Timely Insights

Trump Macro: Three Thoughts On Trump's Tweet About Crypto

San Francisco • July 12, 2019

President Trump posted his first tweet about crypto. We think it’s an important event in the history of bitcoin, crypto and money.

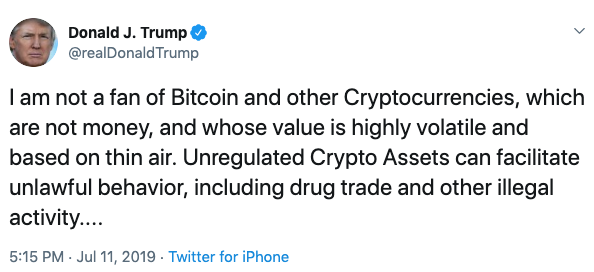

Yesterday, President Trump penned his first tweet ever about cryptocurrency, writing:

It’s a remarkable milestone. Here are our three thoughts on what this means for the crypto ecosystem.

Fact 1: Crypto has arrived; get ready for a big conversation about the fundamental nature of money

Bitcoin emerged in 2009 as a response to the breakdown in the mainstream financial ecosystem that occurred during the 2008 financial crisis. Over the past 10 years, it has operated largely at the margins: An intriguing experiment with interesting possibilities supported by a passionate, early-mover community.

That’s changed in the past few months.

In isolation, the president choosing to tweet about bitcoin and crypto would not be significant, as the president tweets about lots of things. But this tweet isn’t happening in isolation. It’s happening:

Two months after a U.S. congressman warned that bitcoin represented a fundamental threat to the U.S. dollar, and called for it to be “nipped in the bud”

Three weeks after Facebook announced the creation of its own cryptocurrency, Libra, sparking calls for congressional hearings and a global regulatory panic

Two weeks after the CEO of Goldman Sachs said it was “absolutely” looking at creating its own cryptocurrency, and that every major financial institution in the world was examining crypto and frictionless payments

One day after the chairman of the Federal Reserve said that Libra could instantly be “systemically important”

Governments and regulators have woken up to the reality that crypto raises fundamental questions about the nature of money, and are beginning to worry that the government’s monopoly over money creation could be under threat.

We expect to see big discussions taking place over the coming months around what money is, what it means and what role it should play in society (all the more so now that President Trump has nominated someone to the Federal Reserve who has expressed strong support for a return to the gold standard).

Fact 2: The U.S. wants to use currency as a tool … which is good news for bitcoin

It’s hard to disconnect Trump’s comments about crypto from increasing efforts by the U.S. to use both monetary and currency policy as aggressive tools for driving economic growth.

Trump recently tasked aides with finding a way to lower the value of the U.S. dollar as a way of spurring economic growth ahead of the 2020 election, and tweeted that the U.S. should match the Europeans and China in the “currency manipulation game.”

Meanwhile, an increasingly politicized Fed is expected to slash interest rates in the months to come … a move some worry could lead to significant inflation down the road.

We have seen a significant rally in all nonsovereign store-of-value goods in recent months: gold, oil, bitcoin, etc. We expect this worry to be a significant driver of interest in bitcoin in the ensuing months.

Fact 3: Bitcoin’s criminal use is overstated and anachronistic

Trump’s trope about bitcoin “facilitating criminal behavior” is an anachronistic throwback to the early days of crypto, when bitcoin was primarily used as a mechanism of payment on so-called dark web sites like Silk Road.

The government’s own Drug Enforcement Agency has said that that era has passed, and the primary use for bitcoin today is now speculation and investment, not criminal activity. In fact, enforcement agencies now believe the traceable nature of bitcoin actually aids in criminal investigations. As one 2018 Inc. magazine article noted: “Criminals were early adopters of bitcoin and other cryptocurrencies. But these forensic analysis software companies prove that criminals should stick with cash.”

If the government really wanted to crack down on criminal use of payment technologies, it would stop printing $100 bills. Former U.S. Treasury Secretary Larry Summers laid out the case for eliminating $100 bills in 2016.

Conclusion

The Trump tweet, in isolation, is not a big deal. But it is the latest signal that bitcoin has entered a new era, one in which it is increasingly at the center of important conversations and not on the edges. We expect this mainstreaming of the crypto conversation to be an important trend in the remainder of 2019 and beyond.

About Bitwise

Bitwise Asset Management is the largest crypto index fund manager in America. Thousands of financial advisors, family offices, and institutional investors partner with Bitwise to understand and access the opportunities in crypto. For six years, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETFs, separately managed accounts, private funds, and hedge fund strategies. Bitwise is known for providing unparalleled client support through expert research and commentary, its nationwide client team of crypto specialists, and its deep access to the crypto ecosystem. The Bitwise team of more than 60 professionals combines expertise in technology and asset management with backgrounds including BlackRock, Millennium, ETF.com, Meta, Google, and the U.S. Attorney’s Office. Bitwise is backed by leading institutional investors and has been profiled in Institutional Investor, Barron’s, Bloomberg, and The Wall Street Journal. It has offices in San Francisco and New York. For more information, visit www.bitwiseinvestments.com.