Bitwise/ETF Trends Release Results of 2021 Survey of Financial Advisor Attitudes Toward Cryptoassets

San Francisco • Jan 12, 2021

Survey results show a near 50% increase in financial advisors allocating to crypto in 2020, and rising interest in the year ahead.

Bitwise Asset Management, a leading provider of crypto index funds, and ETF Trends, a leading source of exchange-traded fund news, tips, webcasts, and investing ideas, today released the findings of the Bitwise/ETF Trends 2021 Benchmark Survey Of Financial Advisor Attitudes Toward Cryptoassets.

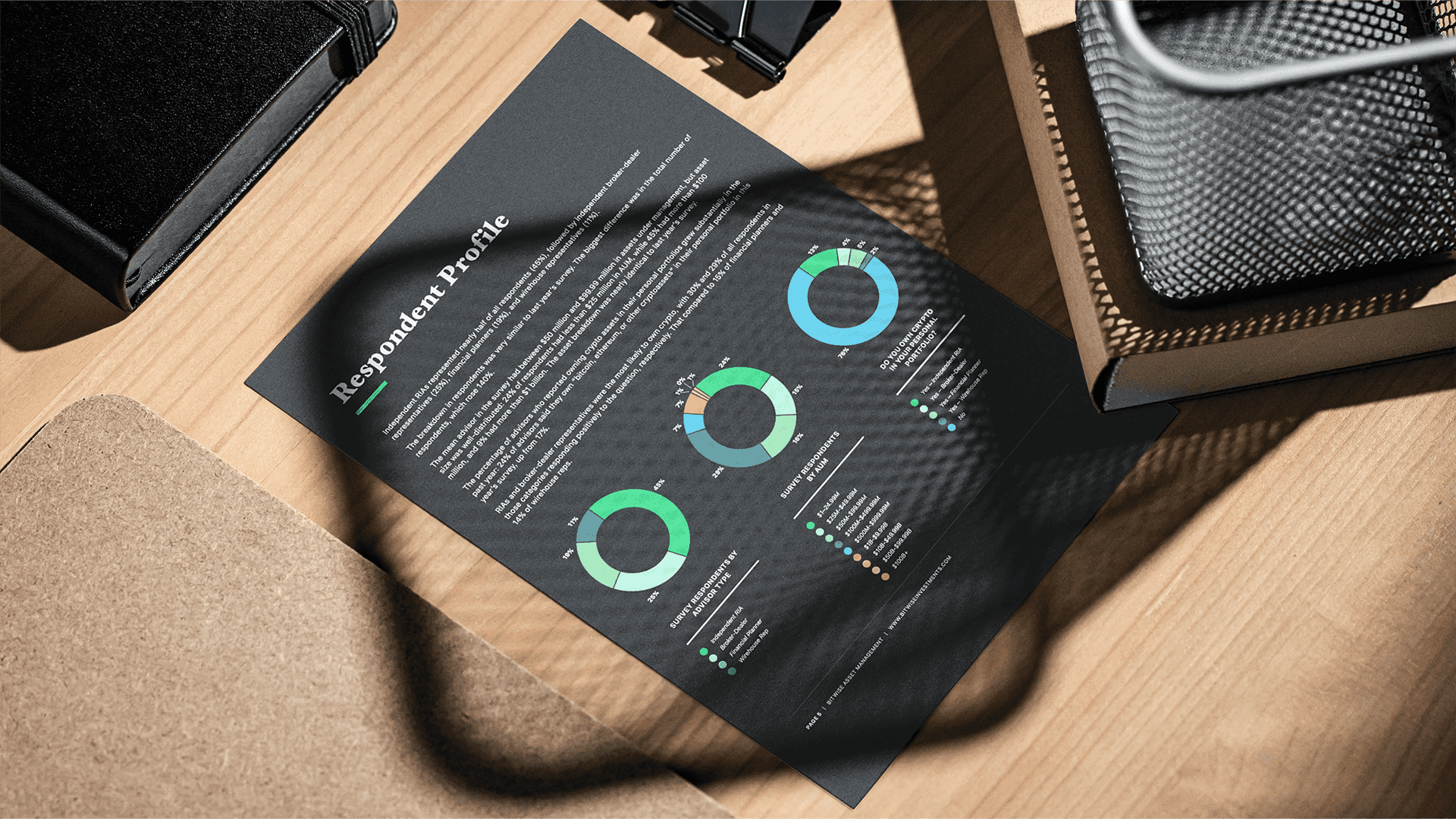

Nearly 1,000 financial advisors answered a series of questions on cryptoassets and their use in client portfolios. Survey respondents included independent registered investment advisors, broker-dealer representatives, financial planners, and wirehouse representatives from across the U.S.

Among the key findings:

A Nearly 50% Increase In The Number Of Advisors Allocating To Crypto Compared With Last Year: The percentage of advisors allocating to crypto in client portfolios rose from 6.3% to 9.4% in 2020.

17% Of Advisors Are Considering Making Their First Allocation To Crypto In 2021: Among advisors who are not currently allocating to crypto, 17% are either “definitely” (2%) or “probably” (15%) allocating in 2021. If all do so, it would more than double the number of advisors allocating to crypto, bringing adoption to over 1 in every 5 advisors.

The No. 1 Motivation For Advisors Is Crypto’s Uncorrelated Returns, And Inflation Hedging Is Of Rising Interest: 54% of advisors selected “uncorrelated returns” as a motivation for including crypto in portfolios. This finding was in line with last year’s survey results. “Inflation hedging” saw the largest uptick in interest, with 25% of advisors highlighting it as an attractive feature of crypto, up from just 9% last year.

Most Advisors Are Getting Questions About Crypto From Clients: 81% of all financial advisors reported receiving questions from clients on crypto in 2020, up from 76% in 2019.

Advisors Are Increasingly Optimistic About Bitcoin’s Price: 15% expect the price of bitcoin to exceed $100,000 within five years, up from just 4% in 2019. Meanwhile, the percentage expecting bitcoin’s price to fall to zero decreased sharply, from 8% in last year’s survey to 4% this year. This continues the trend of the last few years: In our 2019 survey, 14% of surveyed advisors thought the price would fall to zero.

