Timely Insights

Three Reasons Financial Advisors Are Buying Crypto Ahead of 2020

San Francisco • October 22, 2019

Three major catalysts could make 2020 a breakthrough year for crypto.

Advisors often ask us: When is the right time?

I see progress with crypto, but maybe I should wait until X happens before I invest.

“X” could be anything. Some want to see crypto’s volatility settle down; others are waiting for a bitcoin ETF to launch.

The challenge is that crypto continues to move forward even as we wait for these advances. Despite the 2018 bear market, for instance, $100,000 invested in bitcoin three years ago would be worth $1.15 million today, a life-changing amount.*

As we head into year-end portfolio reviews, we believe now is a particularly important time for advisors to consider making their first allocation in client portfolios. There are three major catalysts on the horizon that we think could make 2020 a breakthrough year for crypto.

*Data as of 10/16/19. Historical performance of bitcoin (BTC) is not illustrative of the performance of the Bitwise Bitcoin Fund or any actual account. Past performance cannot predict future results. These historical returns do not include the fees and expenses that are charged by any Fund. Actual Fund returns may differ materially from the historical returns of bitcoin (BTC). The inception date of the Bitwise Bitcoin Fund is December 5, 2018.

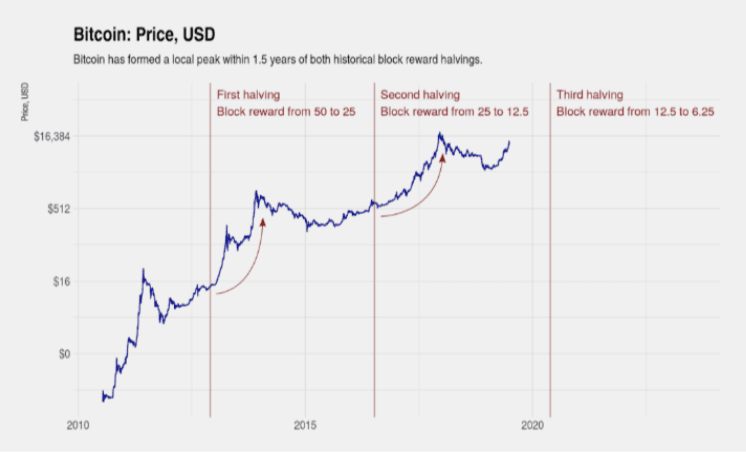

Catalyst No. 1: The Bitcoin Halving

In May 2020, the amount of new bitcoin produced each day will drop in half. Like a supply shock in oil, this process has historically been accompanied by a strong bull market.

Like all real assets, the price of bitcoin is set by supply and demand. The media spends a huge amount of time talking about the demand side of the equation, but supply is equally important.

Right now, approximately 1,800 new bitcoin are created each day. At current prices, that means approximately $5.3 billion in new supply each year.

In May 2020, however, the amount of new supply will fall in half. This quadrennial “halving”—the Olympics of bitcoin—has historically had a major impact on prices.

How major? BayernLB, the seventh largest bank in Germany, released a report recently saying the upcoming halving could drive bitcoin’s price to $90,000. That is an aggressive target, but a 50% drop in supply is significant.

Bitcoin Halvings Have Historically Aligned with Bull Markets

Catalyst No. 2: Facebook’s 2020 Crypto Launch (And No, We Don’t Mean Libra)

Libra may not launch next year, but another major crypto initiative at Facebook will … and it could open up crypto to 2.7 billion users.

When Facebook announced its crypto ambitions in June 2019, it announced two projects: Libra and Calibra. All the media attention focused on Libra, the company’s controversial cryptoasset, but in many ways, Calibra is more important.

Calibra is a Facebook-designed tool that would allow the company’s 2.7 billion monthly active users to send, receive, and hold cryptocurrencies in WhatsApp, Messenger, and other Facebook platforms. With approximately 100 Facebook employees working on the project, we believe Calibra will launch next year regardless of the fate of the company’s embattled Libra coin.

