Decentralized Finance (DeFi): A Primer for Professional Investors

San Francisco • Nov 16, 2021

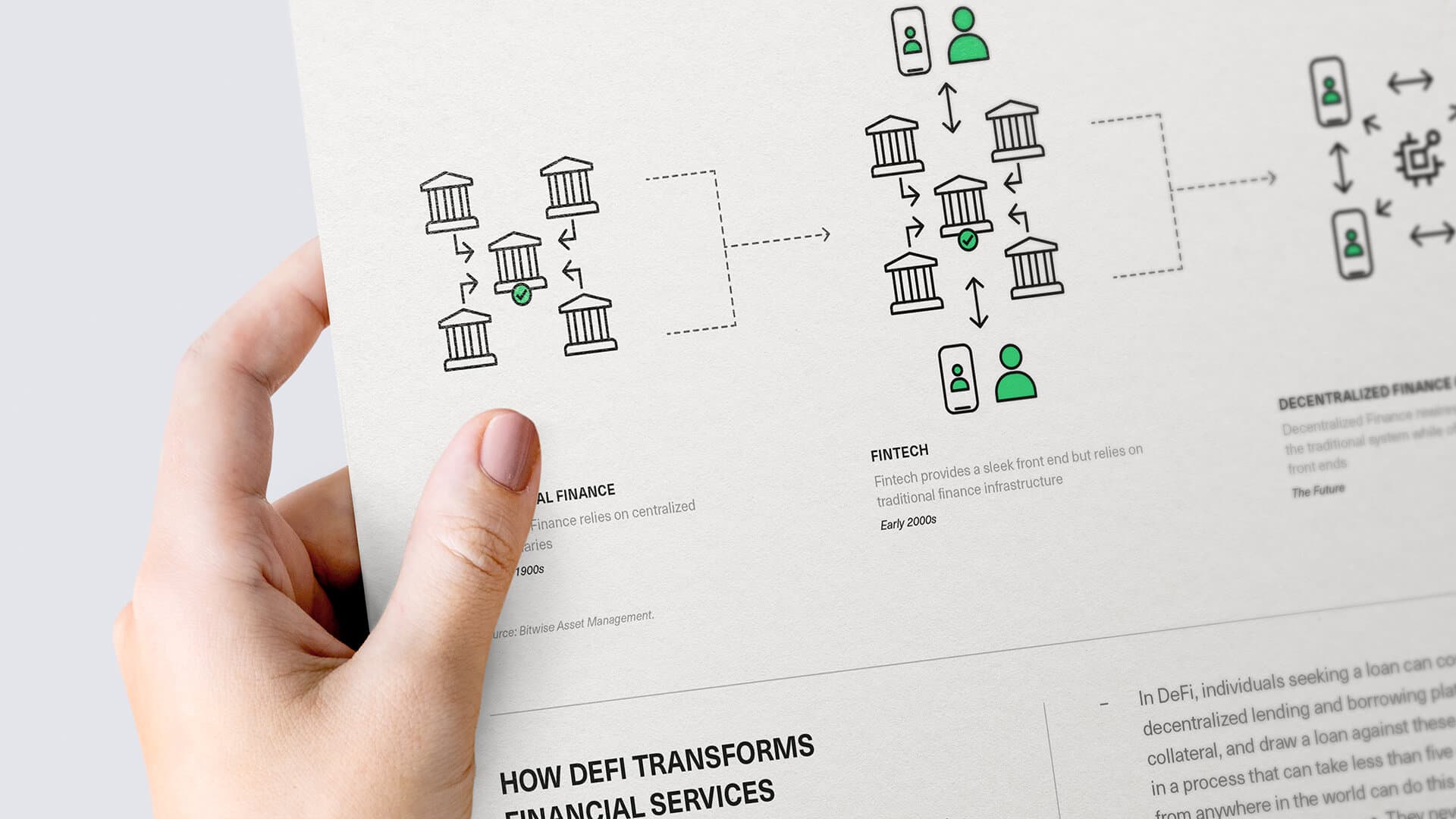

Decentralized Finance (DeFi) is one of the most exciting corners of crypto. The goal of DeFi is to create a more accessible, efficient, and transparent financial system by leveraging one of crypto’s greatest breakthroughs: programmable money. In this white paper, we put the DeFi movement into context, contrast it to the incumbent alternative, and explore how much market share the disruptive technology could capture. We find that if DeFi were to attain the same penetration relative to its incumbents that other successful disruptive technologies like e-commerce and electric vehicles have achieved (50-70%), it could become a $15 trillion industry over the next 5-15 years.

READ WHITE PAPERBitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.