The Case for Diversification Within Crypto Investing

San Francisco • Mar 1, 2018

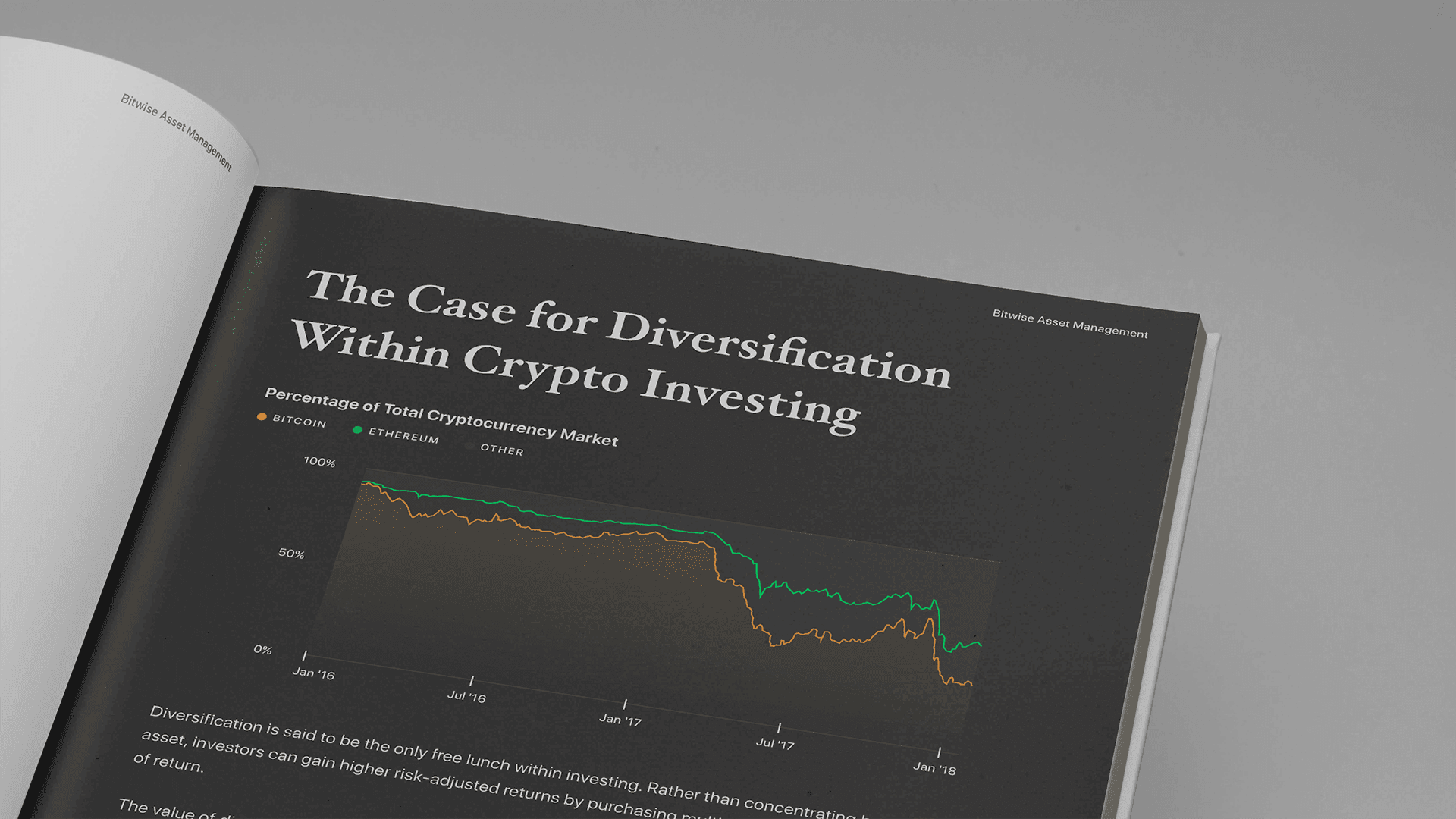

Many crypto investors only hold a single coin, like bitcoin. This white paper lays out why that’s a suboptimal strategy.

This report explores the value of diversification for cryptocurrency investing. It quantifies the relationship between the performance of different large-cap crypto assets through a number of measures: variability of monthly returns, correlations, and performance during drawdowns. As an example, the analysis finds that the average monthly difference in returns between the top- and bottom-performing large-cap crypto asset during the past year is 300.1%. Also, during the 60%+ drawdown in the price of bitcoin in December-January, three of the top 10 crypto assets posted positive returns, with one rising 69%. Though cryptocurrency has a limited track record, the report finds that there has been meaningful variability in performance. Investors stand to benefit from diversification in their cryptocurrency portfolios.

READ WHITE PAPERBitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.