Calibra could be a game-changer because of the scale it brings to crypto. Currently, the most popular app for sending, receiving, and holding cryptocurrencies is Blockchain.com, with around 40 million users. Adding 2.7 billion users (or even a fraction of that audience) would be a big deal.

Catalyst No. 3: The Rising Use of Alternatives By Financial Advisors

Advisors are turning to alternatives as they come to grips with low expectations for stock and bond returns. We believe a significant number will migrate into crypto in 2020.

Advisors face a unique portfolio challenge as we approach 2020.

We’re at the tail end of a 36-year bull market in bonds, and the current bull market in stocks is the longest in history. Valuations are stretched: Nobel-prize-winning economist Robert Shiller’s CAPE ratio currently predicts we’ll see negative U.S. stock returns over the next 10 years. Things are so challenging that Bank of America—the largest wealth manager in the world— recently published research calling for the end of the traditional 60/40 stock/bond portfolio.

Faced with these challenges, advisors are increasingly turning to alternatives as they search out strong returns that are not correlated with traditional markets. A recent Cerulli Associates survey found that 40% of financial advisors are embracing alternatives, and many expect that number to rise.

Crypto can be a powerful alternatives solution for advisor portfolios. Like the best hedge funds and private equity investments, crypto combines high potential returns with low correlations to stocks and bonds. But unlike traditional alts, crypto investments are liquid, with none of the lockups, access issues, or performance fees that make traditional alternative investments difficult for advisors to use.

Studies show that adding just a 1% allocation to crypto has historically had a significant impact on the risk/return profile of a traditional stock/bond portfolio.

Closing Thought: With Institutions Investing, Can You Afford To Stay On The Sidelines?

The crypto market has evolved significantly in the past two years.

In 2017, crypto was a nascent market. There were no regulated and insured third-party custodians, trading was difficult, regulatory views were unclear and institutional investors were on the sidelines.

Today that’s changed.

There are now 9 regulated custodians, many of which have insurance through firms like Lloyd’s of London.[2] Crypto trading is increasingly conducted through established, institutional market makers like Jane Street. Meanwhile, regulators have cleaned up the space and set up new divisions like the SEC’s FinHub to facilitate dialogue with the industry. As a result of these developments, institutional investors—including endowments, pensions, and hedge funds—are increasingly allocating.

This raises the stakes for financial advisors. Two years ago, advisors could credibly argue that the market was not ready to support crypto. But today—with thought leaders like Ric Edelman recommending advisors add crypto to client portfolios—times have changed.

Some advisors are using crypto today to win new business or deliver stronger total returns. Others are playing defense, knowing clients will remember if they miss out on the next opportunity to turn $100,000 into $1.15 million.

Either way, with multiple significant catalysts on the horizon and a huge leap forward in market maturity, we think the time is right for advisors to consider their first allocation to crypto today.

Bitwise exists to serve as a partner to financial advisors looking for professional access to crypto. To learn more about the company’s offerings, or to set up a conversation with a crypto expert, check out our financial advisor page here.

About Bitwise

Bitwise Asset Management is the largest crypto index fund manager in America. Thousands of financial advisors, family offices, and institutional investors partner with Bitwise to understand and access the opportunities in crypto. For six years, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETFs, separately managed accounts, private funds, and hedge fund strategies. Bitwise is known for providing unparalleled client support through expert research and commentary, its nationwide client team of crypto specialists, and its deep access to the crypto ecosystem. The Bitwise team of more than 60 professionals combines expertise in technology and asset management with backgrounds including BlackRock, Millennium, ETF.com, Meta, Google, and the U.S. Attorney’s Office. Bitwise is backed by leading institutional investors and has been profiled in Institutional Investor, Barron’s, Bloomberg, and The Wall Street Journal. It has offices in San Francisco and New York. For more information, visit www.bitwiseinvestments.com.