FedNow vs. Stablecoins: Five Reasons Why FedNow Fails To Disrupt Stablecoins

San Francisco • May 31, 2023

Introduction

As a research analyst at one of the world's largest crypto asset management firms, I spend a lot of time thinking and talking about stablecoins. After all, they are one of the killer apps of crypto to date. From a starting point of $0 just a few years ago, they’ve amassed more than $123 billion in assets.

Recently, however, our clients have been coming to us with a challenging question: With the upcoming launch of the FedNow service, which will offer instantaneous payments and settlement, do stablecoins have a future?

It's a great question. After all, crypto enthusiasts (myself included) have been claiming for years that crypto can do better than the painfully slow and archaic financial rails of the U.S. banking system. So if FedNow offers instant payments, has the main thesis of stablecoins—bringing dollars into the internet age—already become obsolete?

In a word: No.

While it’s easy to see why people might assume stablecoins would compete with FedNow, they actually serve very different markets and have very different attributes and client bases.

We suspect both that FedNow will be a success and that the stablecoin market will grow substantially at the same time.

So, what is it about stablecoins that sets them above the best the U.S. Federal Reserve has to offer?

What Are Stablecoins, and Why Do They Exist?

Last year, we published an explainer on the topic called Stablecoins: Separating the Wheat From the Chaff. It explores the purpose of stablecoins, the different types (fiat-collateralized, crypto-collateralized, and algorithmic), and their various tradeoffs. For anyone who hasn’t read it, here’s the abridged version:

Stablecoins bring the U.S. Dollar on-chain. A stablecoin is a crypto asset that is pegged to the value of a real-world asset. For example, one USD Coin (USDC) is always intended to be worth one U.S. dollar. It achieves this by taking dollars from investors, issuing digital token representations of those dollars, and then investing in high-quality collateral (like Treasuries). What makes them useful is that they hold their value relative to traditional currencies but, unlike the money in your bank account, they are traded freely on the blockchain.

Stablecoins serve many of the same purposes in crypto markets as the U.S. dollar in traditional markets. They’re used for everything from saving and trading to sending and lending, and they’ve been adopted by a range of users, from crypto enthusiasts to traditional financial institutions.

Stablecoins provide global access to the U.S. dollar. For example, in countries facing high inflation, like Argentina, people may prefer to park their assets in a stablecoin, which can be an easier way of gaining access to the dollar and broader financial services than accessing U.S. banks.

Stablecoins flatten the global financial market. For people getting paid for work abroad or sending money to family back home, the low-cost, high-speed features of stablecoins can be an effective solution.

What Is the FedNow Service, and Why Does It Exist?

The FedNow Service is an interbank “real-time gross settlement service” developed by the Federal Reserve to support faster payments. It’s a significant upgrade to traditional payment rails. It is similar in certain ways to Venmo or Zelle, but instead of slapping a shiny, new fintech front end on top of 1970s technology, FedNow is a new settlement mechanism that facilitates real-time payments (or “RTPs”) between U.S. banks. Importantly, it operates outside of banking hours—24/7/365.

The service is designed to support dollar transfers for various use cases, such as person-to-person payments, bill payments, and smaller business-to-business payments. Settlement is final, meaning that a transaction cannot be canceled or revoked once it is processed by the service.

Pro-crypto bias aside, FedNow is a much-needed overhaul of the antiquated payment rails the U.S. has relied on for the past 50 years. Similar services already exist in Europe and elsewhere.

Does FedNow Disrupt Stablecoins?

At face value, FedNow seems to go punch-for-punch with stablecoins. Stablecoins offer 24/7/365 payments at the speed of the internet. That’s what FedNow does. Stablecoins offer instant finality and are irreversible. So does FedNow.

In fact, the odds even appear to be in FedNow’s favor, since the service is created and backed by the Federal Reserve, while stablecoin issuers have recently been in the crosshairs of regulators.

In the end, however, stablecoins land not one but five knockout blows. These services do fundamentally different things, and the FedNow Service falls short of disrupting stablecoins in five major ways.

