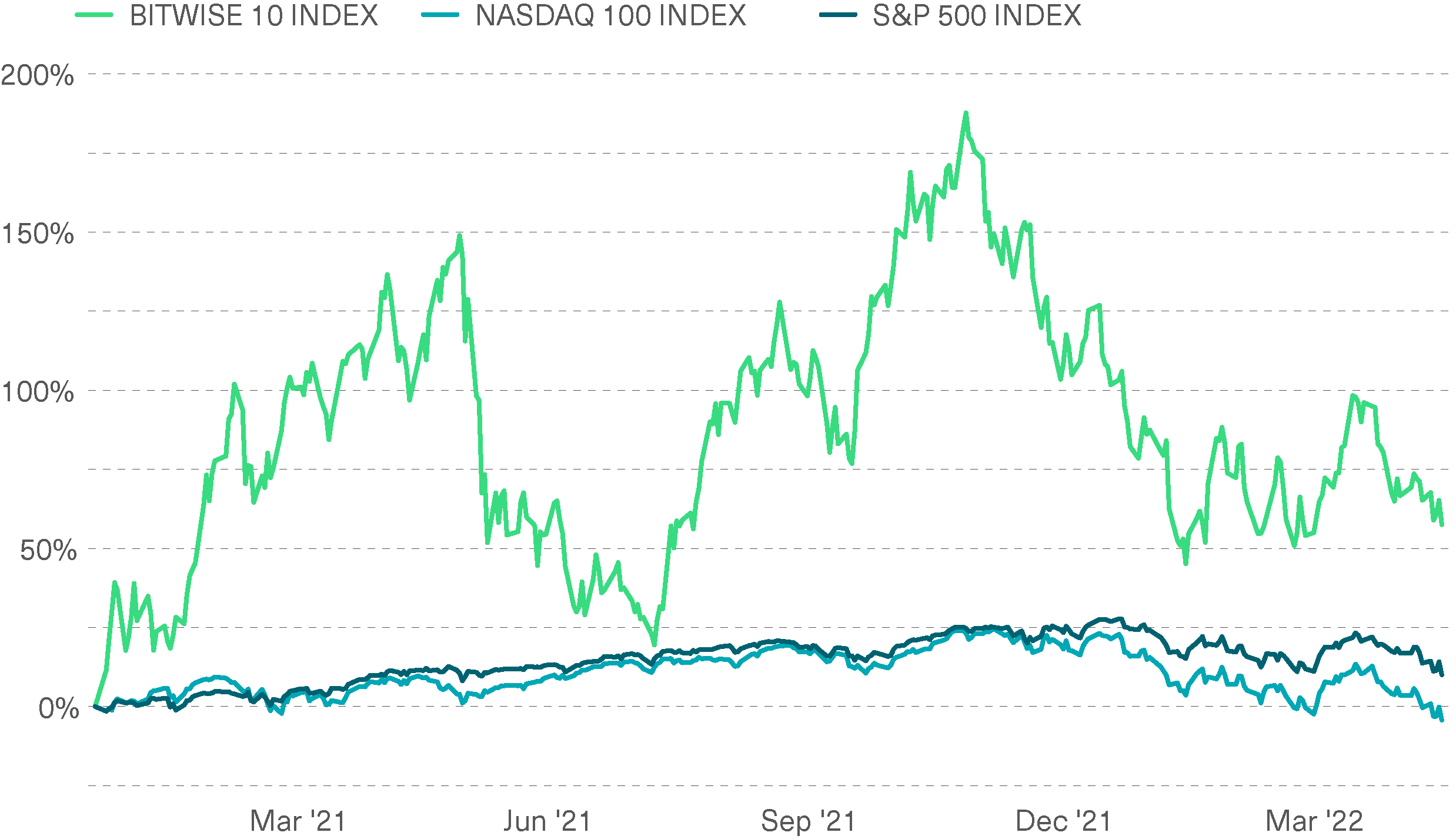

It’s because crypto is a classic risk asset whose fundamentals can be overlooked when risk-off sentiment is strong. That’s happening in today’s market, which is dominated by concerns ranging from inflation to Fed policy to the war in Ukraine. You can see this effect across a variety of assets that have struggled in 2022, from blue-chip tech stocks to emerging-market bonds to crypto. Right now, this “risk-off” trade is overwhelming crypto’s fundamental progress.

Cumulative Returns

December 31, 2020 to April 29, 2022

What Happens Next?

Of course, while crypto’s underlying progress isn’t being recognized by the market, it’s still happening. Developers, engineers, regulators, and others are still pushing the ball forward. We see this at Bitwise, where the pace and intensity of discussions with financial advisors and institutional investors continues to grow, week by week and month by month.

It may take months, or even quarters, for the market’s broad risk-off instinct to moderate and for this undercurrent of steady progress to become reflected in prices. There could be a lot of volatility in the meantime, too. But as we assess the moment, crypto increasingly feels like a tightly loaded spring.

When prices eventually catch up with the fundamentals, that will be a very interesting moment indeed.

Notes From the Research Desk

The Merge draws nearer ... with a twist

The Merge,the highly anticipated upgrade to the Ethereum blockchain that will (among other things) slash its carbon consumption by 99%, is getting closer, and we’re excited about its impact. But market suspense has grown since Ethereum’s core developers recently postponed The Merge by a few months. Our view? The planned upgrade is both crucial to Ethereum’s future and extraordinarily complex, so it needs to be done right—and we think Ethereum’s developers are getting close.

