Research

Country Flows in Crypto: An Analysis

San Francisco • August 9, 2018

What can we learn from analyzing country-specific flows in crypto?

Overview of Memo

EPIQ asked for Bitwise’s take on trends in flows by country (ex: China, Korea, Venezuela, etc). The following document details our current thinking.

1. High-Quality Data Is Difficult To Get and Often Misattributed

It is difficult to track the origin and geographic distribution of cryptoasset transactions. Typical approaches revolve around looking at the physical domicile of major exchanges and assuming most users are local, or looking at fiat-to-crypto trading pairs and making attributions that way. Both approaches are flawed.

The domicile of exchanges is important but not controlling on its customers. Exchanges often attract users from outside their home market, and some exchanges (notably Binance, the largest exchange in the world) have no official domicile at all.

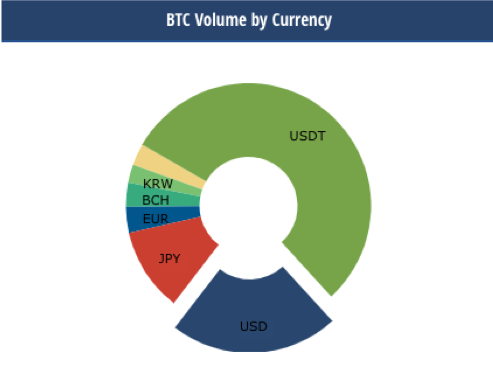

On the other hand, while fiat-to-crypto trading pairs are indicative of the location of a customer, it misses most of the trading volume that takes place, since the majority of trading volume takes place in crypto-to-crypto trading pairs. The chart below, from Cryptocompare, shows the recent share of bitcoin trading volume by trading pair. Of note, the single largest pair is USDT (Tether), a stablecoin designed to facilitate trading on crypto-to-crypto exchanges.

Finally, it’s worth noting that reported exchange volume in general is unreliable due to wash sales, mis-counting of derivative volume or data errors. Bitwise uses a multistep process to clean and verify that data before it incorporates it into its index methodology.

2. The Best Source of Country-Specific Data We Know of Comes from Local Bitcoins

The best source of reliable country-specific data we know of comes from LocalBitcoins. LocalBitcoins is a peer-to-peer bitcoin exchange that facilitates craigslist-style connections between users in different countries looking to buy and sell bitcoin.

LocalBitcoins data is available natively from its website or is consolidated in a helpful manner by Coin.Dance. It provides an interesting source of analysis. Select case studies follow below.

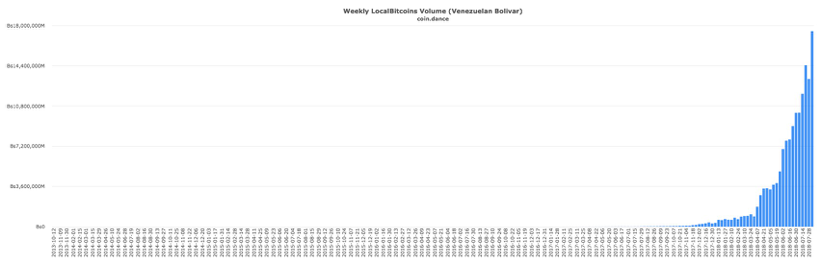

I. Case Study: Venezuela

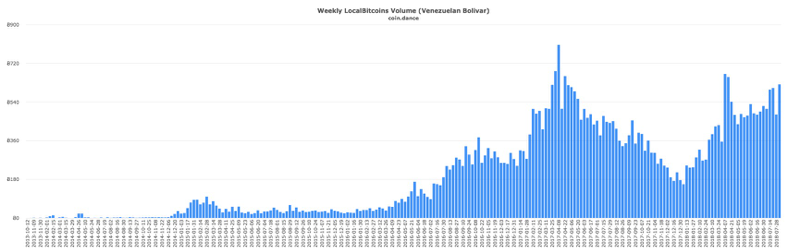

Bitcoin has real utility to residents of Venezuela, where hyperinflation has made using the local currency nearly impossible. Not surprisingly, interest in bitcoin has surged since hyperinflation took hold, as citizens look for an alternative place to store value. Below is a chart of units of bitcoin traded in Venezuela via LocalBitcoins over two-week periods going back to 2013:

Here is the same chart, but denominated in bolivars, a currency that has experienced rapid price depreciation:

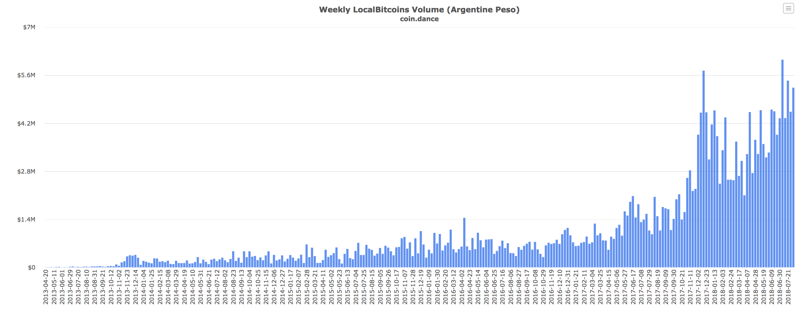

II. Case Study: Argentina

We see similar spikes in activity for most countries seeing significant inflation and/or unusual currency price movements, such as Argentina:

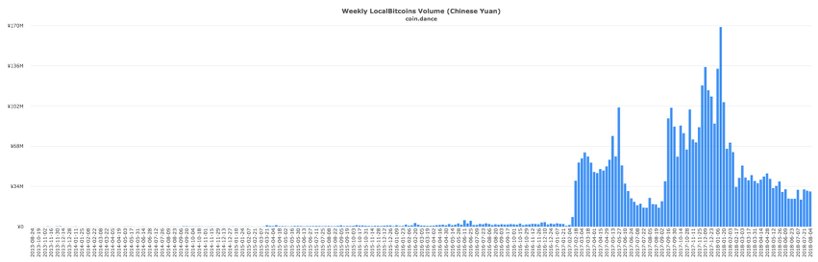

III. Case Study: China

While not facing volatility in its currency prices, it is also interesting to look at the volume in markets that have taken different regulatory approaches to the crypto market. An example is trading volume in China, shown here based in yuan, which has held strong over 2018:

About Bitwise

Bitwise Asset Management is the largest crypto index fund manager in America. Thousands of financial advisors, family offices, and institutional investors partner with Bitwise to understand and access the opportunities in crypto. For six years, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETFs, separately managed accounts, private funds, and hedge fund strategies. Bitwise is known for providing unparalleled client support through expert research and commentary, its nationwide client team of crypto specialists, and its deep access to the crypto ecosystem. The Bitwise team of more than 60 professionals combines expertise in technology and asset management with backgrounds including BlackRock, Millennium, ETF.com, Meta, Google, and the U.S. Attorney’s Office. Bitwise is backed by leading institutional investors and has been profiled in Institutional Investor, Barron’s, Bloomberg, and The Wall Street Journal. It has offices in San Francisco and New York. For more information, visit www.bitwiseinvestments.com.