1) The FedNow Service doesn't broaden the reach of the U.S. dollar.

One critical market that stablecoins serve, which the FedNow service doesn’t touch, is opening up the U.S. dollar marketplace to the world. As citizens have looked for digital solutions to banknote shortages (Venezuela) and to the impact of protracted and elevated inflation (Argentina, Turkey), stablecoins have become financial lifelines. When combined with DeFi lending protocols like Aave and Compound, stablecoins can provide access to financial services and change the financial reality of millions of people worldwide.

2) The FedNow Service doesn’t help bank the unbanked.

FedNow requires users to maintain an account with a U.S. depository institution, like JPMorgan Chase or Wells Fargo.

One beautiful thing about crypto is that it lowers the barriers to enter the financial system. While obstacles like minimum balance requirements and lack of trust in banks cut millions of people off from participating in the financial system, stablecoins have no such limitations. Instead, anyone can set up a crypto wallet in minutes with a computer or smartphone, allowing near-instantaneous access to the stablecoin market.

As great as FedNow is, it is no help to the nearly 6 million U.S. households (disproportionately Black and Hispanic) that don't have a bank account, much less the rest of the world.

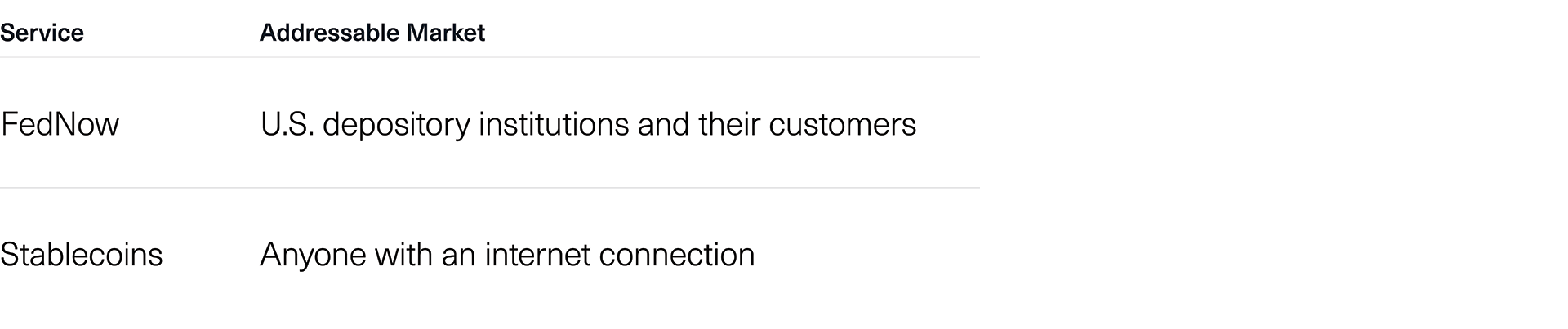

Breakdown of Potential Users: The FedNow Service vs. Stablecoins

Source: Bitwise Asset Management.

3) The FedNow Service doesn’t bring dollars into the booming on-chain ecosystem.

This is perhaps the most significant difference.