“The survey shows it’s still early days for crypto, with less than 10% of advisors allocating today,” said Matt Hougan, chief investment officer for Bitwise. “At the same time, adoption and interest are growing: The survey suggests the number of advisors allocating could double or more in the year ahead.”

“Financial advisors are increasingly looking for exposure to alternative assets, and interest in crypto is rising,” said Tom Lydon, founder and CEO of ETF Trends. “We’ve also seen a steady progression of interest in crypto from clients of financial advisors in the three years we’ve run this survey together. I see no reason for that to change in the year to come.”

READ FULL SURVEYAbout ETF Trends

ETF Trends is a trusted source of ETF industry news, insight and analysis to keep investors a step ahead in today’s investing world. Its editorial team and seasoned contributors stay on top of the latest trends in the U.S. and abroad to educate financial advisors and self-directed investors. From new ETF launches to articles on equities, fixed income, and alternatives, ETF Trends is a wide-ranging financial publication covering every aspect of the ETF universe. With the new addition of ticker research pages to the site, traffic continues its steady rise month by month. ETF Trends publisher Tom Lydon is a frequent commentator on CNBC, Fox Business Network, and Bloomberg, where he shares his expert insight on markets and trends. For more information, visit www.etftrends.com.

Bitwise Asset Management is a global crypto asset manager with more than $15 billion in client assets and a suite of over 40 investment products spanning ETFs, separately managed accounts, private funds, hedge fund strategies, and staking. The firm has an eight-year track record and today serves more than 5,000 private wealth teams, RIAs, family offices and institutional investors as well as 21 banks and broker-dealers. The Bitwise team of nearly 200 technology and investment professionals is backed by leading institutional investors and has offices in San Francisco, New York, and London.