Coinbase enters the NFT game

Coinbase (COIN), the largest U.S. crypto exchange, is now officially entering the NFT space. The company launched the beta version of its NFT marketplace on April 27, letting a few people from its waitlist of more than four million (!) experiment with the program. The move positions Coinbase as a potentially serious competitor to market leader OpenSea, the NFT pioneer that recently fetched a $13 billion valuation. That’s worth noting, since Coinbase’s market capitalization was only $26 billion as of April 29.

Juan Leon, CFA

Senior Investment Strategist

Performance

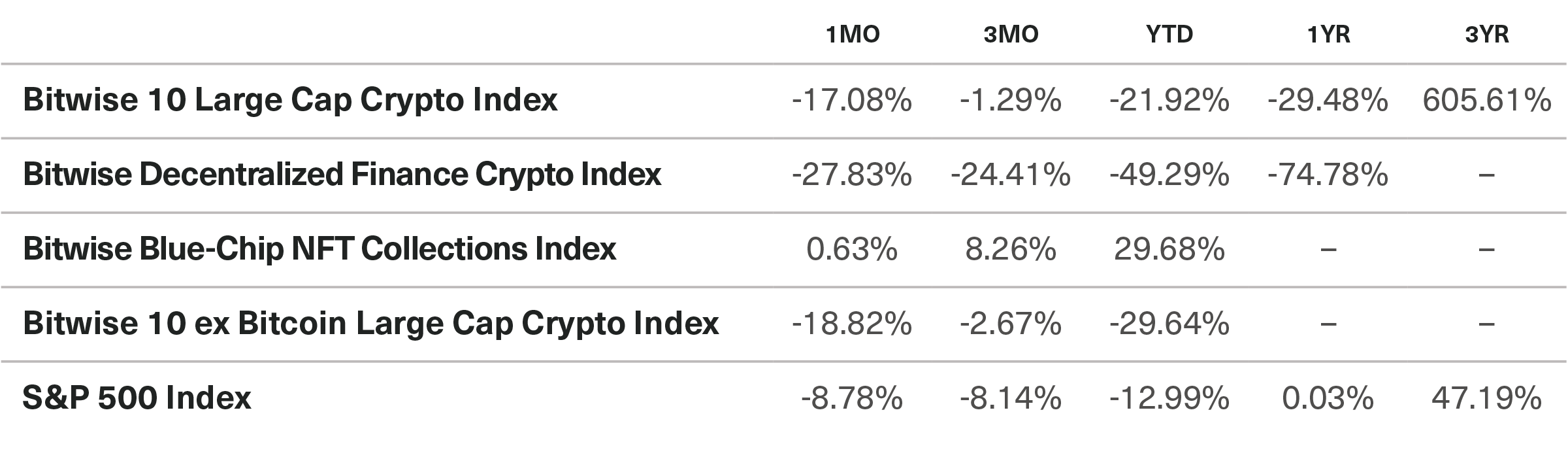

In April, risk-averse sentiment in the broader financial markets spilled over to crypto. The Bitwise 10 Large Cap Crypto Index fell 17%, erasing February and March’s gains and bringing the index negative over the last three months. The two largest crypto assets, Ethereum (ETH) and Bitcoin (BTC), outperformed the other eight index constituents.

The decentralized finance (DeFi) market fell 28%, extending its losses to nearly 50% in 2022. On a brighter note, the NFT market continues to perform well as the Bitwise NFT Blue-Chip Collections Index ended the month in positive territory, with year-to-date returns near 30%.

Benchmark Performance as of April 29, 2022

What's New at Bitwise?

Noteworthy happenings and key milestones.

Bitwise Launches Separately Managed Accounts (SMAs) for Financial Advisors. Recently, we launched a new strategy that allows advisors to offer clients direct exposure to Bitcoin and Ethereum, following an equal-weighted index of the world’s two largest crypto assets. The structure is designed to fit seamlessly into existing advisor workflows, including reporting, billing, and portfolio management.

Select Media Appearances

Barron’s: Want to add crypto to your retirement portfolio? Here’s how— and what to consider

Pensions & Investments: SEC approval of spot bitcoin ETF would attract more institutions

“One Thing to Know About Crypto”

Recently, we launched a weekly educational video series as part of our sponsorship of a new crypto segment on CNBC. Check out some of our latest 30-second videos on the upside of regulation, the future of NFTs, or one question every crypto investor should ask. To see the next installment, tune in to Squawk Box on Monday mornings.

Upcoming Events

Conferences

Going to any of these upcoming events? So is Bitwise. We’d love to connect in person. Email advisors@bitwiseinvestments.com if you’d like to set up a one-on-one meeting.

SACRS Spring Conference | May 10-13 in Rancho Mirage, CA

ACE Academy 2022 | May 15-18 in Nashville, TN

Morningstar Investment Conference | May 16-18 in Chicago, IL

Permissionless | May 17-19 in Palm Beach, FL

Inside ETFs | May 31-June 3 in Hollywood, FL

Vision | June 7-8 in Austin, TX

Consensus | June 9-12 in Austin, TX

Bitwise Webinars – Free to Join

June 15 | RIA Channel

“The Outlook for Crypto Equities: High-Growth Stocks Trading at a Discount” – Registration coming soon

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.