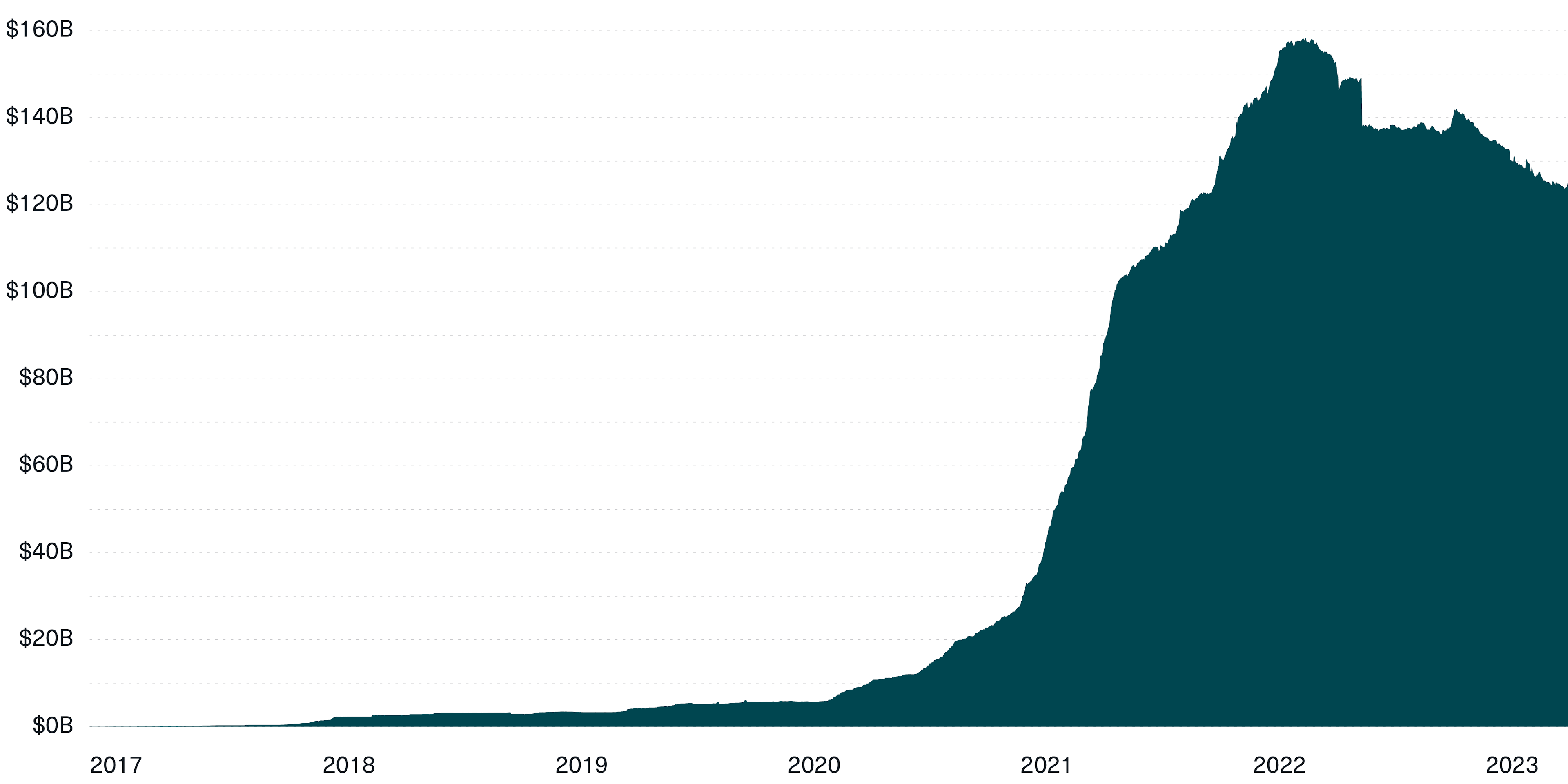

There is growing demand for on-chain dollars—since January of 2017, the total supply of stablecoins (you can think of this as stablecoin AUM) has grown 8,750%, from $1.4 billion to more than $123.9 billion. Many of these stablecoins are being used in DeFi protocols, like Aave and Compound; to trade against more volatile crypto assets, like Bitcoin (BTC) and Ethereum (ETH); and as on-chain payment vehicles. FedNow won’t replace these applications, as it doesn’t allow dollars to exist on-chain.

The Stablecoin Market Has Grown 8,750% Since January 2017

Stablecoin Supply, 2017 to 2023 (USD billions)

Source: Bitwise Asset Management. Data from Coin Metrics and The Block as of May 15, 2023.

4) The FedNow Service doesn’t help with cross-border payments.

FedNow is focused only on domestic payments and, as even the 2023 Economic Report of the President admits, brings limited improvements to international payments. For individuals looking to send money to family members overseas, FedNow is out of scope. It also doesn’t make a difference for businesses like Premise, a market research company that coordinates gig workers across the globe, that need an efficient and secure way to pay those workers in small amounts.

Admittedly, it’s tough for any single government to create payment rails that make cross-border payments more affordable and accessible. But that’s exactly what stablecoins do. With stablecoins, it doesn’t matter where the sender and receiver are located geographically. Just like the internet, stablecoins are borderless. And just like the internet, stablecoins are accessible anywhere, by anyone.

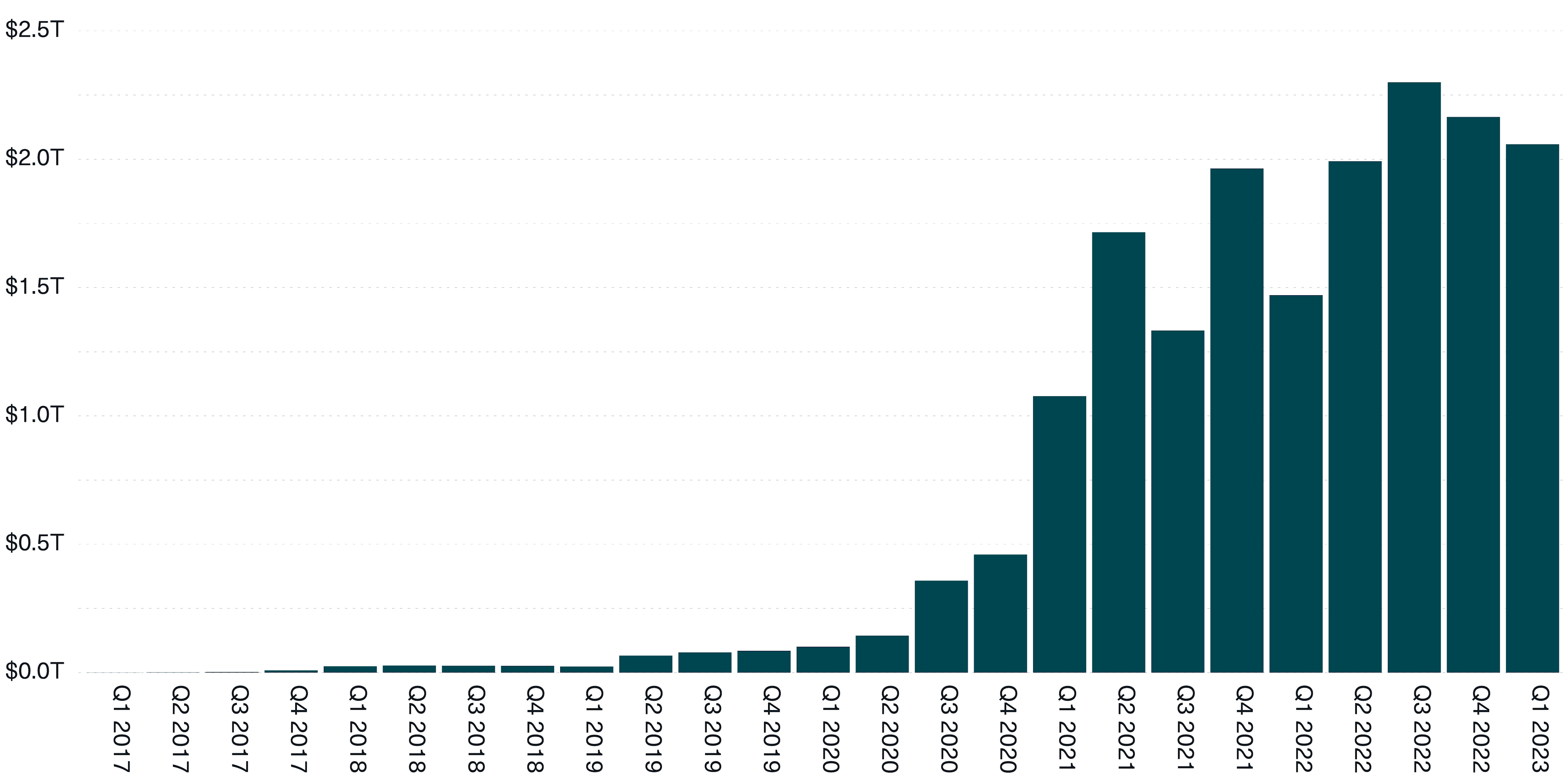

That’s one reason why stablecoin payments and transfers are snowballing, with $17 trillion in stablecoin transfers to date—more than $2 trillion in Q1 2023 alone. For context, $2 trillion is more than the total volume of transactions processed by PayPal in all of 2022.

Stablecoin Activity Is Growing at a Rapid Pace

Value of Stablecoin Transfers, 2017 to 2023 (USD trillions)

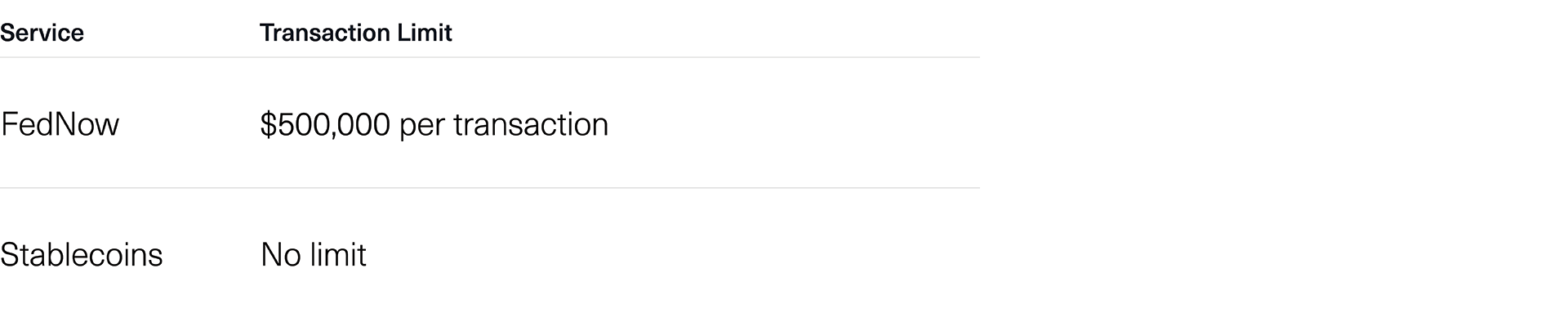

5) The FedNow Service has a $500,000 transaction limit.

Stablecoins, on the other hand, have no transaction limits. So it doesn't matter if you send $500… $500,000… or $5,000,000.

Of course, FedNow’s transaction limit won't impact most small businesses and individuals. But countless corporations, financial institutions, and even the U.S. government regularly transact in excess of $500,000. That's a large segment of the economy that remains unaddressed by FedNow. For transactions above $500,000, it’s back to the 1970s payment rails: Senders and receivers—whether retail or institutional—would have to default back to Fedwire and ACH. Both services operate on traditional banking hours, with transactions taking multiple business days to settle.

With stablecoin transactions over $500,000, however, it's back to the future.

Transaction Limits: The FedNow Service vs. Stablecoins

Conclusion

It would be naive to suggest that FedNow will have no impact on the stablecoin market. The FedNow Service is a significant upgrade to traditional finance, allowing interbank payments in the U.S. to go from dial-up to broadband. It makes it less likely that stablecoins will be used within the U.S. for daily payments.

But that’s not the primary use case for stablecoins. Buying coffee with USDC was never the point—I can use cash for that. Or, if I want, I can use my Delta AMEX and earn frequent flyer miles.

Instead, the primary use cases for stablecoins are to provide access to dollars abroad; help bank the unbanked; bring dollars on-chain; facilitate low-cost, high-speed cross-border transactions; and remove the limitations of decades-old infrastructure to unlock capital flow for the global economy.

The FedNow Service doesn’t disrupt any of those use cases—it’s just trying to keep up.

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.